- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

We head into the new trading week with the S&P500 closing at its 45th all-time high (ATH) in 2024, with the Dow also at ATH’s, while the Russell 2k rallied 2.1% on Friday and could test the 52-week highs of 2299 this coming week.

Sentiment towards US equity is clearly upbeat but importantly not yet at euphoric levels – S&P500 cyclical sectors are outperforming defensive sectors, high beta equity outperforms low volatility beneficiaries, and shorts continue to cover. Market internals portray good participation, but the various metrics are not yet at alarming levels, with 62% of S&P500 companies above their 20-day average, while 21% of S&P500 constituents closed at a 4-week high on Friday, where we would typically see the S&P500 peak when this number moves above 50%.

US Q3 earnings set to increase in frequency

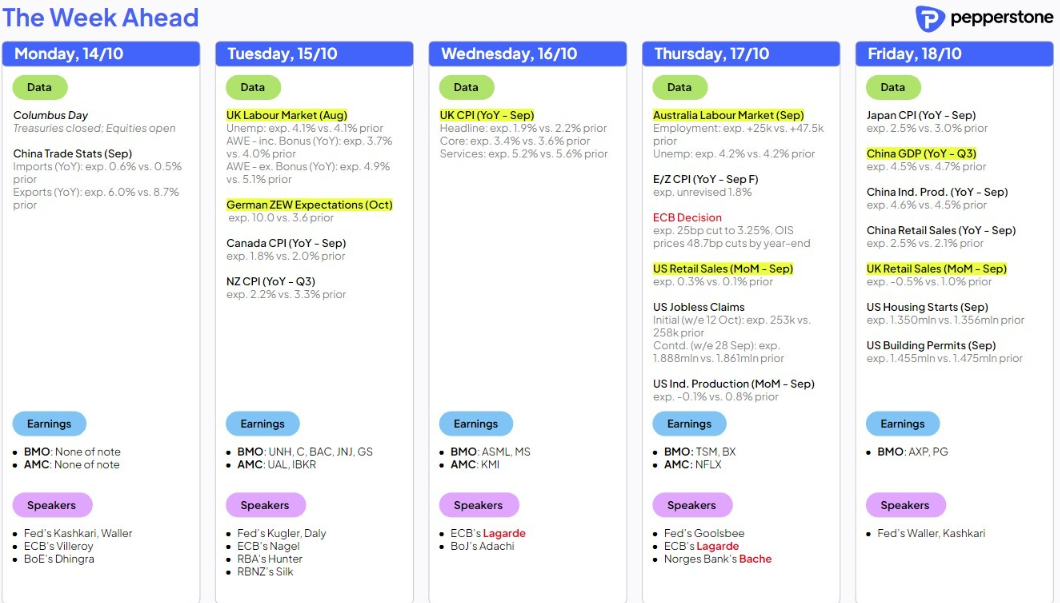

US Q3 earnings will start to play a greater role in influencing variance in the respective US indices this week, with around 9% of the S&P500 market cap reporting, although it’s the following week where we get the deluge with 37% of the S&P500 market cap set to report.

JP Morgan has set a precedent reporting a solid set of numbers on Friday, subsequently raising the bar for other upcoming reporting banks to also inspire in the guidance. Notable reporting names for traders to put on the radar are Bank of America, Goldman Sachs, Citigroup, and Netflix. United Health (UNH) also report, and while unlikely to attract the same level of attention from traders as Netflix, UNH does hold a 9.1% weighting on the Dow. With options volatility pricing a -/+4% implied move in UNH on the day of earnings, any outsized move in UNH share price would influence the Dow.

In Europe, the skew in directional risk for the German DAX40 is for higher levels and remains my preferred long play within the suite of EU indices, where a push through 19,500 would attract further momentum-focused capital. While in Asia, the NKY225 needs a push through 40k to get the momentum pumping, and while a weaker JPY would be a tailwind for the index this week, we can price the NKY225 in CHF terms (the strongest G10 currency last week) and see the index still holds up well, suggesting the recent gains are not simply a currency play.

China/HK markets set to react to the weekend MoF briefing

The volatility in Chinese & HK equity indices may have settled late last week, but there are risks that increased range expansion may return. Subsequently, we watch for the reaction in equity and the yuan to China’s Minister of Finance’s weekend press conference.

