- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Daily Fix: 'Buy everything' and hedge with JPY

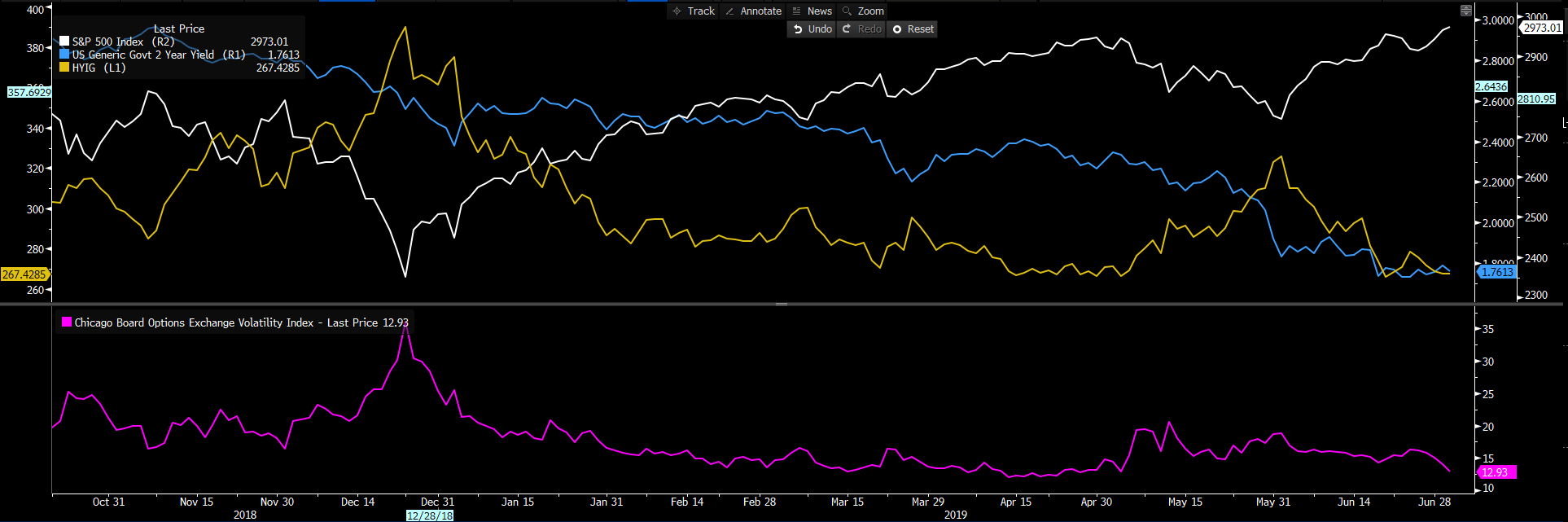

The “buy everything” trade — a somewhat cynical view of markets I heard recently from a friend, James Whelan (of VFS Securities) — is working like a dream. If we look at a multi-asset overview of markets, we see the S&P 500 (white) at an all-time high (ATH), and high-yield credit spreads narrowing relative to investment-grade credit (yellow), while the US two-year Treasury is oscillating in a 1.7% to 1.8% range, consolidating after a huge rally. In fact, it’s the longer end of the curve that’s getting the attention as funds increase duration risk, with the US 10-year Treasury now at 1.95% — the lowest yield since November 2016.

"The hunt for yield is still very much in play."

The hunt for yield can be linked to implied volatility (IV) in the S&P 500 (purple line above). At this juncture, we can see the VIX index below 13%. In fact, I can see a world where IV heads into an 11% to 13% range as the financial system is pretty much set up to sell volatility. It’d not surprise to see carry trades in FX ramp up as the flavour du jour again, and traders wanting to be paid to be in a position. Even though saying that, USDJPY is finding sellers easy to come by, with spot trading at 107.59. So, maybe if you want to buy risk, hedge with long JPY positions.

In the options market, we can certainly see the demand and premium for S&P 500 “put” volatility flattening out relative to “call” volumes. This tells us that options traders, while still hedging downside risk, don’t see potential price moves as pronounced as they possibly could have been a week or two ago. For any hedge fund that uses volatility as a key input into how invested they’re in the market, one could argue that the S&P 500, Dow and Nasdaq 100 still have further upside.

