- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Our flow has taken further aim at the precious metals complex, with silver (XAGUSD) gaining a further 8%, taking its gains since 17th July to 21%. Gold is for the calmer heads and those with a lower risk tolerance, with the yellow metal putting on a further 1.5% (now $1871). One simply has to ask whether it’s a matter of time before the all-time high of $1921 seen in September 2011 comes into play.

(20-day intra-day chart of silver)

(Source: Bloomberg)

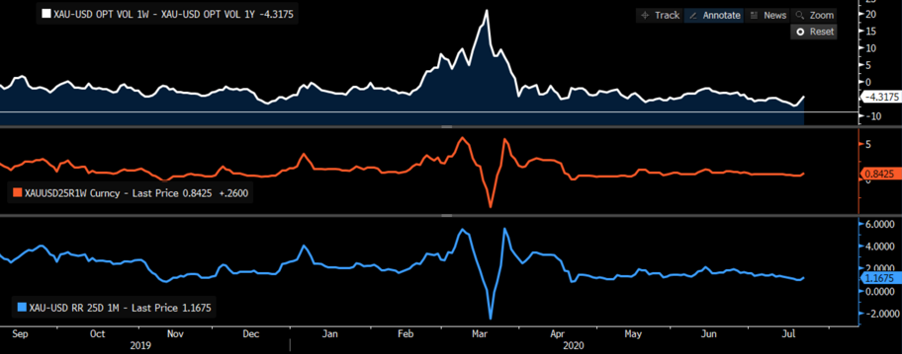

Precious metals feel like a pure momentum play here, with money managers and leveraged funds hoovering up gold futures. The GLD ETF has also seen good inflows of late too. That said, on the options side sentiment is still pretty neutral and while I see short-term (1-week) implied volatility increasing relatively to longer-vol (1-year) it’s still not at a level reflective of the now more impulsive price action. The skew of call volatility over put volatility is not at levels where I would feel deep concern with euphoric conditions and subsequently cutting longs.

- Top – 1-week implied vol – 1-year vol

- Middle – 1-week gold risk reversals

- Lower - 1-month gold risk reversals

By way of catalysts, we’ve seen limited moves in US Treasuries, with UST 5yr ‘real’ yields unchanged at -1.15%, and with the USDX down just 0.2%, makes me think this is pure momentum.

Fundamentally the ever-changing policy settings of the Fed have been discussed, with the WSJ weighing in. The idea that the Fed would no longer raise rates to combat inflation like they would have done proactively in the past seems important for markets. By allowing inflation to remain above its 2% target for some time, subsequently targeting inflation to average above 2% is key. Average inflation targeting has been talked about by economists and market participants for a while now, but it looks real.

This change in the Fed’s reaction function would be a headwind for the USD and positive for equities and perhaps is playing into the move, as it would result in the Fed holding off from hiking when other central banks may be embarking on tighter policy.

Anyhow, it’s not something we need to concern ourselves with anytime soon.

We also saw the White House ordering the closure of the Chinese Consulate in Houston, which brought up remarks of potential retaliation from the Chinese. I am not sure I’d be buying gold on this headline alone and most expect more of this ahead of the November election.

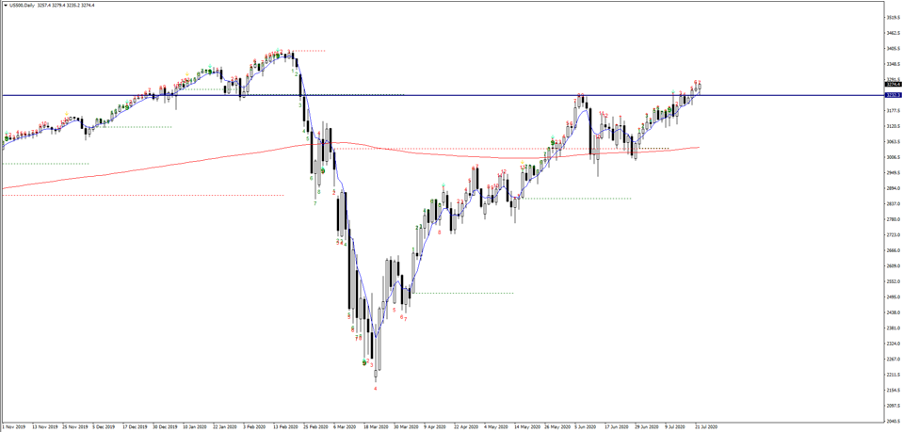

The S&P 500 has closed 0.6% despite the US-China headlines, with a better bid coming into the market in the final two hours of cash trade - taking a big picture view it just feels to me that like the index trades higher still. Ok, the US fiscal negotiations poses a risk to that call, and some have pointed to the fact turnover was light (15% below the 30-day average, 1.3m S&P 500 futures contracts traded), but breadth was ok for a 60bp move (74% stocks higher).

The notion of the stock market and gold moving as one still feels strange to many, but this is the way of the world. Real yields are driving the show and equity traders like gold as a hedge and I guess when we’re seeing a bearish trend in the USD and rising inflation expectations these correlations will play out.

Earnings are rolling in with close to 20% of the index (by market cap) having reported quarterly numbers. 81% of companies have beaten on earnings, 71% on sales, so perhaps micro has helped broad equity appreciation. Microsoft is not helping matters though and the stock is 1.4% lower in after-hours trade. Retail favourite Tesla is faring somewhat better with the stock up 7% in after-hours trade, with better-than-expected numbers.

One thing that has jumped out is that the firm turned over a 50c profit vs expectation of a $1.06 loss – with some $428m in regulatory credits helping that along. Importantly, Tesla has not just generated solid free cash flow of $418m, but met its goal of selling 500,000 cars in 2020 and reported a fourth straight quarter meaning it qualifies for inclusion in the S&P500 where passive funds will need to buy given its high weighting on the index.

On the FX side, USDCAD is making a tilt at the June lows, although USDCHF is also one to watch as the move lower has picked up the pace and is eyeing the March low. The trend is mature, with price having already moved from 0.98 in May and has moved significantly far enough from all moving averages for the medium-term mean reversion traders to question when the turning point is. AUDUSD is holding the breakout high of 0.7063, but the move lacks conviction here.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)