- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The much-hyped idea of a ‘pivot’ from the Fed has been walked back of late and risky assets have found renewed selling pressure – we know inflation is at multi-generational levels and is the backbone of market concerns, which makes this week's US CPI print so important – market liquidity and price action will evolve as we go into the data point, while traders could react intently to the outcome – volatility risks are clearly elevated.

Given how important the data is to sentiment and broad market pricing, it can often pay to think about the distribution of potential outcomes - We can consider a simplistic trader playbook around the US CPI print.

Time – Thursday 23:30 AEDT / 13:30 BST

Expectations:

Headline CPI - 0.2% MoM / 8.1% YoY (range of estimates 8.3% to 7.9%)

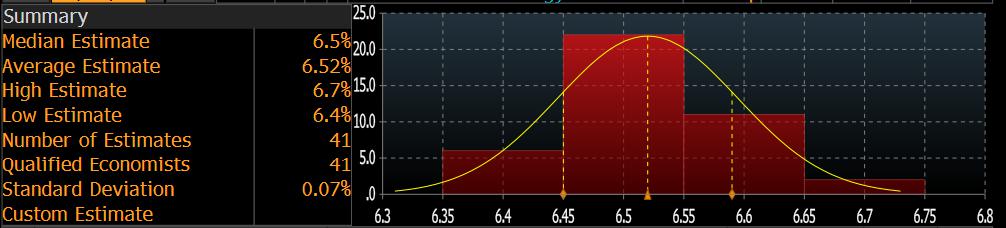

Core CPI inflation - 0.4% MoM / 6.5% YoY (6.7% to 6.4%) – see the economist’s distributions below

Form guide

In 10 of the past 12 US CPI reports we’ve seen the CPI print come in above consensus expectations – in the occurrences where the CPI print has come in above expectations, the USD rallied in 8 of them. The NAS100 has sold off in the 30 minutes after the release by an average of 2%.

The market will therefore see a higher risk of an above-consensus print.

Positioning

Pepperstone clients are broadly skewed short on the USD, with USDJPY and GBPUSD the largest short expressions – whether this reflects the perception of a weaker CPI print or mean reversion after a strong USD rally is debatable. In the broader markets, we can look at the weekly CFTC report and see the aggregate USD positioning is very long, certainly against the NOK, NZD, and AUD – investment bank flow suggests CTAs (systematic trend-following funds) are also max long.

Positioning favours a bigger USD sell-off should the data come in below consensus.

Volatility and implied movement

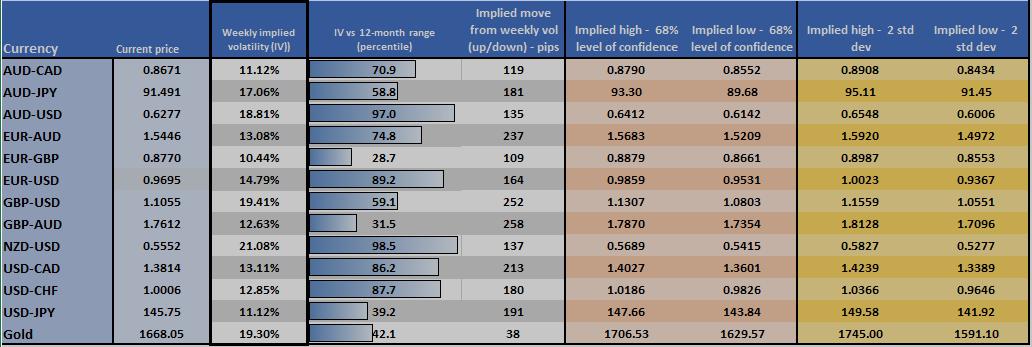

The options market is good for assessing the expected movement in an asset by a set expiry date – looking at 1-week implied volatility (IVOL) across G10 FX and XAUUSD we see vols at highly elevated levels – notably, NZDUSD and AUDUSD IVOL sits at 12-month highs. EURUSD is in the 89th percentile of its 12-month range and prices an expected move of 164-pips moves from current spot prices. Gold IVOL is mid-range and prices a $39 move (up or down) over the coming week.

We can see the VIX at 32%, and S&P500 10-day realised volatility at 34%, not far off its 12-month highs.

The market expects movement - lots of it – and this is a core consideration throughout the trading process. It is a consideration for traders on whether they choose to hold exposures over the news and of course position size and/or leverage ratio.

Traders’ playbook

The bulls are desperate for signs that inflation is set to roll back to the Fed’s target – they may be mistaken and while headline inflation is expected to fall thanks to a decline in energy, the Fed’s focus has shifted towards core CPI – shelter costs and medical care services are expected to increase by 0.7% MoM a piece, which will be at the backbone of inflationary pressures and they are sticky – this is why core CPI will unlikely roll over anytime soon and why the Fed has made it clear they will hike further and leave the fed fund rate in restrictive territory for an extended period.

While the playbook is diverse, and while we should consider the reaction should inflation come in line with consensus, there are two prominent scenarios in which traders will be asking “what if”?

- Headline inflation comes in at 8%, or lower, and core CPI prints 6.3% - here we see US 2yr Treasury yields fall c.15bp, the USD would likely fall 1%+ and on a broad basis, with AUDUSD and NZDUSD outperforming. Gold would also find solid buying interest, as would the NAS100 which would likely rally 2%+

- Headline CPI prints 8.4%+ and core CPI 6.6% - here, the terminal fed funds pricing moves from 4.69% towards 4.8% and traders ask whether the fed funds rate could be taken to 5% in 2023. Higher for far longer would be the tradeable mantra and the USD would fly, with equities down hard and risk FX slammed. Granted, the market already feels we are skewed to an above-consensus CPI read, but a higher terminal price would tighten financial conditions.

The battle lines are drawn – the playbook is set - and the question to ask is would there be a bigger downside move in risky assets on a below consensus print – or would the move be bigger on a higher number?

What’s your position?

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.