- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

See my take on the CPI figures and reaction here.

We look ahead into today’s trading session at the event risk for traders to manage, and we see China's high-frequency data (Industrial Production, retail sales, fixed asset investment), Aussie Q3 Wage Price Index, UK CPI and US retail sales/PPI. It could be another lively day ahead, especially if we see a below consensus US retail sales print.

Here are five charts that visualise the mood and reaction.

US rates pricing – the market confident of easing in 2024

We can see in US swaps that the first-rate cut from the Fed is now priced for May 2024, with 1.6 cuts priced now for June. Looking further out in 2024, we can look at SOFR 3-month interest rate futures and assess what is priced for 2024 – I use the equation “CME:SR3Z2023-CME:SR3Z2024” in TradingView, where we see the difference between Dec23 and Dec24 futures. In reaction to the CPI print the market essentially added 21bp, or nearly one full rate cut, into its pricing for next year. We now see a full 105bp of cuts priced and where the movement is influencing the USD.

EURUSD – just another expression of USD trends

When we see a full-blown USD liquidation, it can be a case of choosing the highest beta currency and trading that vs the USD. The MXN, NZD and AUD typically hit that criterion, but we still see good flows into GBP and EUR. On the day, we’ve seen the yield premium command to hold US 5-year Treasuries come in 11bp vs German bunds, and that spread narrowing has been at the backbone of the rally in EURUSD into 1.0875. On the daily, we see EURUSD having retraced 50% of the July to October sell-off and we’re testing former trend support, which is now resistance. I am looking for sellers to kick up into 1.0900 but there is no doubt the USD is driving the FX market, and on current dynamics, it seems as though the market is growing more comfortable running short USD exposures into year-end.

AUDUSD – big upside levels tested once again

With US rates pricing in a higher degree of cuts from the Fed in 2024, we’ve seen higher beta FX working well, with 2%+ net gains on the day in SEK, NZD, and AUD. EM FX has seen even larger percentage changes which is also a function of lower relative liquidity. In the session ahead we watch for the Aussie Wage Price Index and the tape in China equity. With the consensus expecting a 3.9% yoy increase in wages, a 4-handle could take AUDUSD above 0.6520 – this has been resistance since mid-August and could be a level scalper focus on today. The actual structure of this pair is looking interesting and while this is predominantly a USD move, if China’s equity kicks up and we see a weak US retail sales report. A break of 0.6520 brings in 0.6600.

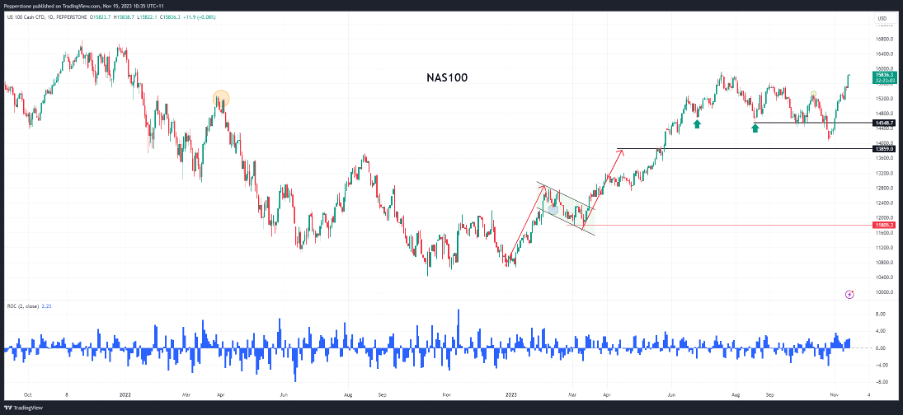

NAS100 – chasing for new highs

The chase is real. Granted, we’ve seen more pronounced moves in the US2000, and certainly in the ETF complex with punchy moves in the KRE ETF (S&P regional banks), XHB ETF (homebuilders) and high short-interest baskets. However, it’s the NAS100 with the wind to its back, where price sits a whisker away from the July highs of 15,931 and only 5% from the ATHs set in Nov 2021. While traders are buying tech and the Magnificent 7 on the back of the big reduction in both nominal and real Treasury yields, which makes the net present value of these long-duration businesses more attractive, there is a momentum play here and active managers are presumably chasing. Another catalyst for NAS100 traders is that Nvidia report quarterly earnings next week (21 Nov) with the implied move on earnings at 7.7%.

China CN50 – time for China to shine?

Chinese equity markets have been underperforming for some time, but could better times be coming, with China equity launching into year-end? There has been a preference to buy what is strong and sell the weak, and as a momentum trader, this makes sense. So, I remain of the view that until we see momentum indicators kick up in China’s equity markets and we see better inflows through the Northbound ‘connect’ that until we see such developments, the preference is to trade the NAS100 and even the GER40 / EU STX50 from the long side. On a positive note, the USD sell-off will help China/HK equity, but we’ve also seen new headlines of $137b in low-cost funding to sure up confidence in the housing market, and there has been increased speculation of deploying funds from the Pledged Supplemental Lending program. In the session ahead we get China’s retail sales, and fixed asset investment and better numbers here could set China’s markets off. We will also see earnings from Tencent, Alibaba and JD. Com this week.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.