- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Don’t ignore the Fed meeting just because you expect them to hold

It’s the first we hear from the Federal Reserve (Fed) this year. Unemployment is at a 50-year low, the stock market is at all-time highs, and the Phase One trade deal has assured markets there will be no further tariffs (provided Beijing plays by the rules). We expect Fed Chair Jerome Powell will maintain his cautiously optimistic stance that policy is set for the “appropriate” path.

It’s my opinion that risks to the US economy remain to the downside. The magnitude of the economic impact on the Chinese (and then global) economy from coronavirus is not yet known. Also consider that tariffs on Chinese imports ramped up in stages during 2019. Despite the Phase One trade deal, the average tariff on Chinese imports will be higher this year than last. Headwinds persist despite the calm.

Global growth remains slow, although the lows seem to have bottomed and one hopes this is a gentle turning point. The UK, Germany, and the Eurozone all reported soft but better than expected manufacturing PMI data on Friday.

For 2020, the risk remains to the downside. One more rate cut before the end of the year is far more likely than a hike and we see that priced into the rates markets with 28bp of cuts priced by year-end. Powell should reinforce this sentiment.

Ballooning balance sheet

Powell is expected to spend considerable time addressing the recent balance sheet expansion and repo market operations. He had previously insisted this was not a form of quantitative easing (QE), yet US stocks and the USD responded as if it was.

The Fed intervened in the repo market in September. Liquidity had dried up and overnight rates spiked from 2% to 10%. The Fed injected billions into the repo market to meet banks’ needs, and has since purchased $60 billion worth of treasury bills a month, bolstering its balance sheet to support those needs.

This cash injection was supposed to be a temporary measure, however a rocky repo market saw purchases continue. Four months and $270 billion later, worry is mounting that liquidity will dry up when the T-bill purchases finish in April.

Powell has maintained this is not a form of QE and rather a technical adjustment, yet taking duration assets out of the market boosts liquidity. To the markets, if it looks like QE and smells like QE, it’s probably QE. Markets responded as such.

One FOMC member, Robert Kaplan, has called it a derivative of QE. “When we buy bills and inject more liquidity, it affects risk assets. This is why I say growth in the balance sheet is not free.”

The view puts him at odds with colleagues. Perhaps it’s time the wider committee acknowledged this and guided markets forward.

Is the sugar hit over?

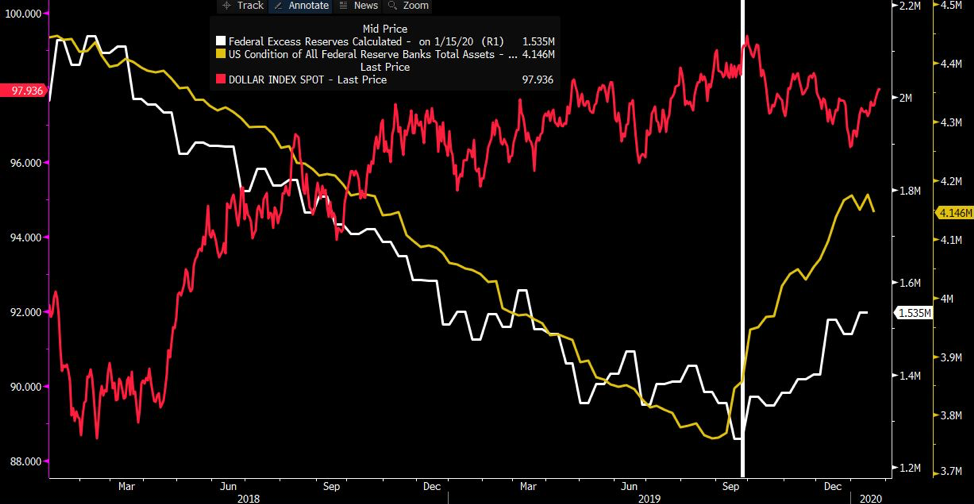

The liquidity boost has driven stock markets higher. On the chart below, you’ll see the S&P 500 (red line) has rallied since balance sheet expansion (yellow) commenced in September (vertical white line), with a slight lag.

Source: Bloomberg

The sugar rush is expected to conclude in April, so pay attention to Powell’s guidance around what comes next. If the FOMC intends to then slowly sell down its balance sheet, as it has been doing prior to repo market liquidity issues, stocks might slide too. Holding the balance sheet constant would be preferable in order to maintain buoyancy.

Also note how the USDX (red, below) has moved slightly, from its 28 month high, since the expansion. Of course there’s a lot at play here: the USDX is tied to a basket of currencies, including EUR, GBP, and JPY. One explanation could be that by pushing more USD into supply, the greenback has depreciated.

Either way, expect Powell to maintain his optimism and iterate that there is nothing to worry about, and that liquidity will not dry up when the expansion ends.

Why you should watch the Fed meeting

Tomorrow’s meeting will aggregate sentiment within the FOMC, and confirm or deny market pricing of expected rate changes. We also want to understand the Fed’s flexibility should the US and global economy move off the expected path.

Markets are not expecting a cut at the January or March meetings, but have fully priced in one cut by the end of 2020: The 16 December meeting has a forward rate of 1.22%. Rates are expected to stay low in the medium term.

The Fed needs the US economy to meet three criteria before it is ready to hike again.

1. Core inflation must meaningfully pass 2%, perhaps for one year or longer

2. Inflation expectations will need to trend higher

3. Higher growth.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.