- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

That said, it still seems likely that a resolution to the matter will be found, despite bitter partisan divides in Congress, given the potentially catastrophic long-term consequences that a default could have. Nevertheless, as drawn-out negotiations to raise the debt ceiling continue, with no end in sight, it’s clear that markets are becoming increasingly concerned about the issue.

The spread between 1- and 3-month bill yields is a good indicator, having blown out to record levels over the last couple of weeks. Given that both are among the safest and most liquid investments available, this implies that markets are concerned about something that could occur within that time period – not coincidentally, roughly when the ‘X-date’ is likely to be reached.

A similar theme emerges looking at the CDS market, though a heavy pinch of salt is required here, given the illiquidity that is known to be a feature of the space.

Nevertheless, we see 1-year US CDS trading at the highest level since the financial crisis, while the 5-year tenor trades above 50bps for the first time since 2011; a year which had a debt ceiling crisis of its own.

Moving away from market-based measures, we can also see rising worries about the so-called ‘fiscal cliff’ by monitoring news stories and social traffic, as the below chart shows, where mentions of such an event are surging once more.

Despite these market-based, and anecdotal, measures showing increasing jitters over the debt ceiling, a technical default still seems a relatively remote prospect. Given how these instances have played out in the past, the game of political brinkmanship is likely to play out for some time, though an eventual raising of the borrowing limit must remain the base case.

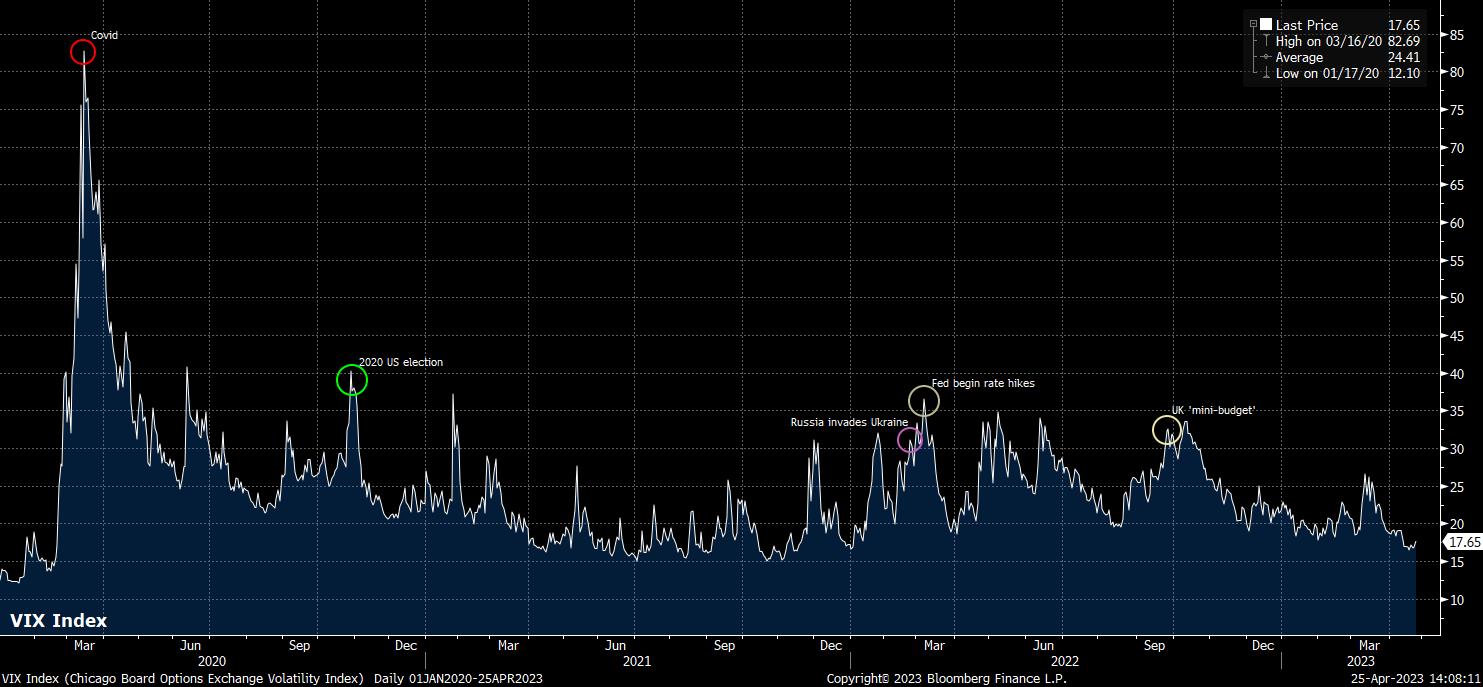

Although that may be the case, given that the road to a ceiling increase is unlikely to be a smooth one, trading opportunities are likely to present themselves. Chiefly, one can expect volatility to (finally!) increase as political deliberations drag on, and traders increasingly look to purchase downside protection and hedge exposure to risk. Consequently, while the VIX currently lingers around its lowest levels since November 2021, it may not remain so for long.

On the subject of hedges, equities may see some downside if the debacle drags on for longer than markets deem palatable. In such a scenario, any deterioration in risk appetite can logically be expected to spark a resurgence in demand for havens – the USD, JPY and CHF are likely to benefit in such an environment.

The USD is in an interesting spot from a technical perspective too at present, with the DXY last week snapping a 5-week long losing run, as buyers finally stepped in, despite there being little catalyst to do so in what remains a largely rangebound G10 FX market, though price does remain within the downward channel which has driven the market since mid-March.

_D_2023-04-25_14-02-07.jpg)

Dollar bulls are likely to retain some hope so long as price remains above the recent 100.80 lows, which have held firm on a couple of tests. However, a break above the 102 figure would be required to embed a more prolonged USD bull trend.

The final factor worth watching in the debt ceiling saga is what happens when the matter is resolved. Upon being raised, the Treasury would again be permitted to issue debt, therefore rebuilding the cash balance in the Treasury General Account (TGA). Doing so would, in turn, drain liquidity from financial markets, thereby adding another block to the top of the ‘wall of worry’ that equity bulls must attempt to climb.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.