- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

US data was seemingly the smoking guy with the weakest reading in US consumer confidence since July 2022, and the second sub-100 read since August 2022. The Chicago PMI data, which rarely gets much focus, fell to the lowest levels since November 2022. The big talking point though was the US Employment Cost Index (ECI), which grew 1.2%, well above the economist’s consensus, and when we know the Fed look at this closely, so will the market.

The reaction in markets speaks out, with US swaps now pricing just 28bp of cuts by December – so essentially, one full 25bp cut. US Treasury yields rose 7-8bp across the various tenors, with US real rates (i.e. US Treasuries adjusted for expected inflation) – i.e. the real cost of capital – rising 8bp and looking to print new run highs. This move in rates was toxic for gold, Bitcoin and US equity, where the S&P500 closed -1.6% and on its lows, with the NAS100 -1.9% and small caps (US2000) -2.1%. However, it was the spark the USD clearly needed, and the USD put on a show against all major currencies.

USDJPY continues to be front and centre with price pushing into 157.84, and the recent intervention lows of 154.52 are firmly in the rearview mirror. AUDUSD has been offered into 0.6472 and after a run of form, we ask whether the tables have turned so that rallies will now be sold. EURUSD sits near the session lows at 1.0668.

Are we looking at the start of a trending USD? That is a big talking point now, and while a lot while ride on higher US bond yields and whether we can see US 5yr real rate push into 2.5% (currently 2.28%) or the US 10yr Treasury above 5%, we also need to consider the performance of equity, volatility and credit – should equity roll over and head lower again and the VIX index pushes into 20%, then the USD will likely trend higher and it will be given additional legs by systematic players, who’s rules tell them to buy because price is simply going up.

A closing break of 106.50 in the USD index would certainly get me interested in that view.

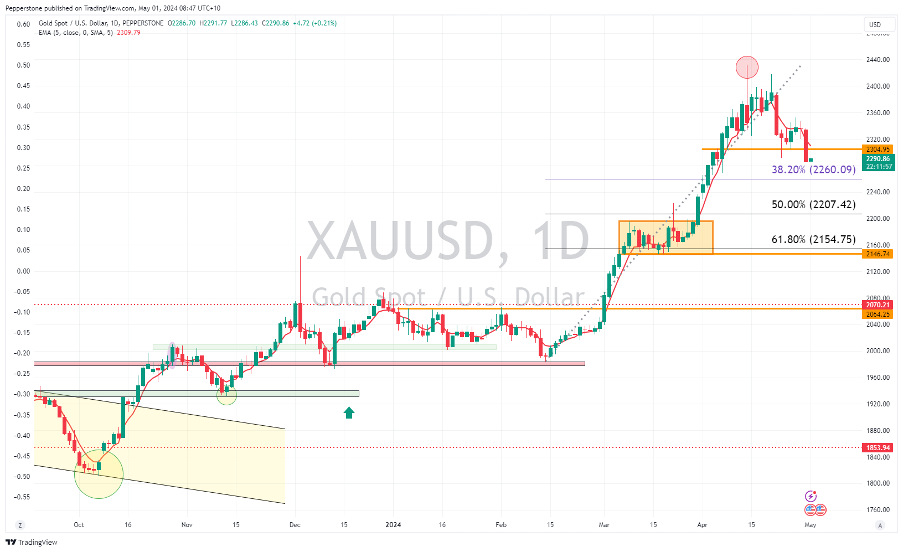

Gold has been well traded by clients and has broken the range lows of $2305 and looks set to target $2260 – the 38.2 fibo of the Feb-April retracement and 50-day MA. If the rate of change remains elevated and the price holds below the 5-day EMA then I would be short or neutral, as the market is favouring selling into strength.

In the post-market equity session, we’ve heard numbers from Amazon, Super Micro Computers, and AMD, and while Amazon sits up 2.2% in the after-market, it hasn’t been the saving grace index traders (longs) would have hoped, and S&P500 and NAS futures are some 0.2% lower from the respective cash market closes. It leads to a weaker open for Asia equity, with our opening calls for the ASX200 -1.2%, NKY225 -0.8% and HK50 -1%.

All eyes are on the US Treasury’s Quarterly Refunding Announcement (QRA), and the FOMC meeting and Jay Powell's presser through US trade (4:00/4:30 am AEST). Many expect a slight hawkish turn from Jay Powell; however, one questions if it will be as great a twist as what markets are now pricing? I am not so sure, and it feels like most are expecting a ‘hawkish’ reaction. The market is running long USD positions into the event risk, but will Powell’s narrative meet the positioning and pricing? I am cautious about this and will be managing USD exposures according.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)