- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The door has been left open for a third cut as part of the ‘mid-cycle adjustment’, which would be consistent with the 1990s’ adjustments that he’s referred to. Future decisions, he said after the September meeting, will be data-dependent.

So, what’s the data saying, and why has the Fed announced another round of balance sheet expansion? And do last week’s trade talks change the economic outlook?

The Fed are committed to keeping the economic expansion going and that means running the economy hot.

Here’s what you need to be paying attention to if you’re planning to trade the 30 October rate decision, because what the statement reveals will matter to a market still craving rate cuts.

Calming trade tensions

The US and China struck a partial trade agreement on 11 October after a further round of negotiations. Washington ceded the mid-October tariff hike from 25 to 30% on $250bn worth of goods, while Beijing agreed to purchase an extra $40-50 billion worth of agricultural goods, notably soybeans and pork.

USDCNH dropped from the 7.16 level to 7.05 over the days of trade talks. Yuan-proxies AUD and NZD strengthened. Over the same period, gold against USD fell below the 1500 level and closed at 1489 on 11 October. The USDX dropped from 98.7 to 97.9.

Note that the US-China truce was verbal only, and according to Bloomberg, Chinese state media didn’t refer to the agreement as a deal at all. Beijing is hesitant to raise trade expectations, showing the world’s second-largest economy remains uncertain on the trade front.

Existing tariffs remain in place and more are still planned for December, so we don’t expect USDCNH to drop meaningfully from here, although it remains a must-watch currency pair

Mixed US data

The door is open for a third rate cut as part of Powell’s ‘mid-cycle adjustment.’ The middle-of-the-road approach taken after the September meeting says future rate decisions will be data dependent.

And that economic data has been so mixed, with certain data points flirting with record-high achievements one moment, then approaching rock bottom the next, staring recession dead in the face.

The ISM manufacturing PMI index changed the mood this month when it slipped to a decade low on its 1 October release: 47.8 against 50.0 expected. The considerable miss renewed recession fears, as the S&P 500 dropped 1% and USDJPY weakened to a one-month low. Rate cut expectations jumped and gold against USD was propelled above the 1500 level.

Two days after the manufacturing print, we saw the US ISM services come in at 52.6 well below expectations of 55.0

Then came the monthly nonfarm payroll data on 4 October, falling 9000 below expectations: 136k against 145k. Despite the shortfall, unemployment hit a 50-year low of 3.5%.

Markets were bearish leading up to non-farms after the poor manufacturing print. So when payroll data was bad, but probably not as bad as expected, some of that lost confidence was restored. Equities rebounded, USDJPY strengthened back above 107, and gold pared back, hitting a 1488 low on 7 October.

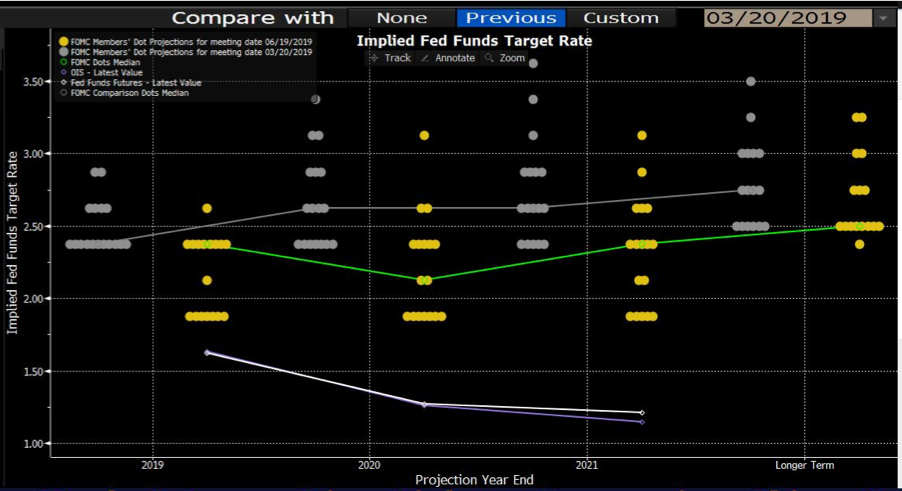

As at 14 October, markets are pricing a 72% chance of a rate cut at the October meeting, from a target of 2-2.25% to 1.75-2%. According to the quarterly FOMC dot plot released September, the median forecast sees the cash rate hold steady rather than easing. Although with seven members favouring one more cut, there is room for a final dovish move.

Note how different this is to the market expectations (white). Fed funds futures are pricing in much more considerable cuts than the FOMC voting members’ forecast.

Permanent open market operations (POMOs)

A new round of balance sheet expansion has been announced, and this round is permanent and larger than expectations.

The move is to bolster the short-term funding markets, into which the Fed pumped billions of dollars on 16 September when available cash dried up.

The Fed has announced this in advance of the October meeting so it comes as no surprise, especially because it risks being confused with quantitative easing (QE). Powell has stressed it is not to be confused with the QE measures that followed the 2008 financial crisis, which could stoke fear of a systemic failure or impending recession.

Two weeks to go

When the poor manufacturing data was released, President Trump quickly blamed it on the Fed’s reluctance to ease rates. The president has previously called for 100bp of rate cuts and even a 0% rate – to depreciate an overpriced dollar and maintain export competitiveness. This is a crucial point. Remember that Trump campaigned on saving US manufacturing, and his aggressive trade policies with China were supposed to fulfil these promises. He’ll continue to shift the blame and increase pressure on the Fed for more rate cuts, especially as the trade truce changes little in the bigger picture.

Trump would have been pleased that the USDX pare back after last week’s trade truce, although only to just below the 98 level. Assuming global data remains poor while US data remains average, expect the USDX to rebound as the USD remains the least dirty shirt in the global laundry basket.

Market pricing of an October rate cut fell from an 85% probability before the trade truce to a 72% probability on 14 October. This probability will likely tick up as we approach the 30 October FOMC meeting as the trade outlook isn’t materially much more certain.

It will be worth listening to Fed Vice Chair Richard Clarida’s words Thursday 19th. If he thinks it’s more appropriate for rates to stay on hold, he’ll use the opportunity to guide markets lower again.

Stay ahead of developments with Chris’s Daily Fix commentary, and we’ll review the meeting and probabilities nearer the time. It goes without saying, this is a risk event and has to be on your radar.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.