- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

There has been spluttering of news of note over the weekend, although the G10 FX open has been fairly sanguine, as should the futures open at 10am AEDT.

A worsening of China’s producer inflation (-1.7% YoY), and Iran detailing they have come across oil fields with some 53 billion barrels shouldn't cause too much angst. Consideration has also been thrown on the UK, with Moody’s cutting the UK credit outlook to negative, although, it hasn’t affected proceedings with GBPUSD currently trading 23 pips higher on the open, and looking to reclaim the 1.28-handle, with small strength in the GBP crosses.

The bulk of the news flow has largely centred, predictably, on US-China trade and whether there will even be agreement on a ‘Phase One’ deal – something the market has gone someway to pricing to almost perfection. White House trade advisor Peter Navarro detailing that “there is no agreement to roll back any existing tariffs as part of Phase One” is getting some focus and brinkmanship firmly in play one suspects with the Chinese expecting all, if not a decent portion of tariffs to be unwound.

The market has bought into the idea of agreement, certainly judging by the fact USDCNH remains sub-7. USDCNH 1-month implied volatility sits at a lowly 4.78%, which, for context is the 23rd percentile of the 12-month range. Trade aside, it’s a big week for Chinese data too, with credit data (no set date - new yuan loans, M2 money supply), industrial production, retail sales and fixed asset investment (Thursday at 13:00 aedt) in play. Whether this data influences is yet to be seen, as trade remains the clear driver in CNH variability.

Markets setting up for a buy the rumour, sell the fact

Either way, implied volatility is shot to pieces in this pair, as it is across G10 FX, most notably in USDCAD and EURUSD. The world wants to be long risk and short volatility into any impending meeting between Trump and Xi, but will they get what they want, and tactically if we get an agreement, do we then see a classic buy the rumour, sell the fact scenario play out? I see this as a material risk.

Of course, it’s not just trade which is influencing, but stabilisation in the economic data flow has seen an aggressive unwinding of recession hedges, at a time when central banks continue to allow economies to run hot. Jerome Powell’s “significant inflation is needed before any rate hikes”, testament to that view. I guess we can add in a touch of buying from systematic players and, a touch of FOMO, and we have a nice move in asset markets. Nowhere exudes this more than in bond and rates markets, with some incredible moves last week.

Big moves in fixed income

We saw the UST 10-year up 23bp on the week, and eyeing a move into 2%, with 5s +20bp. In Japan, we saw 5-year JGBs moving +12.8bp higher to -17.8bp, with 10s potentially even looking to go positive for the first time since March. We’ve seen steeper curves with the highly-watched US 3m10yr +19bp on the week, although I do find it interesting that US inflation expectations haven’t moved anywhere nearly as aggressively, and thus we can deduce that the move in longer-duration bonds has really been a reduction in term premium and extended bullish positioning.

It’s also interesting to see that in the rates market Eurodollar futures (see below) are pricing in a very small element of HIKES in 2020, which is fascinating given it comes over the presidential year. Let’s see how things shape up if Michael Bloomberg gets some momentum on the Democrat side, but, while I do not sit in a recession in 2020 camp and do not expect rate hikes either, USDJPY is a good way to hedge against further upside in rates. Happy to hold a modestly bullish ST view here, and would look to change this on a move through 108.65 (Thursday low).

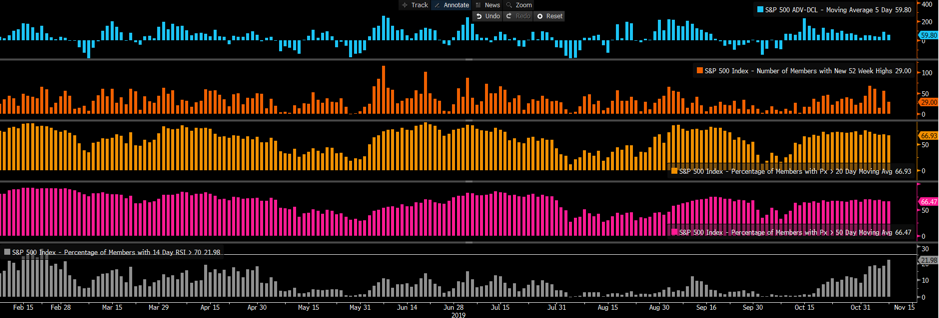

Stocks continue to grind higher with the S&P 500 closing up 0.3% on Friday, taking the gains on the week to 0.9%. Valuations worry me here, with the S&P 500 on 17.54x forward (the highest since January 2018). However, are we there yet in terms of internals? Not quite it seems, with 29% of S&P 500 companies closing at a 52-week high and 66% above their 20-day MA. I’d be more concerned if this was 50% and 80% respectively, although I’ll note 22% of stocks closed with an RSI above 70 – the most since 25 February. Happy to remain bullish here for now, but caution is increasing, especially given the index is up for five consecutive weeks.

When priced in own-currency terms European markets are working best, with the CAC 40 putting on 2.2% last week. Asian markets have also fared well, with the Nikkei 225 (2% last week) showing that when it comes to steeper curves and reduced rate cut expectations you head to the Nikkei 225 as your default hedge – Japanese banks are feeling a little bit more optimistic after what we have seen recently. The Hang Seng also putting on a lazy 2%, while the ASX 200 and CSI 300 lagged a touch, gaining 0.5% and 0.8% respectively.

We can expect Asia to open on the front foot again with Aussie SPI futures +26p from 16:10 AEDT to the futures close. Again, this puts the ASX200 on a collision course to the top its multi-month trading range, although, our early call sits closer to 6750, just shy of the upper Bollinger Band, which is narrowing relative to the lower band - realised volatility is coming in. I’d be fading moves in the ASX 200 should we see the bulls push us into 6760 on the day.

All eyes on the bird

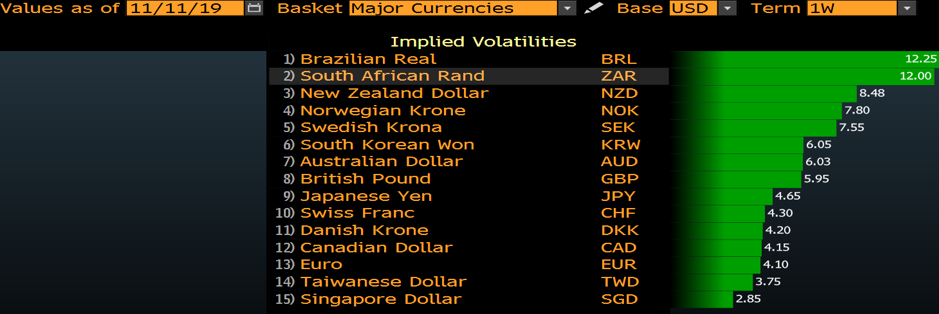

The currency I expect traders to pay more attention to this week is the NZD. Outside a couple of EM names, the NZD has the highest 1-week implied volatility, and that is no surprise given Wednesdays (12:00 AEDT) RBNZ meet.

The Bloomberg consensus is we see a 25bp cut, with 12/18 economists calling for it, which fits nicely with the 64% chance of a cut priced into swaps markets. Trading this event, therefore, is for the brave, as the market feels they may well ease, but like most other central banks, they will offer insights that they are now in a protracted hold period.

The move in the NZD comes if they leave rates on hold and then offer a longer wait-and-see approach. In which case NZDUSD could be closer to 64c. Consider aligning with the consensus has form, correctly backing 80% of the RBNZ moves.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.