- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

The BoC became one of the first G10 central banks to bring their campaign of monetary tightening to a halt in January, noting that rates would remain at their current 4.5% level providing that “economic developments evolve broadly in line with the MPR outlook”. While this guidance was maintained in March, the most recent April statement saw the reference to a rate hold removed, along with a repetition that the Bank are prepared to raise rates further if required to return inflation to target.

Since the April decision, however, economic developments have been somewhat hotter than the BoC had been expecting.

Headline inflation, for instance, although continuing to decline, is doing so slower than expected, while also printing 0.3pp above consensus at 4.4% YoY. Though various trimmed and core inflation measures have continued to roll over, it seems likely that progress on disinflation is occurring too slowly for the BoC’s liking.

Furthermore, and also exerting upward pressure on inflation, is the remarkable tightness of the labour market. In keeping with the surprising jobs resilience seen in the US, there are also few cracks emerging in the Canadian employment landscape.

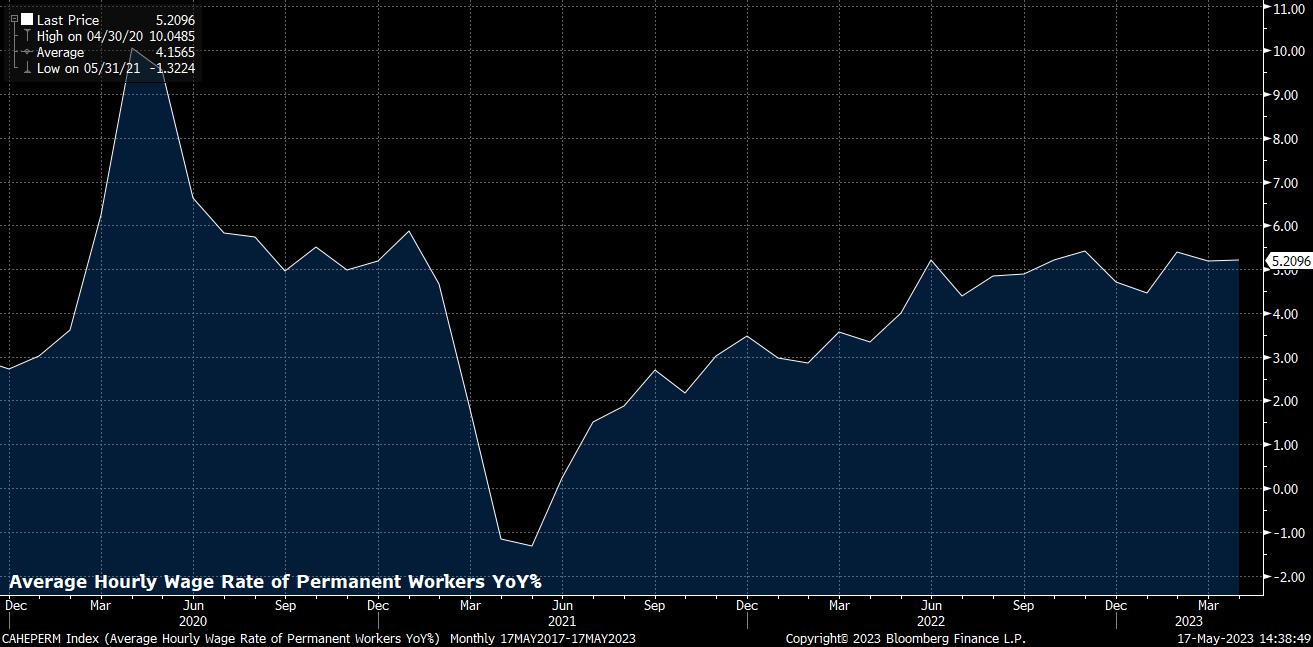

Unemployment remains close to historical lows at 5%, the level where it has sat all year, while the economy has added jobs for 8 consecutive months, and total employment has been above its pre-pandemic level for around 18 months. More importantly, while participation has steadied at 65.6%, earnings growth appears to have steadied around 5% YoY, a pace clearly incompatible with a return to the desired 2% inflation level.

Against this backdrop, the case is building that the BoC may follow in the footsteps of their Australian counterparts and hike again, abandoning their previously announced pause. Markets currently assign a 1-in-3 chance to the BoC raising rates once more at the 7th June meeting, which appears a little underdone.

While it is still a high bar for the BoC to hike once more, it is by no means impossible; nor is it impossible to envisage markets moving to upgrade the chances of further tightening to, say, 50/50. Either poses upside risks to the CAD, the former clearly more so, though either could see the loonie finally break the well-defined months-long range in which we’ve traded.

A closing break of the 200-day moving average is likely to entice USD/CAD bears to re-enter the market, targeting key support at both 1.3265, then 1.3225, the latter of which marks the bottom of the range traded since last November. A flip north of the 50-day MA would flip the short-term momentum in favour of further upside, however it is a break of 1.37 that would really be required in order to invalidate the short USD/CAD view.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.