- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Traders looked past the poor US payrolls with a belief that these were transitory numbers and that the February employment report should capture more the re-openings and snapback.

Calls from the DEM’s for the $1.9t stimulus are in play and after passing a budget resolution the street has raised its expectations for the eventual fiscal stimulus to be closer to $1.5t. This has led to a public debate between UST Secretary Janet Yellen and Larry Summers about the prospect of overstimulating and overheating, with Yellen predicting that the US will hit full employment next year if Congress can pass its $1.9t fiscal proposal. A big call given full employment is 4.1% but one that will sit well with the market at a time when the vaccination program is being rolled out efficiently in a number of countries.

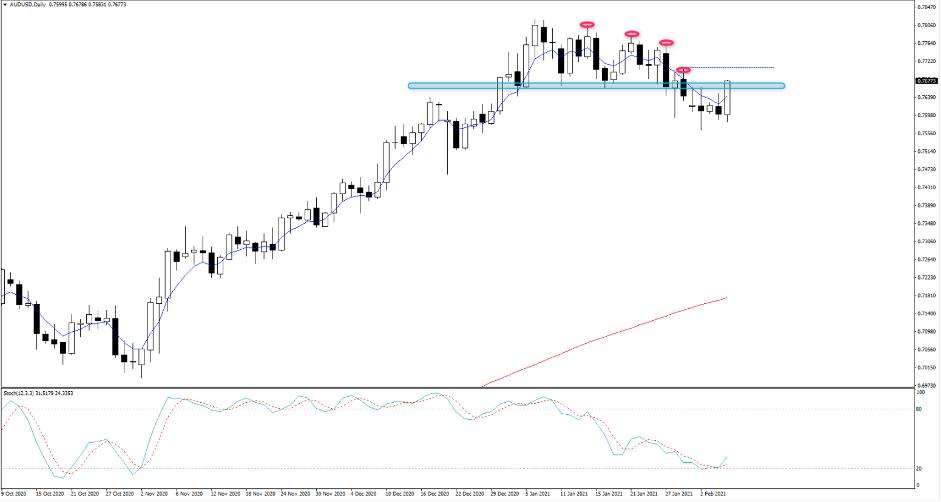

A softer USD boosting commodities

The USD is opening the new week slightly bid, but I wouldn’t read too much into it at this stage. However, on Friday it was again the victim of the inflation trade which filtered through most of the market and was the theme of the day. After one day of saying the EURUSD was a “sell on rallies candidate” we’ve seen a bullish reversal play out on the daily. Price has closed above the 5-day EMA, so the facts have sufficiently changed that I’ll wait this one out for more intel – let’s see if the bulls can drive this above the 1.2053 swing low or conversely whether the bullish reversal lacks follow-through. USDJPY pushed into the 200-day and needs the kick through Fridays low to confirm a reversal of sorts as the pair is extended.

The MXN has been the star of the show and clearly if playing crude it's MXN or NOK that leads the way. AUDUSD was well bid through EU and US trade and another that had a solid reversal. Will the buyers cement their dominance with a higher high today? EURAUD is another to watch, with price eyeing the multi-year lows of 1.5593.

AUDUSD daily

In equities, we saw the Russell 2000 again fire up, with a gain of 1.4% and again this market looks super-hot – but too hot? In the S&P 500 materials outperformed energy by 78bp, with a gain of 1.7% as the USD weakened and commodities turned higher on a broad basis. I would've liked the financials to really kick on and to confirm the reflationary vibe, as the sector was closed unchanged despite a steep yield curve.

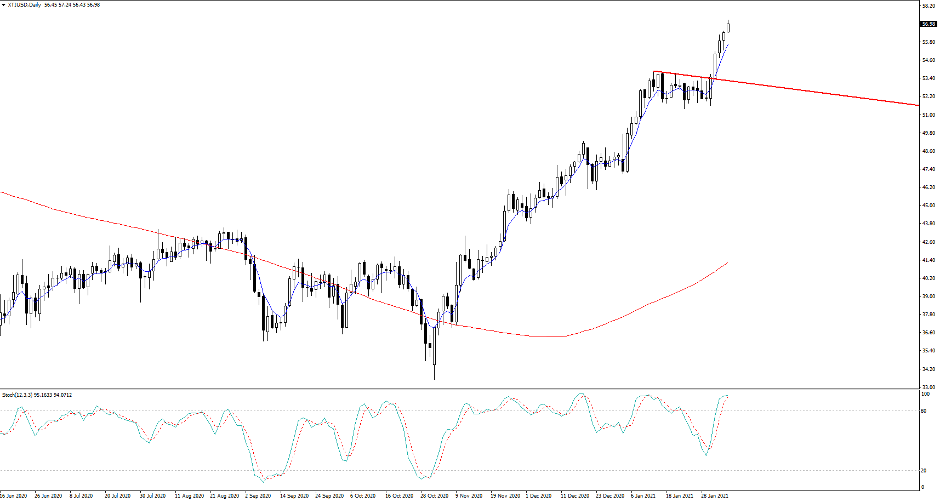

Crude movers front and centre

It’s hard not to have noticed the moves in crude, given Brent is off to the best start of the year since 2001. The moves are important as our XTIUSD price is flying and testing $57, after breaking out nicely from the $53.29 resistance and resonating in higher inflation expectations, and nominal Treasury yields with UST 10’s and 30s up 2 and 3bp respectively on Friday. The 5/30 Treasury yield curve one of the preferred inflation focal points, has moved to a 150bp differential. Which is the highest since 2015 and tells us a clear story. US 5-year breakeven inflation rates sit at 2.31% - in essence, they're now saying inflation will average 2.3% over the coming 5-year, so the Fed will achieve its inflation mandate, while 10-year breakevens closed up 3bp at 2.19%. Crude is a factor driving that.

