- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

A traders’ week ahead playbook – technically long, tactically cautious

In Europe, the FRA40 was the best performing EU equity index, +8.9% for July, while in APAC and Asia the AUS200 rallied 5.7% and trending beautifully into FY earnings.

Ethereum gaining a massive 67% in July has shown us once again that if risk is going up then crypto is the high beta play and we watch this space for a new leg higher in this move. FX markets were less clear, with the NOK working well as a pure pro-risk FX play, while the once safe-haven JPY has also shone as US bond yields fell, validating the BoJ’s dovish stance – clients have been heavy buyers of JPY of late and continue to hold a positive JPY stance.

We start the week pricing on a slight negative vibe

China released a poor manufacturing PMI print, with the index at 49.0 and pulling into contraction territory – geopolitics was looking like making somewhat of a return with US and China relations in focus as talk of a possible Nancy Pelosi visit to Taiwan did the rounds, but that looks to not the case now.

As we look ahead, we consider what themes and event risks will drive markets this week. With the Fed moving to a more data-dependent/balanced structure last week felt as though we saw a temporary ‘goldilocks’ scenario – if the data proved to be poor then rates hikes are priced out, bond yields fall and the USD found sellers – subsequently, we buy growth equity, crypto, gold and the JPY. If the data proves to be better, then we speculate the recession trade may have gone too far. One thing is clear, bad news has been bad news for the USD and certainly versus the JPY, with USDJPY -2.1% on the week – falling through the 50-day MA, which has worked as a primary trend filter since March.

From a momentum perspective, my indicators are bullish and there are few reasons to be short – the NAS100 has some big levels to break into 13k – an upside break here could suggest adding to longs. The USDX tests the lower levels of the regression channel (drawn from the Jan lows), while EURUSD consolidates in a 1.0100 to 1.0270 range. XAUUSD looks interesting for $1786 but requires a weaker USD and lower real rates and SpotCrude needs to break out of a $95 to $103.70 range.

The battle lines are drawn, but tactically I would be looking more favourably at short-risk trades – as always, when the tactical and fundamental view and technicals disagree on the longer-timeframes I'll back Mr Market, especially if using leverage. However, I see a refresh this week in the markets thinking and good economic should see the market price a greater chance of another 75bp hike from the Fed in the September meeting and now US Q2 earnings are drawing to a close, and financial conditions are more accommodative than they were before the Fed hiked the fed funds rate by 75bp last week - one suspects the Fed will not want to take the foot the inflation break just yet. Feels like the skew of risk is for the Fed to gently tighten financial conditions and discourage greater risk-taking from hedge funds.

We can also see the bank reserves held at the Fed increased by $40.4b last week – this looks at the liability side of the balance sheet and has correlated well with growth and high beta equity and gives a good guide to liquidity. If this was to turn lower, and we won’t know until Thursday, then it will hold well with a weaker equity tape.

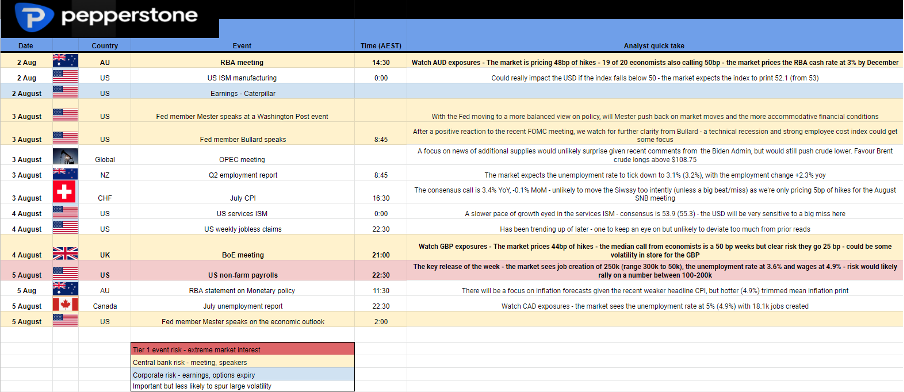

Looking at the economic calendar

We have the RBA and BoE meeting – we can see GBPUSD 1-week implied vols are still quite elevated and could easily see some moves play out in the quid. I think they go 25bp myself, which offers moderate GBP risk, but the job of the trader is to run the distribution of potential outcomes and assess the sort of moves that could play out. In the US, the ISM manufacturing report, payrolls, and Fed speakers will garner my close attention.

After a huge July, we turn to the Northern Hemisphere summer holiday trading conditions – it doesn’t feel like traders should be shutting up shop and taking a break given the unfolding dynamics, even if it can be the best thing for the mind.The week ahead event risk calendar and trader playbook – if you can’t read this then click through to the Twitter thread for increased clarity.

(Source: Pepperstone - Past performance is not indicative of future performance.

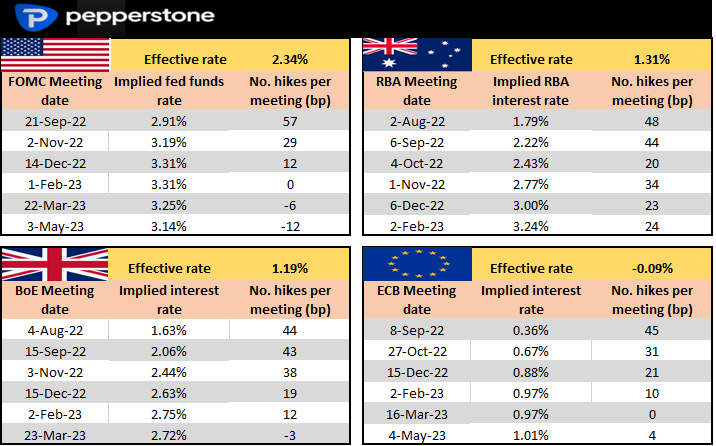

Rates Review – we look at interest rate market pricing for the upcoming central bank meeting and then the step up (in basis points) to the following meetings. We see 48bp of hikes priced for this week’s RBA meeting and 44bp of hikes from the BoE.

(Source: Pepperstone - Past performance is not indicative of future performance.

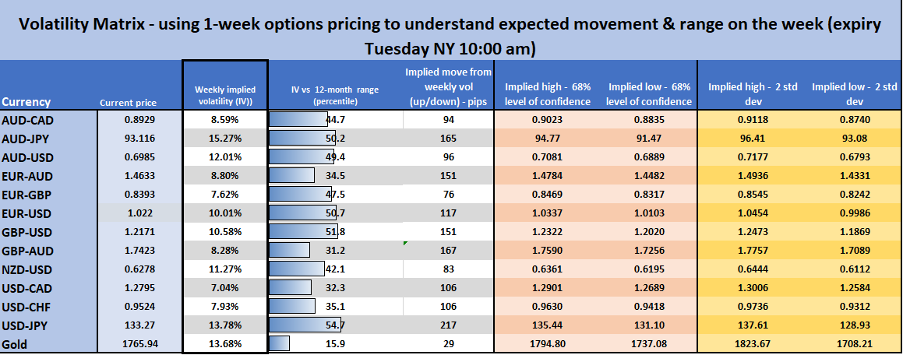

Implied volatility (IVOL) Matrix – taking into consideration the event risk disclosed above we look at the implied moves, which are derived from options pricing. We can calculate the expected move on the week and project to get an expected trading range with a 68.2% and 95% level of confidence. Good for understanding the perceived risk on each asset and for mean reversion. We see USDJPY and GBPUSD having the highest relative implied move, with most pairs holding the 50th percentile of the 12-month range.

(Source: Pepperstone - Past performance is not indicative of future performance.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.