While it’s hard not to be cautious, I, for one, am loath to hold short exposures in an index trading at an ATH. In fact, while we question everything, I was once taught that if you absolutely have to hold a position, a market at 52-week highs should only be traded from the long side, as is the case in a market at ATHs – where, at its most simplistic, you can’t really get any more bullish. I guess that holds merit again even when we sit at an ATH in the S&P 500. I’d like to see this play out in the Dow and Nasdaq 100, too, although the price isn’t far off. But this is about liquidity. With economics and crude giving us a few red flags that fundamentals may exert themselves, we don’t have the clarity at this stage to be wholly concerned.

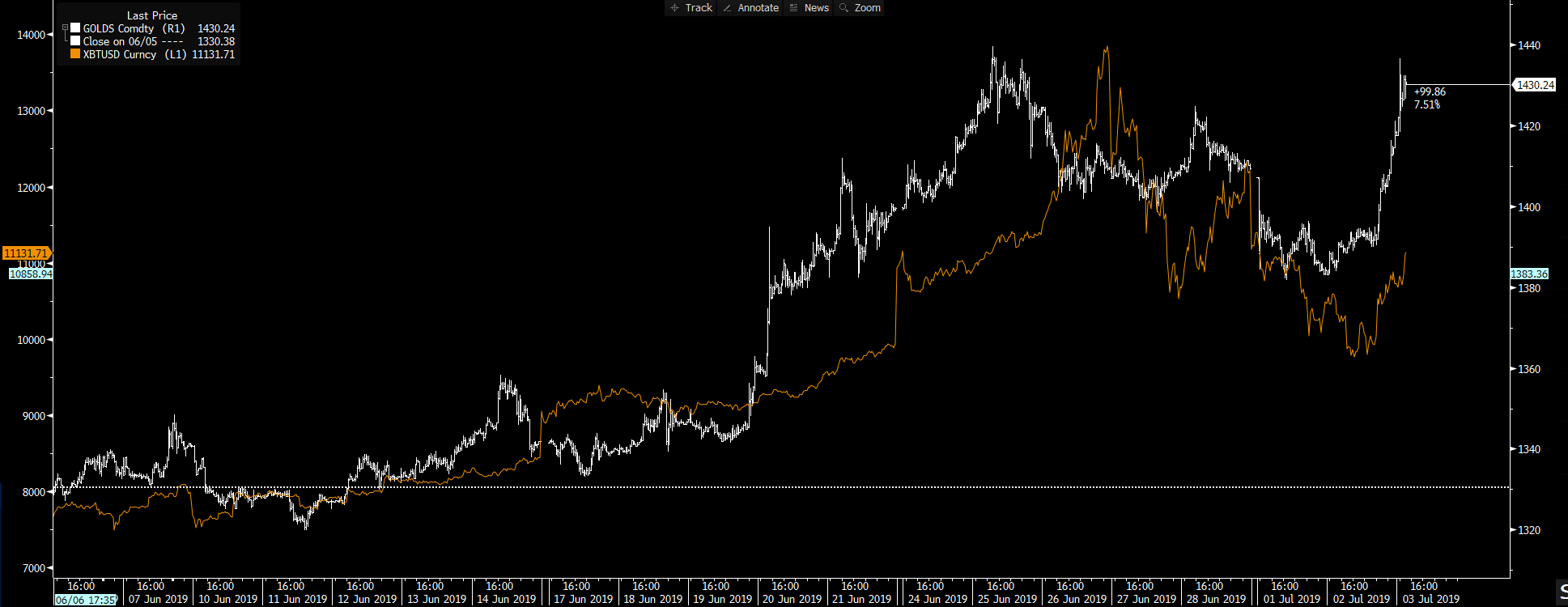

The fact that equities are bid and US Treasuries are also finding renewed buying tells us that G20 Summit is behind us, and we’re back to looking at the path of central-bank easing. Gold is flying today, as is Bitcoin. It feels like they’re the same trade, with gold a bit of a leading indicator.