(XTIUSD daily)

Crude is also another risk market rising and holding the 5-day EMA, as is XBRUSD (Brent) which is eyeing the 60-handle. The market is convinced of OPEC’s ability to manage supply, but we’ve also seen a sizeable US inventory drawer, the roll-out of the COVID vaccine, 127 tankers (a six-month high) en route to China and belief that global economics are going to drive far better demand despite OPEC reducing its forecasts to 5.6m b/d YoY - but has it run too far, too soon?

Well, the steep backwardation of the crude futures curve is clearly bullish and offers investors a decent roll-yield if they hold futures. The institutional crowd are playing calendar spreads, trading long December 2021 crude futures and short December 2022 futures and looking for the futures curve to steepen. Again, at a $3.37 premium there’s a lot priced, so one I’ll be watching. But if the crude price continues to push higher then it will only guide money to flow into short bond exposures and energy names – Exxon Mobile looks interesting for those trading US shares on MT5 – A break out of $51.08 could see $60 come into play fairly soon.

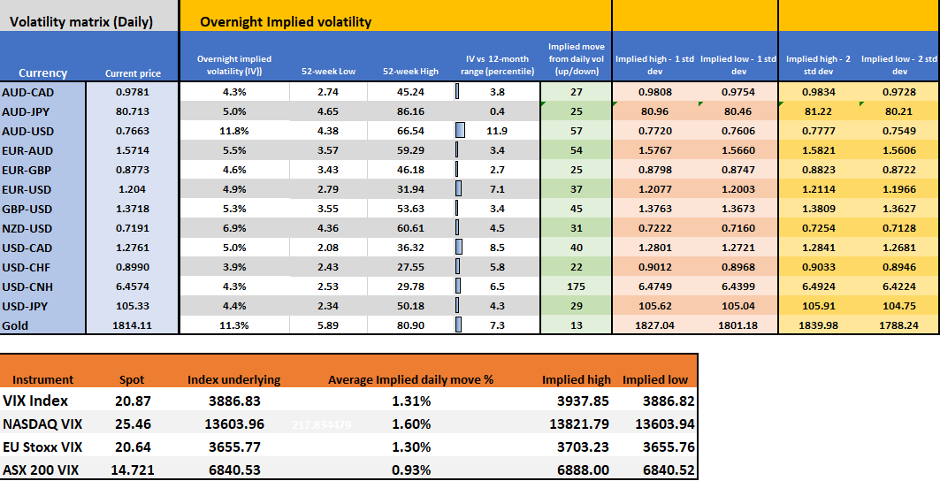

Gold and silver have benefited from the moves in the bond market, with 5-yr real yields -3bp and the softer USD. As suggested on Friday gold was getting oversold, with 1-month risk reversals getting to levels that showed extended pessimism. Still, a 1.1% rally in XAUUSD is not convincing and I’ll be watching to see if the sellers kick back in should we see a move into the 5-Day EMA at 1822 and just shy of the implied high derived from XAU overnight implied volatility.

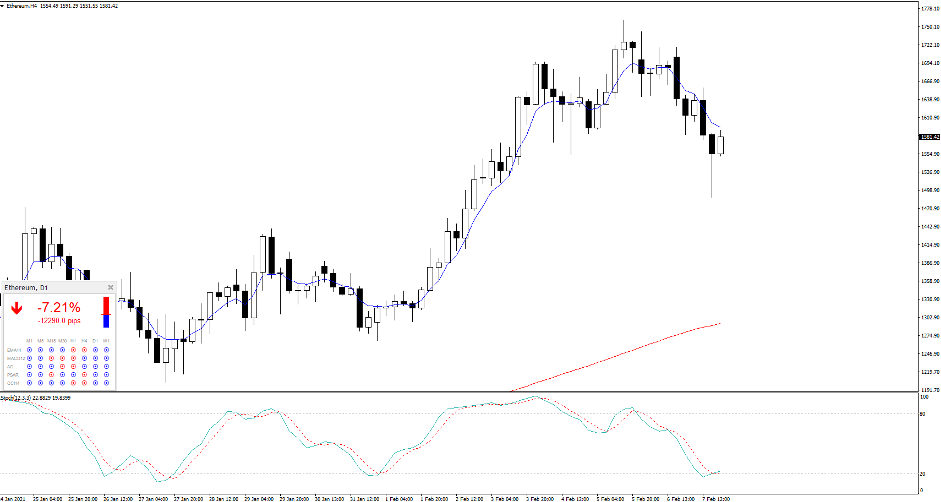

There’s not a huge amount to concern on the risk docket to truly worry today. Fed member Mester talks at 4:00am AEDT, ECB President Lagarde speaks in EU trade, although in true fashion the weekend news flow has been quoting Madame Lagarde as saying any removal of stimulus. When it comes it will be gradual. Aside from that we've the launch of Ethereum futures on the CME, which offers a new vehicle to hedge exposures, hence we’re seeing XET under pressure as traders front run that.

Near-term Asian trade will be disrupted by the US Super Bowl, which will have many traders’ eyes diverted to this spectacle. Chiefs edge it for me in a 60-point classic.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.