Gauging a potential reaction is always a tough job to price, however, on balance, despite expectations of defined fiscal measures having been reduced through the week, the risk seems skewed for a weaker open in China/HK equity markets. The market failing to hear enough substance and a defined timeline in the roll out of fiscal stimulus, notably in the areas that will directly consumption and lift China out of its debt deflation loop. However, there was a message of strong intent and a defiant stance to hit its 5% GDP target, with a clear appetite for a sizeable increase in the fiscal deficit and a potential move away from its 3% deficit limit – a factor that may limit any initial fallout in equity.

Ultimately, with market participants looking to efficiently price certainty on China’s growth prospects, the lack of immediate clarity on China’s efforts to reflate the economy is unlikely to be taken well.

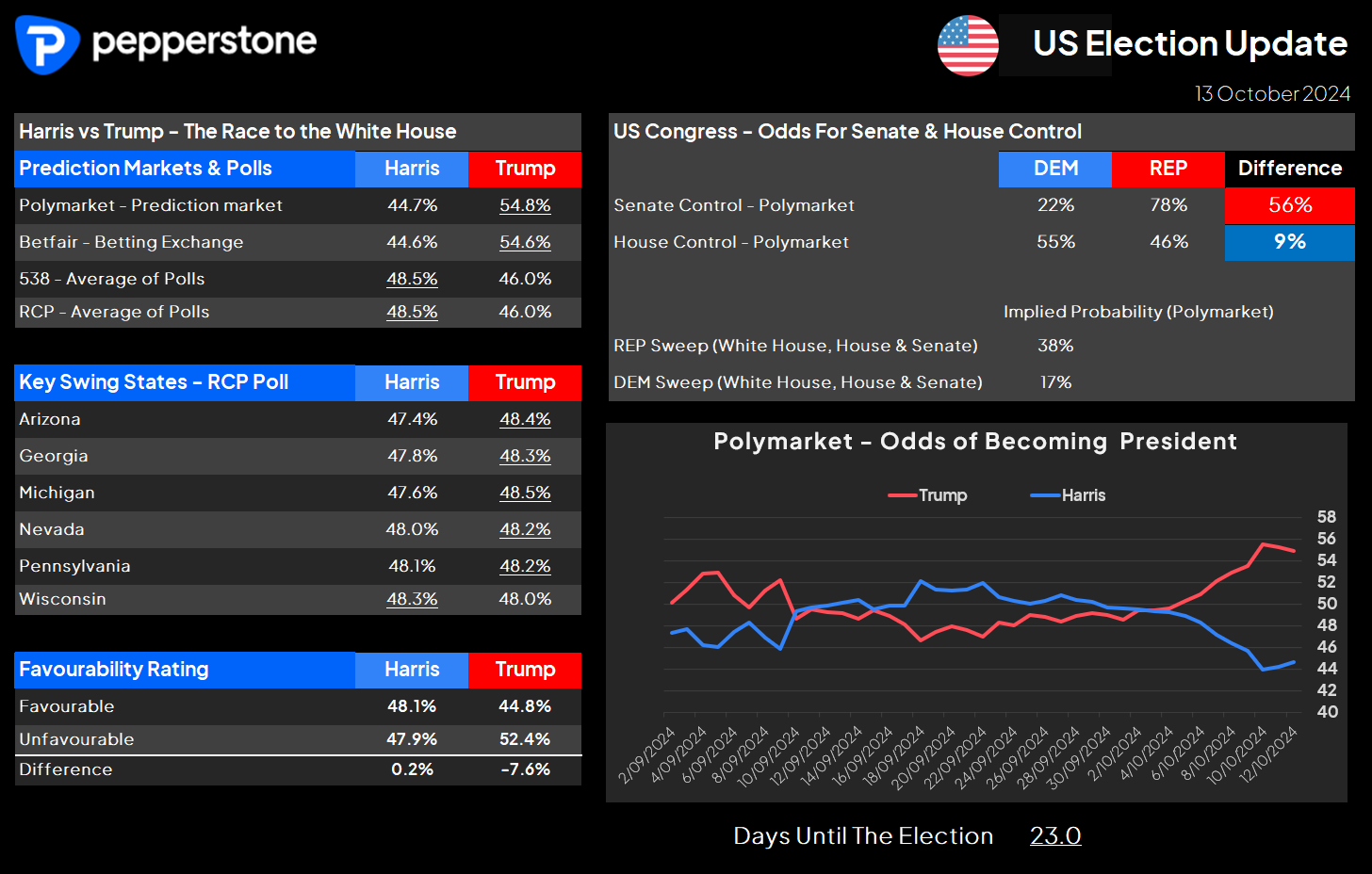

Trading Trump tariff risk – the yuan to get the clear focus

Another factor which is emerging is that Trump’s rating in the polls, notably in the 6 key swing states has picked up – certainly enough for market players to increase tariff hedges and trade expressions. We observe that most prominently in the options space, with increased demand for 1-month volatility in USDCNH, USDMXN and to a lesser extent in EURUSD. Of course, scepticism of polling data remains, and even more so the use of betting markets as a guide to efficiently price tariff risk, but it is still the best we have.

If Trump’s prospects are indeed increasing, then a potential 35-percentage point increase (to 60%) in tariffs on China’s imports would clearly negatively impact China’s efforts to engineer consumption and reflate.

The standout trades for a potential Trump presidency and the threat of tariffs are best expressed in the FX markets, with long USDCNH a growing consensus expression. Many will recall the 11% move higher in USDCNH in 2018 after the initial Trump tariffs resulted in China depreciating the CNY to offset tariffs. Short EURUSD also screens as a compelling alternative, where Trump tariffs would likely come at a time when the US economy is looking in relatively fine form – a factor that would give Trump, if he does become president, increased leverage to go hard on tariffs. USD upside risks remain but the ECB will need to lift its dovish game With the USD in mind, its near-term prospects remain positive, and this should limit pullbacks in the USD pairs.

The US dollar index (DXY) tests 103, where a break of a defined congestion zone (best seen on the daily timeframe) should see a further push to the YTD average of 103.72 and the 200-day MA at 103.76.