"Bitcoin - orange line; gold - white line."

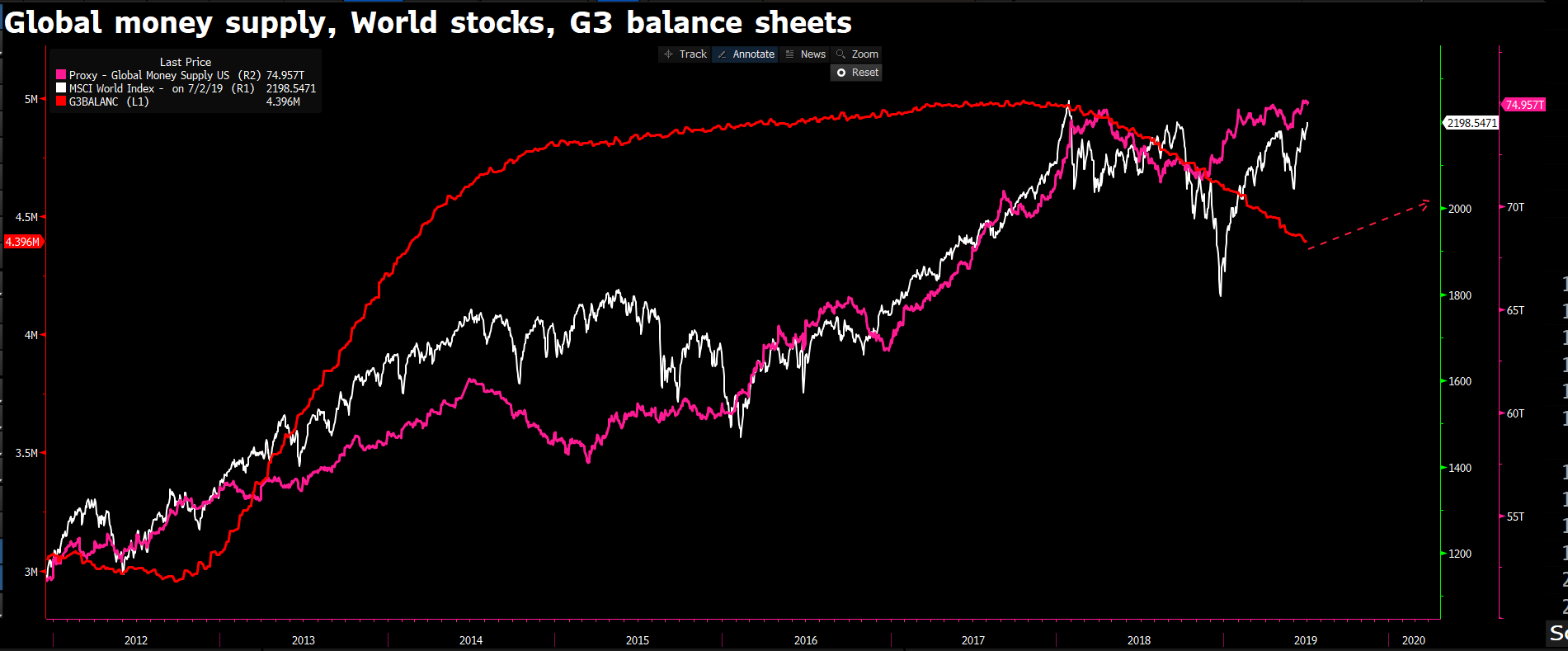

However, we can also look at global money supply (the purple line) and the G30 balance sheet (red line), and see the backdrop for the MSCI world equity index. With the European Central Bank expected to restart QE later this year, and the Federal Reserve to halt its balance sheet normalisation program (known as quantitative tightening, or QT) in the next month or two, we can argue the red line will start to head higher soon.

"Source: Bloomberg"

Europe looks interesting, too, especially now we have confirmation Christine Lagarde is the ECB chief. That removes the threat of a less market-focused candidate at the helm. The market will like this recruitment. Certainly, the German DAX looks bullish, although there’s a gap that needs to be filled. But if price starts to move higher and EURUSD kicks lower, I’d be jumping on board.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.