Week ahead: No support for markets from the Jackson Hole Symposium

Of course that’s tongue-in-cheek, but Friday’s session was incredible. It started with China announcing a retaliatory $75bn worth of additional tariffs on US goods on Friday. Shortly after the China news broke, Fed Chair Jerome Powell spoke about the changes with monetary policy at the Jackson Hole Symposium in Wyoming. We would categorise this as a slightly more dovish shift even if markets didn’t react as such. We define this by Powell’s more definitive approach in identifying the pain points for the US and global economy. Trade tensions and Brexit are two clear headwinds that could impact their growth estimates.

The announcement from China clearly hit a nerve, subsequently sparking a twitter tirade from Trump. Numerous attendees were reportedly eagerly refreshing twitter feeds during Powell’s speech at Jackson Hole. Whatever they might have expected, Trump certainly delivered. Not only did he raise tariffs on the various tranches of goods by five percentage points, he also demanded US businesses pull out of China, which, if he follows-through here, would mark a genuine escalation in proceedings.

"US2000 sees sharp decline after Trump\u2019s series of tweets on Friday."

Amid the volatility, here’s what to look for this week:

Trump’s tweets and USDCNH

Equity indices have shown a strong sensitivity to Trump’s tweets, so what he says will continue to guide markets. However, as tensions between the US and China escalate to more than just a trade war, keep an eye on the USDCNH.

USDCNH gapped between Friday close and Monday open, with the USD strengthening to a record high against the off-shore yuan (CNH). The on-shore yuan (CNY) hit its weakest point against the USD since 2008. The People’s Bank of China (PBoC) ‘fixed’ the daily reference point at 7.0570, lower than the street’s estimate 7.0628. There was scope for the PBoC to further weaken its currency, its restraint once again limiting FX volatility.

However, in the short-term USDCNH seems to be driving the show and when we see CNH strengthen we tend to see risk coming back into the market, and traders buying equities, AUD and selling JPY and gold.

"USDCNH gapped between Friday close and Monday open."

US data points

Powell refrained from directly mentioning Trump while speaking at Jackson Hole. He did, however, make the point that trade wars hurt economies in a way central banks may struggle to fix. RBA Governor Phillip Lowe, who also spoke at Jackson Hole, echoed the sentiment on Sunday morning, saying central banks can’t save the world economy alone. He called for global fiscal stimulus.

Nonetheless, Powell acknowledged the US is in a “favourable place,” but with global risk now at the forefront of Fed decisions, it’s ready to cut rates. The market is pricing in a 25bp cut in September with 100% probability, with a larger 50bp cut set at a 29% probability, with a total of 65bp of cuts priced in before the end of the year.

The market wants to see the Fed get ahead of market pricing (or ‘ahead of the curve’), and perhaps then we can see the USD materially weaken. Until then, selling USDs has really only manifested against the JPY and CHF.

Watch:

Durable goods orders up on Monday report. Durable goods are generally higher-ticket items with at least a three-year lifespan, from home appliances to cars and aircraft. Orders increased 2.1% for July, surpassing expectations of just 1.2%, however, excluding transportation orders, the data was down 0.4% on the month prior. This is an important indicator for the US economy, as 70% of GDP is comprised of business and consumer spending.

US consumer confidence figures on Tuesday. The market expects a decline to 129.0 on the survey, down from 135.7. While this will be affected by the trade tensions, it won’t be as bad as what we saw in the recent University of Michigan survey, which was conducted before the recent trade truce. Consumers are typically the last to express the effects of a downturn, so poor numbers could accelerate the notion we are in late cycle, and not mid-cycle as the Fed have characterised.

Chicago PMI Friday. As we head into the influential ISM manufacturing report next week on 4 September, we look at the regional surveys to offer guidance and set expectations. Here, a reading above 50 indicates an expansion; below 50 a contraction. Expectations are for Chicago manufacturing PMI to come in at 47.9, after 44.4 month prior. A rebound in this survey could give us some hope that manufacturing could modestly rebound and would certainly go some way to pricing out of 50bp cut. Watch USDJPY here, where good numbers should find buyers easy to find.

Europe

Moving to the Eurozone, where negative interest rates have done little to boost inflation, which has stagnated well below the ECB’s 2% target. Markets are pricing 79% probability of a further rate cut by 10bp to -0.5% at the September meeting, with calls of a change of guidance and renewed asset purchases.

Watch:

German business sentiment, Ifo survey, dipped lower on Monday. The German economy supported Eurozone growth after the global financial crisis, but it’s now in trouble. Indicators are pointing to recession: US-China tensions are impacting exporters; carmakers face weakening global demand; and Brexit uncertainties loom.

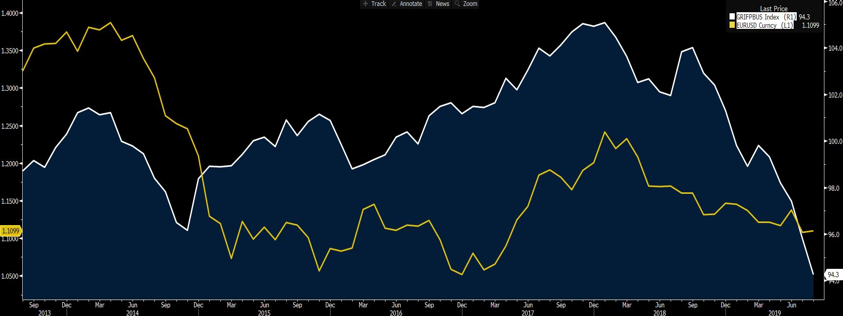

Watch EURUSD here. German business sentiment (blue) dipped further to 94.3 on Monday’s data. It’s been declining for almost a year, dipping below 100 into negative sentiment. Further sentiment decline could see EURUSD (yellow) shorts come into play. EURUSD hit a session low of 1.1094 this morning.

"Keep an eye on EURUSD against German business sentiment."

German Q2 GDP data comes through Tuesday. GDP data is expected to print a second quarter of contraction - the technical definition of a recession. Continue to watch EURUSD as this result comes through.

Eurozone inflation indicator on Friday. The Harmonised Index of Consumer Price (HICP) is an inflation and price stability indicator. Inflation is stagnant well-below the ECB’s 2% target, and this is unlikely to diverge from 1.1%.

Australia

Australia private capital expenditure on Thursday. Q1 QoQ private capital expenditure came in at -1.7%, against expectations of 0.4%. Q2 expectations are for another 0.4% QoQ increase, and again the outcome here could be influential for the Q2 GDP point on 4 September. The private capex indicator could indicate the reach of the US-China trade dispute, where another negative result would show that firms are holding off investment and other business decisions, amid broad economic uncertainty.

AUDUSD has been tracking in at 68c to 67.40 channel since 2 August and this data is unlikely to really move the dial. AUD is still going to take direction from moves in the CNH.

The chart below shows expectations (purple) against actual (blue). Markets are expecting modest 0.4% QoQ growth after significantly missing the mark by 1.3 percentage points.

"Actual (blue) QoQ private capital expenditure missed expectations (purple) by -1.7%."

China industrial profit on Tuesday will be watched closely to gage the sector’s performance amid US trade tensions and slowing global growth.Industrial profits in China have been falling since the second half of 2018: many firms responding with pared back manufacturing investment and other business decisions. This suggests the US-China trade war is impacting industry margins. Another decline here will exacerbate uncertainties and the looming fear of recession.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.