- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Daily Fix: Navigating a massive week of event risk

All the speculation around whether the Federal Reserve will cut by 25bp, 50bp or — given the domestic data of late — not at all comes to light. We get the chance to marry speculation with fact. In fact, we don’t just get answers towards Fed policy. Event risk comes at us hard this week from many geographies, so it’s a case of keeping your friends close and your stops closer.

US event risk

- Core PCE inflation (Tuesday 22:30 AEST): expected to rise 10bp to 1.7%

- FOMC meeting (Thursday 04:00 AEST), followed by Fed Chair Jerome Powell’s press conference (04:30 AEST): a 25bp cut is fully priced, with 17% implied probability of 50bp

- ISM manufacturing (Friday 2 am AEST): expected to improve to 52 on the index

- US non-farm payrolls (Friday 22:30 AEST): consensus eyeing 169,000 jobs created in July (224,000 in June), with the unemployment rate to remain at 3.7%, and average hourly earnings expected at 3.1%

It’s all about the Fed meeting, though, and the base case is they cut 25bp and offer a view they’ll keep the economic expansion going. With 2.6 hikes priced in through 2019, when they do cut this week, the outlook needs to install a firm belief they’ll go again — or we’ll see a decent sell-off in rates and treasuries, and the USDX will move into the top of its multi-month range of 98.0. A move in EURUSD through 1.1100 would look very interesting, and this will no doubt bring out a tweet storm from US President Donald Trump, who’s seemingly taken it upon himself to defend 1.1100.

"A move in EURUSD through 1.1100 would look very interesting."

Will we see a buy-the-rumour-and-sell-the-fact play out?

The key question in equities is whether we get a classic buy-the-rumour-and-sell-the-fact scenario playing out, notably in equities. The key to that will be how US Treasury’s twos and fives trade, where if we see higher bond yields, equities should trade lower (and vice versa). We can see in the Dow that price is consolidating here and needs to be inspired to push through 27,400. The bears will want to see a break of 27,030 to confirm that the sell-on-fact is playing out, and that’d go some way to highlight disappointment.

"Dow that price is consolidating here and needs to be inspired to push through 27,400."

I expect gold to be well traded, with the yellow metal tracking the fortunes of the US bond market, especially real (i.e., inflation-adjusted) yields.

Obviously, if we don’t see a cut, then the USD will spike higher, and equities will get taken to the woodshed. The market will take the Fed to town, as will Trump.

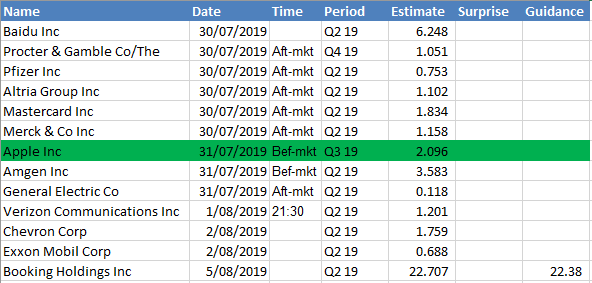

US Q2 corporate earnings

We’ve seen 44% of US corporate report numbers so far, with 77.5% beating on earnings, by an average of 5.3%, and with 59% beating on the sales line. Aggregate EPS has grown 4.25% so far, so it hasn’t been a terrible earnings season. But it’s the macro that dominates this week, and how the market responds to the Fed’s outlook. I’ve included a list of the names I’d expect to get attention from clients, but it’s Apple that should get the lion’s share of attention.

"Apple's EPS that should get the lion\u2019s share of attention."

Consider Apple has beaten EPS and sales in their last eight consecutive quarters, with shares rallying (on average) by 3.38% on the day of release. The implied move on the day of earnings sits at 3.9%, so traders are expecting the stock to have some volatility.

Europe

I was surprised at the disappointment to last week’s European Central Bank meeting. But it seems the lack of urgency to ease at the July meeting was the key consideration here. What I heard reinforces the view the bank will cut again on 12 Sept — a fate the market ascribes a 78% probability. We also feel the ECB will announce a framework for renewed asset purchases (QE). My short EURAUD trade was hurt in the process, and I take that off the table for a loss. That said, I’d be looking this week at EURJPY downside, which works as a hedge against central-bank disappointment this week, and tactically running EUR shorts through August seems logical.

On the docket this week, we get EZ economic sentiment — German retail sales and unemployment — as well as EZ GDP and CPI.

