A traders’ week ahead playbook

In the US the recent data has frustrated both the USD bulls and bears, and we see consolidation in the USD index - we’ll therefore need to see a series (and trend) of weaker growth data prints for the USD to take another leg lower – this puts tier 2 data releases, like the regional manufacturing prints, in the market’s sights as a possible volatility event risk, when it may not have been the case in a number of months ago.

US corporate earnings will get much greater focus given the marquee names reporting - and extent of the S&P500 and NAS100 market cap - hitting us with earnings outlooks this week. This will build on the 17% of the S&P500 who have already reported, where we see 75% have beaten consensus expectations on EPS and 54% on sales – sounds impressive, but it’s in line with the long-term average.

Looking at the technical set-up, consolidation is the name of the game in the US500 and NAS100, again, favouring mean reverting strategies. While EU equity markets and JPN225 are seeing a more bullish structure.

The play of last week in G10 was short NOKSEK (fell 2.3%), although this one doesn’t come up as frequently on client radars. This week, we see a neutral set-up in the USD, and this aligns well with client flow, with clients holding a net short bias in EURUSD and GBPUSD, but also in USDCHF and USDJPY, while skewed long in AUDUSD. I expect good attention toward the AUD, with Aussie Q1 CPI a potential landmine.

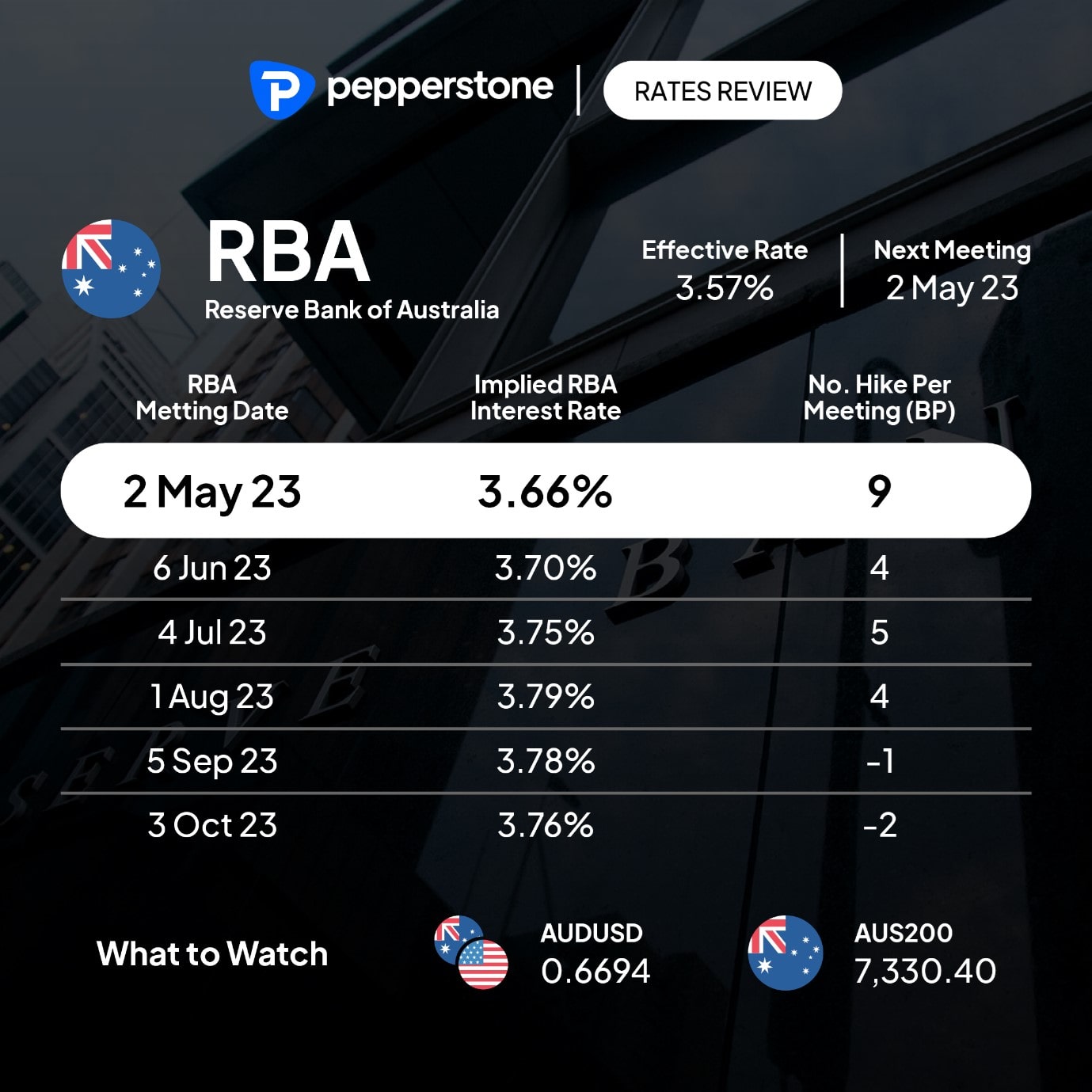

The RBA has said the May RBA meeting is ‘live’, so the Q1 CPI print could have meaning. We also see AUDJPY 1-week implied volatility above 30%, really the only FX pair where movement is being priced in G10 FX – this low vol is in-fitting with levels of volatility broadly at 12-month lows across asset classes. Like most traders I would like to see higher vols play out, but I am not sure this is the week it comes – so we adapt to the trading environment and that means deploying mean reverting strategies, tighter stops (given the reduced trading ranges) and potentially increased position sizing.

As always, we look for the risks and react and adapt to a major change in the trading environment.

