- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The move in European markets was strong to say the least with the DAX up 10.1% and FTSE +9.1%. This will inspire Asia, as will the move seen in high yield credit, with HY CDS index coming in 153bp, and the equity market would have fed off that.

I would have liked volume to have picked up across the markets to give it some real backbone, but shorts have clearly covered and many reversed for this trading rally. Whether this has legs is another thing and when we see the virus case count numbers, with 5249 new cases in Italy (743 deaths) and 8003 new cases in the US, it does make me question if the rally will be sustained. It feels as though traders will be looking at price action for signs this is ready to roll over.

Trump’s call that he’d “love to have the US economy open by Easter” seems optimistic, but co-incidentally would marry nicely with the Hubei capital of Wuhan, due to lift lockdown restrictions from 8 April.

We also await the next vote on the US fiscal bill and the fact we saw the Dow closing +11% (the best gain since 1933), with the S&P 500 +9.4%, suggesting the market is positioned for a positive announcement. Interestingly, S&P 500 Implied vol has not moved, with the VIX index closing unchanged at 61%. Granted, volatility works both ways (i.e higher and lower), but even if we look at S&P 500 1-month implied call volatility it rose a mere 2 vols, so not as much demand for bullish structures as I would have liked to have seen.

I do think the Fed’s move to buy unlimited US Treasury and mortgage bonds is behind the rally in risk, although traders need time to digest it. The fact we have the Fed working closely together with the Treasury Department to improve liquidity in the investment-grade (IG) credit markets, while allowing better efficiencies in the primary market, offering confidence for corporates to issue debt, is a genuinely positive step, at least for market sentiment. The market is feeding off closer ties between the Fed and the Treasury team and while the dollar value of the capital the Fed can leverage from the SPV is fairly low at this stage, it will increase and the market is seeing more and more signs that MMT (Modern Monetary Theory) is here and it's right in front of us. The question is, how do you trade MMT, what is our best hedge?

The answer is always gold and it’s flying. Granted, there has been some major issues in the OTC spot gold market, with spreads moving significantly wider and price moving aggressively vs gold futures. There is much focus on the tightness in the physical market, notably after three Swiss bullion refiners detailed, they would halt production due to the Coronavirus. Either way, gold, and more so silver and palladium are on fire.

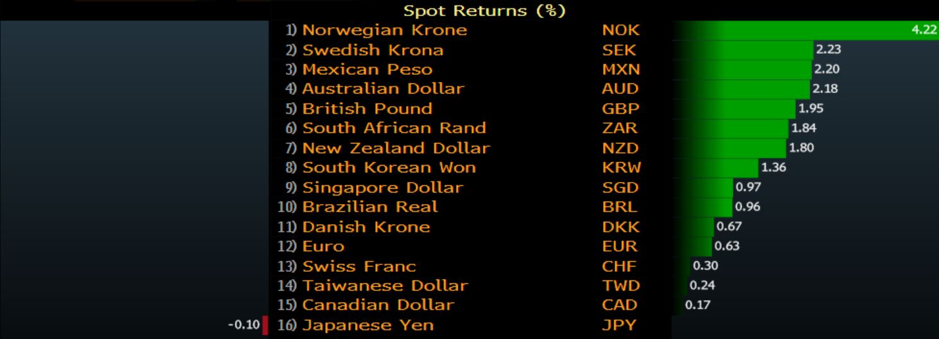

In FX markets, unsurprisingly it is buyers of higher beta currencies that are working. The NOK is up another 4.2% and we see the pair now trading 11.12 and granted we saw a 32% decline, so a daily close below 11, would signal a further move lower. We saw the USD index -0.6%, and that is helping sentiment in risk assets too, with EURUSD pushing up 0.6% and few have worried too greatly about the awful EU service PMI data. AUDUSD has pushed into 0.5975 and taken solace from the move in risk, and it’s interesting that 1-week put vol is still 6.8 vols at a premium to call vol – so the market still feels the downside move, should it come, is likely to be more empathic than upside.

So a big open expected, and it would surprise to see Asia continue to put money to work on the bullish side here, at least through trade today.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.