The EUR, which holds a 57% weight on the DXY, will naturally impact the direction of travel in the broad USD, where the EUR takes its steer from Thursday’s ECB meeting, with the bank almost certainly set to cut rates by 25bp, with EU swaps priced accordingly. The move in the EUR, therefore, comes from the tone of the statement and Lagarde’s presser and how it reconciles to the 147bp of cuts priced over the coming 12 months. EURUSD has absorbed a raft of dovish ECB speaker rhetoric of late, so a dovish read in the ECB’s statement may well be in the price. Still, given the current technical set-up, it feels like countering the trend lower is a tough call at these levels, at least for those working off higher timeframes.

US event risk centre's on retail sales and Gov Waller’s speech

US event risk is perhaps limited to US retail sales on Thursday, and while the labour market remains the primary focus, consumption trends still command attention. The market looks for a 0.3% m/m lift in sales, with many seeing an elevated risk of an upside surprise, where the prior three retail sales reports have come in well above consensus. We also have 11 Fed speakers to navigate through the week, although I would be most concerned about holding positions over Gov Waller's speech on Monday (Tuesday 6 am AEDT), where we look for any guidance on the 25bp cut or hold debate for the November FOMC meeting. In the ongoing battle to price US interest rate risk, we see 20bp of cuts priced for the November meeting, or an 83% chance of a 25bp cut.

Further out, we see US interest rate futures pricing the fed funds rate to trough at 3.33% by Q1 2026, implying 150bp of further cuts to come.

Other key event risks for traders to navigate

Elsewhere in the week, we continue to be on the lookout for geopolitical headlines that could increase the prospect of a shock to Iranian crude output, which would lead to a spike in the crude price. In the UK we get job numbers, CPI, and retail sales, with the market firmly of the view the MPC cut rates by 25bp in the 7 Nov meeting. In Australia, we see the September employment report, but with the first 25bp cut not priced until February, it's questionable how influential this well-watched jobs data will be to the AUD or ASX200.

We also get CPI numbers in NZ and Japan, and certainly the NZ CPI print could be worth putting on the radar, given the market expects headline CPI to drop to 2.2% y/y and we’re hearing calls from some circles that the RBNZ may cut rates by a punchy 75bp at the 27 November meeting.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.