- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

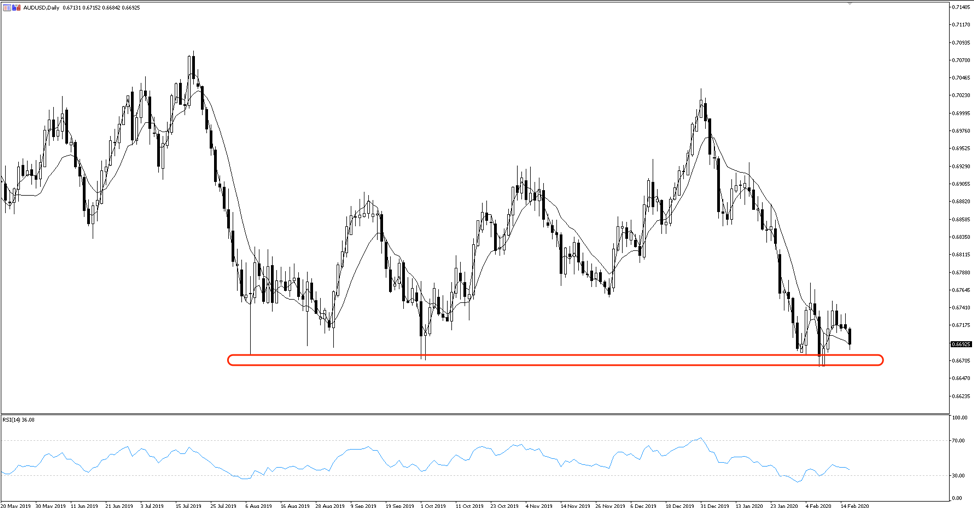

AUDUSD slipped to a post-GFC low of 0.6665 last week. A poor employment print and AUDUSD plunges into no-mans land - and that’s before Asia February economic data rolls out that will begin to clarify and portray the extent of the coronavirus economic fallout.

AUDUSD hit a post-GFC low last year - the lowest point in 11 years.

Source: Bloomberg

The risks for the AUD and Aussie economy are once again skewed to the downside after 2019 ended on a positive note, with RBA Governor Lowe suggesting the economy had reached a “gentle turning point.” A series of three rate cuts might have been enough to curb disinflation and to an extent support the labour market amid a dragging trade war, but the coronavirus (CoVID-19) outbreak puts growth prospects into question yet again.

Add to that the December jobs data that wasn’t so flash, and the case is certainly building for another rate cut. Sure the December jobs number printed slightly above expectations, but the increase came from a boost in part-time employment only. It suggests casual and temporary employment, which might not be sturdy enough to maintain the slightly lower unemployment print of 5.1%.

So what to expect?

Consensus expectations are for a jobs increase of only 10k, which is below the 12-month average of 20,900 net jobs. In turn, the market expects the unemployment rate to head back to 5.2%. One suspects if we see 5.3%, which seems unlikely but not out of the question, then we will see AUDUSD falling 30-40pips off the bat.

The latest RBA minutes revealed the central bank had considered a February rate cut but were hesitant, fearing it would just further inflate asset prices and household debt. The central bank has however pointed to a key indicator that could force its hand: unemployment trending in the wrong direction.

“Trending” here means the next two or three months’ of jobs data showing no real improvement. This week’s data is expected to be the beginning of such a trend. Assuming the unemployment continues to track higher over the next few months, and considering the April meeting is scheduled ahead of March CPI and employment data, we’re looking at the 5 May meeting for the next rate cut.

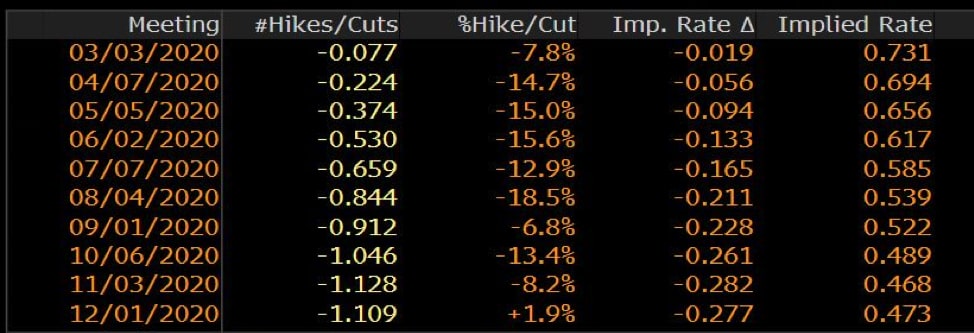

Markets are currently pricing in one full rate cut over the next twelve months.

Source: Bloomberg

Currently, markets are pricing a rate cut by October. Poor jobs data Thursday and this will be brought forward closer to May.

Beyond the jobs data, South Korea’s 20-day import/export data on Friday will begin to clear the foggy AUD outlook. It will be one of the first economic data prints revealing the economic impact of CoVID-19, which has more than 60 million people in quarantine and international travel restrictions.

The AUDUSD forex pair has served as a risk proxy during the virus scare. It’s been pushed to the lowest levels since the GFC and is sitting on support just below the 0.6700 handle. If February data throughout Asia looks poor, rate cut probabilities will be brought forward and AUDUSD price action will tell the story.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.