- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

As can be seen in this piece I previously wrote, largely as a result of USDCNH topping out and moving into 6.6600, as well as markets pricing hikes in other jurisdictions.

(Source: TradingView - Past performance is not indicative of future performance.)

With EURUSD now breaking above 1.0641, I’m now eyeing resistance at 1.0766/68 (50% fibo of March sell-off, April lows and 50-day MA). There is some wood to chop to crack this potential supply but through here and I would see 1.0805, possibly 1.0860 as the targeted move. That said, with the threat of the S&P 500 rolling over and headed for another leg lower, which could get ugly, it feels unlikely that we’ll see much higher than 1.0850, but as we know, the market does what the market wants to do.

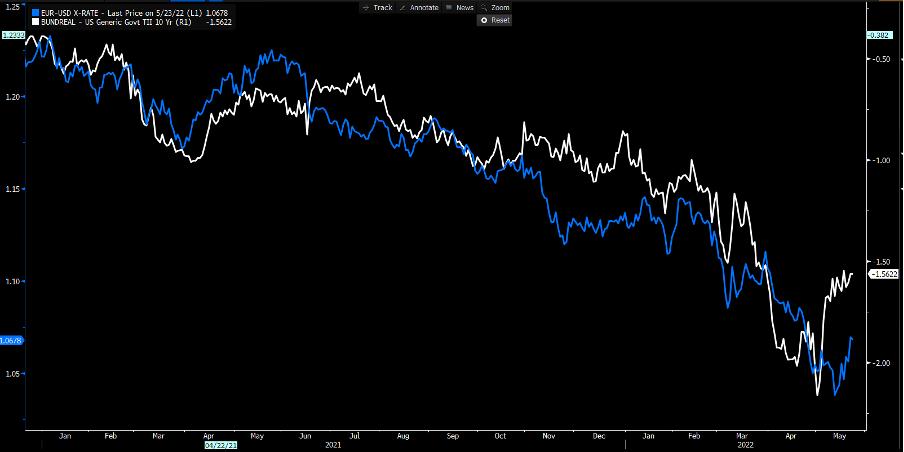

Blue – EURUSD, white – GE-US 10yr real rate differentials

(Source: Bloomberg - Past performance is not indicative of future performance.)

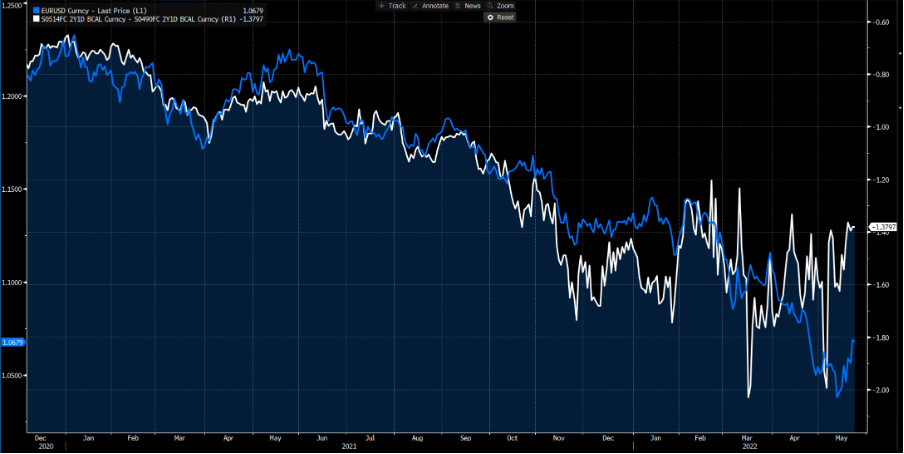

Again, if we take the analogue of the move in 2000, we see a similar feel in the tape, which if history does indeed rhyme, then could see further EURUSD upside into early June. My simple EURUSD model, based solely on GE-US real rate differentials, has EURUSD pushing towards 1.1000, as EURUSD plays catch up to the moves in relative rates settings. If we look at what's priced in forward rates markets, we see expectations for ECB policy have evolved more intently vs the US, with ECB President Lagarde making it clear their base case is to hike in July and move to positive deposit rates in Q3.

Blue – EURUSD, white – EU-US 3yr forward rate differentials

(Source: Bloomberg - Past performance is not indicative of future performance.)

Near-term we watch EU manufacturing PMIs and FOMC minutes as potential drivers, but while we may see a touch of weakness in EURUSD through Asia today, the risks are we trade into 1.0760 – happy to reverse that view if USDCNH trades higher, S&P 500 futures roll over and EURUSD heads back through 1.0640. Trade the possibilities with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.