Data that could move markets:

AUS

Wednesday – AUS Q1 CPI (11:30 AEST) – the market consensus is for headline inflation to come in at 6.9% (from 7.8%), or 1.3% QoQ. The trimmed mean reading is eyed at 6.7% YoY (6.9%). Rates markets price 8bp (or a 32% chance) of hikes for the May RBA meeting. A trimmed mean CPI print above 7.0% would see markets take the implied probability of a 25bp hike into and possibly above 50%, setting up for a very lively May RBA meeting. Conversely below 6.6% and we’d take this below 20%. Favour selling AUD rallies this week, with AUDUSD rallies likely capped into 0.6780/90.

Market pricing/expectations of RBA policy per meeting and the step up (in basis points) - how will this look after Q1 CPI?

China

Sunday

- Manufacturing and services PMI (11:30 AEST) – the market expects the pace of expansion in manufacturing to decline modestly to 51.1 (from 51.9). China’s data is improving so there is upside risk here. A read below 50 may see small sellers of CN50, HK50 and AUD on the re-open of Monday markets.

US

- US Debt ceiling negotiations – while we get more intel on tax receipts which will give us a firm idea of when the US Treasury reach its cash limits - The House will attempt to pass Speaker McCarthy’s bill to raise the debt ceiling by $1.5t – while there could be the far-right fiscal conservatives vote against lifting the debt ceiling, it seems probable this passes the House. Although few expect this to then pass through the Senate, at least in this form. The start of what will be a drawn-out process of negotiations to raise the debt limit. The noise around this will soon be deafening.

- Regional manufacturing surveys – Chicago Fed (Monday 22:30 AEST, consensus is we see a read of -0.2), Dallas Fed (Tuesday 00:30 AEST, -11), Philadelphia Fed (Tuesday 22:30 AEST), Richmond Fed (Wed 00:00 AEST -8), Kansas Fed (Friday 00:00 AEST -2) – economic growth is a clear consideration in markets, so these regional manufacturing reports could move markets.

Wednesday

- Consumer confidence (00:00 AEST) – 104.00 (104.2) – the market hasn’t really moved on this data point for some time, so it may take a big miss/beat to move the dial.