UK event risk

It’s all about Brexit in the UK now, with the prospect of a general election in late Q4 / early Q1 rising by the day. Certainly, Boris Johnson would welcome the Tories’ rise seen in the weekend polls, and that he’s winning over Brexit party’s support. Much has been made of his pro-Brexit cabinet, including the appointment of “Vote Leave” campaign’s director Dominic Cummings, who’s been tasked by Johnson to deliver Brexit by any means. It’s a powerful statement to the EU.

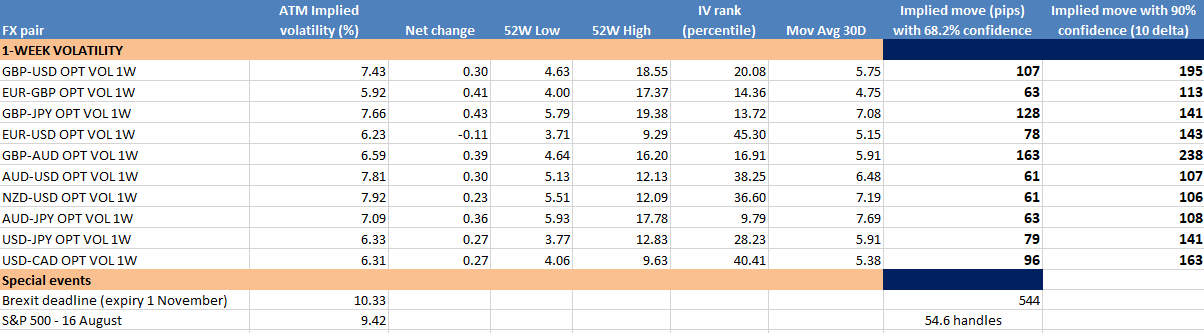

As we can see below, GBP implied vols are on the rise, as traders see the possibility of bigger moves in price, so please factor that in when considering position sizing. If I were to hold GBP exposure, it’d be in a smaller size than, say, AUDUSD.

- Bank of England meeting (Thursday 21:00 AEST)

Thursday’s BoE meeting is about setting the scene and how they may deal with the economic fallout of a no-deal Brexit. The market ascribes a 1.7% chance of a cut at this week’s meeting. But it’s about the outlook and whether the bank will lay out a cut this year. Expect dovish commentary, which should keep the pressure on the GBP. Although if I look at the setup on GBPUSD, there are some optimistic signs, with bullish divergence and a wedge pattern on the daily.

"GBP implied vols are on the rise."

Australia

After Reserve Bank of Australia Governor Philip Lowe suggested the bank is open at another cut this year, the market has brought forward its assumptions for further easing, with the implied probability of a cut in September priced at 54%, and November at 80%. Of course, the ASX200 likes this backdrop, and is eyeing a break of the 6,851 all-time high, with investors gearing up for our own earnings season.

"AUDUSD is in the 38 percentile, and the implied weekly move of 61 pips takes the price to 0.6851, which marries nicely with the lower Bollinger band."

Should the market be disappointed by the Fed, then we should also see the AUDUSD retest the recent lows around 0.6864. We can see one-week implied volatility in AUDUSD is in the 38 percentile, and the implied weekly move of 61 pips takes the price to 0.6851, which marries nicely with the lower Bollinger band. So, I’d expect some support to kick in here. Aside from the global factors, keep an eye on:

• Aus Q2 CPI (due Wednesday 11:30 AEST): The market expects headline CPI to push up 20bp to 1.5%, while core CPI is expected to ease to 1.5% (from 1.6%). The market will be more sensitive to weak inflation numbers than stronger, even if the market is already short AUDs.

China

- July manufacturing PMI (Wednesday at 11:00 AEST): consensus sits at 49.6, up from 49.4 in June

- Non-manufacturing PMI (also Wednesday): 54.0 from 54.2

- Caixin manufacturing PMI (Thursday 11:45 AEST): 49.6 from 49.4

Implied volatility

"Implied volatility is, as the name entails, forward-looking and a view of trader\u2019s perceived future movement in an instrument\u2019s price over a pre-defined period."

Implied volatility is, as the name entails, forward-looking and a view of trader’s perceived future movement in an instrument’s price over a pre-defined period. So, rather than looking at what’s happened and what’s effectively fact, we can assess how the market interprets the known event risk in the period ahead, as well as how it’ll affect the price and to what extent it’ll likely move. That can be incredibly powerful for assessing how much risk to take in each position and, subsequently, our position size.

It’s important to understand that we should only use the implied move as a statistical guide, and one should still look at key technical levels to work a stop-loss. As at its core, the bigger the implied move, the wider the suggested stop-loss and the smaller the position size, and vice versa.

With all the event risk in play, I’ve looked at the expected moves in the major currency pairs based on straddle-and-strangle pricing.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.