- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

A defiant move from the PBOC - the yuan now central to FX markets

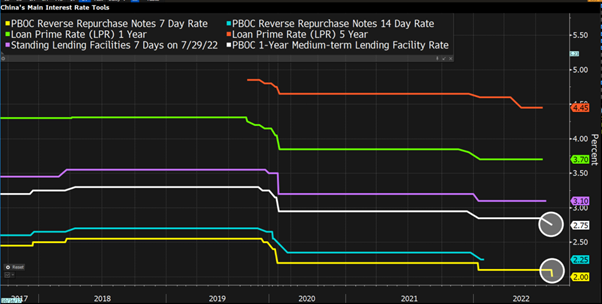

Growth concerns have resurfaced – most notably, the quite shocking China data, where the retail sales (2.7% vs 4.9% eyed), industrial production (3.8% vs 4.3% eyed) and fixed asset investment (5.7%), married with poor credit data (released Friday), were deemed bad enough to cut the 7-day repo rate to 2%, and the 1-year MLF (Medium-Lending Facility) 10bp to 2.75% – the first cut since January – while the weakness in credit demand can be readily explained and shouldn’t shock too intently, the easing of the two policy levers was a massive surprise to the market given recent narrative from Chinese officials that it wasn’t on the cards.

Next week the PBoC should cut the 1 and 5-year loan prime rate (Monday at 11:15AEST) – a policy lever tied more closely to the mortgage market - but the more pertinent question surrounds the degree to which they will ease – when demand is the core concern making loans cheaper will help to a small extent and is a better solution than going through liquidity channels, where they would typically cut the banks’ Reserve Ratio Requirement (RRR) – liquidity, in the Chinese financial system is ample and while equity bulls would like to see more liquidity operations – much of this capital flows into financial assets – the PBoC has shifted policy gears and stepped up its support of the economy knowing that the government will still be cautious on Covid measures ahead of the 20th Party Congress in November, with new covid cases pushing higher again in August.

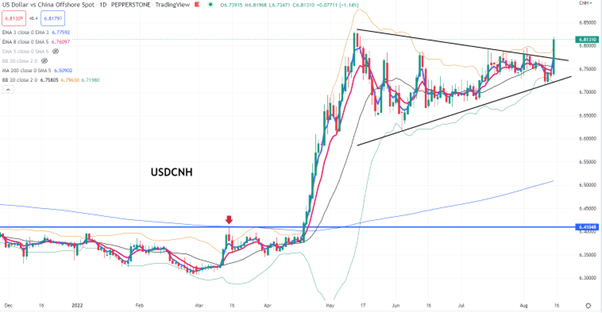

The direct market response was notably seen in a sizeable move lower in Chinese 5- and 10-year bonds, which has knocked the CNH (Chinese yuan) for 6, with traders flocking to the USD as a result. Some took the cuts as a defiant statement that the Chinese authorities want a weaker yuan to stimulate growth – and when we consider the relative dovish central bank's policy stance, where we see the PBoC as the sole entity easing in central bank circles.

USDCNH should be on the radar – it’s not a pair you often see much volatility in and the moves are typically a grind – however, on the day we’ve seen USDCNH trade 6.7359 to 6.8199 - 1.2% - the biggest one-day gain since 5 August 2019 and looking like it might test the May highs of 6.8372 – subsequently, we see the falls in the yuan rippling through high beta FX and impacting China proxies such as the AUD, and NZD and other commodity plays such as ZAR.

I had been holding a GBPAUD short bias given the broad equity market rally has pushed traders into yield and carry positions and high beta FX – the easing from the Chinese and the data flow were a clear surprise and while I haven’t closed yet, I would be looking to manage soon.

We’ve seen a solid reaction in copper (-1.7%), crude (-3.5%) and US Treasuries have found good buyers, which has pushed capital in the JPY – granted, we also saw a very poor US NY Empire Manufacturing report (-31.3 vs +5 expected), which would heighten the conviction for those calling for a US recession within 12-months, but I think Chinese growth concerns are at the heart of the moves in FX, commodities and rates.Equities are a whole different beast and when the US cash market opened, it was all buyers yet again, although defensive outperformed with staples, utilities and tech working. We come back to our friend flow, momentum, and the chase for performance.

Today’s PBoC CNY mid-point fixing (at 11:15 AEST) could drive – recall, the PBoC manage the USDCNY rate, and the market can trade USDCNY 2% of the fixing rate on any given day. If the PBoC lift the USDCNY mid-point today (i.e. weaken the yuan) sufficiently it could send another round of selling in the AUD and China plays. Looking at the spread between CNH (offshore yuan traded in HK) and the CNY (yuan traded in the mainland) we see a big downside move – traders are betting on further yuan weakness – not great for those economies who are big exporters to China.

Chinese and HK equities look fairly well supported – while the action seems to be in FX and commodities, Chinese equities face slowing growth, and renewed covid case counts, while we saw a net withdrawal of liquidity yesterday with the PBoC choosing to roll over RMB400b of the RMB600b maturing MLF loans – easing of various rates, falling bond yields and a lower cost of capital and has helped support equity – one to watch but I can't see many of the various Chinese/HK market breaking above the 20-day MA.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.