- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

Trading views – is the rates market signalling better times ahead for the USD?

We see clients aggressively long USDs across the board, countering the USD weakness and positioned for a short-term bout of mean reversion. From a fundamental perspective, we can look at the interest rates market and see fewer immediate reasons to chase USD downside here - where the more probable scenario is that price chops around and further consolidates.

A rise into 100.50 – the former YTD range lows – could be very telling. A rejection of this former range (now resistance), with price accelerating lower, could compel new USD shorts. Subsequently, a closing break above 100.50 could suggest a rejection of these lower levels and offer scope for 101.50/102.

Interest rate pricing – concerns for USD shorts?

One aspect that cautions me from selling USDs here, especially against the GBP, is what’s priced into the interest rates markets.

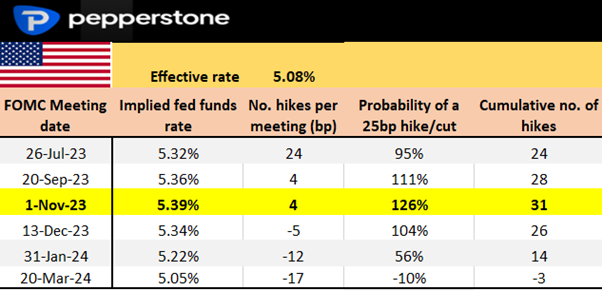

Here we see the implied probability of the Fed hiking by 25bp next week at 94% - so the market essentially sees a hike next week as a done deal.

Further out though, the implied probability of a further hike in the September meeting is 11%, and that feels a touch too low. A reading of 0.3% or above (MoM) in the June core PCE deflator (released 28 July) and again in the US July core CPI read (10 Aug), and the rates market could easily be pricing a 50% chance of a hike in September and an 80% chance the Fed hike in November. A big USD positive.

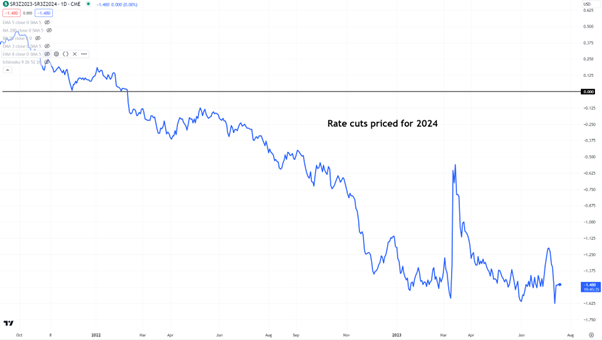

We can also look at SOFR interest rate futures and see 147bp of CUTS priced for 2024 – TradingView users can see this through CME:SR3Z2023-CME:SR3Z2024. While keeping an open mind, 6 rate cuts in 2024 feels rich. The market is pricing US inflation grinding to target, which will allow the Fed to lower rates from a restrictive setting to a more neutral one.

The market is essentially saying the Fed will not only be the first G10 central bank to cut but also the most aggressive when they start.

The recent pricing of additional cuts from the Fed through 2024 is one reason why we’ve seen the USD under pressure and gold eyeing a move back to $2000.

UK rate hike expectations unlikely to eventuate

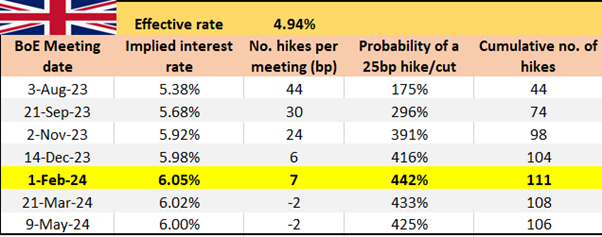

If we look at UK rate expectations (priced by UK swaps), we see peak bank rate expectations in Feb 2024 at 6.05%, and while this may take time to realise, I see this as too rich. Today’s UK CPI print will enlighten, and while we’ve seen the last four UK CPI prints come in above market consensus expectations, with the market running a huge GBP long position amid such elevated rates pricing, a below consensus CPI print could really impact GBP.

If the BoJ fail to change YCC it could lift USDJPY

We look ahead at Japan and next week’s BoJ meeting – If the BoJ raise the JGB 10yr yield cap to 0.75% to 1% (from 0.5%), it would incentives Japanese pension funds to invest a greater share of their investible capital in the domestic bond market.

Part of the recent JPY strength has therefore been FX traders front-running this potential change, yet commentary from BoJ gov Ueda at the G20 finance leaders meeting in India suggests they are in no rush to move. Should the BoJ leave policy unchanged, then USDJPY could push markedly higher.

The ECB hiking cycle is close to an end

We’ve also seen ECB Governing Council member Knot (a hawk) detailing that hikes beyond next week’s ECB meeting “would be a possibility but not a certainty”. This is perhaps the first time a known hawk within the ECB has backed the market’s view that we’re close to the end of the hiking cycle in Europe.

The rates market sees the ECB hiking next week and one last hike by October, but that is the last in the cycle. If we look at EU-US 10yr ‘real’ rate differentials and see these working in favour of USD appreciation.

So, a few red flags that suggest that the risk-to-reward trade-off in the USD is shifting to the long side – however, as always, price is true, and we react accordingly.

But when I look at the interest rate dynamics, it does suggest that the USD mean reversion may be the more probable direction – we shall see.

FOMC meeting (27/7 04:00 AEST) – expect a hike of 25bp, but the Fed won't declare victory, offering a view more work needs to be done and they are prepared to hike again – a hawkish hold that is data dependent.

ECB meeting (27/7 22:15 AEST) – a 25bp hike is assured – but we move closer to the end of the cycle.

BoJ meeting (28/7, no set time) – a change in policy is a line ball call, but should they move, it could have big implications for the global bond market and the JPY.

Aus Q2 CPI (26 July 11:30 AEST) – we get unemployment data tomorrow, but the CPI print could decide whether the RBA hike by 25bp or pause on 1 August RBA meeting.

China politburo meeting (28th) – a meeting of the key personnel – given recent economic trends, the market will be expecting a number of tangible stimulus measures, but will they meet expectations?

US Q2 earnings – 48% of the market cap of the S&P500 report this week – it’s the biggy – the marquee week.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.