Thursday

- Initial jobless claims (22:30 AEST) – the market is watching jobless claims closely, and while the consensus is that we see 250k claims, I’d argue we’d to see a print above 270k to really get the market fired up. The higher this is the greater the negative reaction in the USD (gold higher)

- US Q1 GDP (also 22:30 AEST) – the market eyes growth at 2% - shouldn’t move markets too intently given the backward nature of the data point – would need to be a big beat/miss to the move rates expectations and the USD, gold, NAS100 etc.

Friday

- Q1 Employment Cost Index (22:30 AEST) – the consensus is we see this print 1.1% (from 1%) – the Fed watch this closely, so one would expect the market to do so too. A print above 1.2% would cement a 25bp hike in the FOMC meeting, while a print below 0.9% would bring out buyers of Treasuries (yields lower) and weigh on the USD.

- Core PCE inflation (also 22:30 AEST) – the Fed’s preferred inflation gauge is eyed at 4.5% (from 4.6%) on core, and 4.1% on headline PCE inflation. A print below 4.3% on core would get tech firing and see the USD lower. Conversely, a core PCE print above 4.7% would see the odds of a June rate hike increase and see USDJPY test – and potentially break - the recent highs of 135.13.

Europe

Monday

- IFO survey (18:00 AEST) – the market sees this coming in at 96.0 (95.4) on the ‘current assessment’ sub-survey, and 91.1 (91.2) on ‘expectations’ – while this often gets a good focus from traders, it’s hard to see this survey moving EU rate expectations to markedly, with the market currently pricing 32bp of hikes in the May ECB meeting. Favoured long EURs, with EURAUD looking strong with 1.6500 as an initial target.

Friday

- EU Q1 GDP (19:00 AEST) – the market eyes growth at 1.4% YoY, with the economist range from 1.7% to 1.1% – hard to see this affecting pricing and expectations for ECB tightening in the May ECB meeting.

- German CPI (22:00 AEST) – the consensus is we see this in at 7.3% (from 7.4%) – has the potential to move rates pricing, with the market pricing a near 30% chance of a 50bp hike at the next ECB meeting. A print above 7.5% would see EUR longs fire up, while a print into 7% (and below) likely see the market favour a 25bnp hike at the next ECB meeting. Favour EURUSD above 1.1000 but upside capped this week into 1.1100.

Japan

- Tokyo CPI (09:30 AEST) – the market sees an unchanged reading of 3.3% on headline CPI (from 3.3%), and core at 3.2% (3.2%). The Tokyo print is seen as a precursor to the national CPI print, so they can matter. JPY bulls would want to see a print above 3.4% on core CPI to get fired up – unlikely to affect expectations of near-term BoJ action.

- BoJ meeting (no set time) – the first meeting under Gov Ueda’s tenor – keep an eye on JPY exposures over this meeting but given recent rhetoric from Ueda there seems a high probability we see no change to policy here - the June BoJ meeting is the more likely setting for a change in its YCC policy. Put the JPN225 on the radar given it's trading at the highest levels since Aug 2022 and looks like one of the stronger equity markets on my radar.

Sweden

- Riksbank meeting (17:30 AEST) – the market expects a 50bp hike from the Riksbank – SEKJPY longs have worked well of late and could be ready to test the Feb highs.

Corporate Earnings

- US – It’s the marquee week for US corp. earnings with 42% of the S&P500 market cap due report – look for numbers from Alphabet (the implied move on the day of earnings is 4.6%), Meta (8.6%), Microsoft (3.3%), Intel (6.2%) and Amazon (6.1%). We also hear from First Republic (FRC) on Monday – one for the radar.

- UK – GSK, Barclays, AstraZeneca, Sainsbury, NatWest

- EU – Deutsche, BASF, Banco Santander, Iberdrola

Central banks speakers

- The Fed blackout period starts – no Fed speakers due until the FOMC meeting on 3 May.

- ECB – 8 speakers (Lagarde speaks on Friday)

- BoE – Broadbent speaks (Tuesday 19:00 AEST)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.