- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Learn to trade

What is the RBA cash rate?

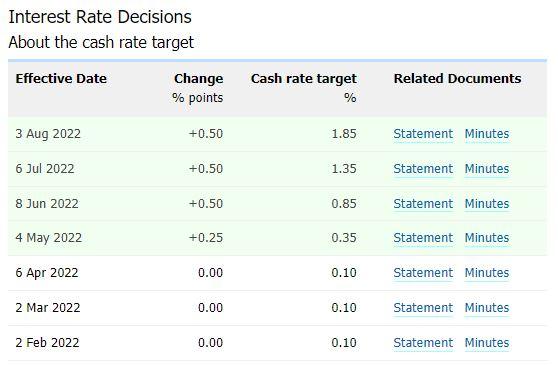

The RBA cash rate currently stands at 1.85% *. The cash rate is the interest rate charged on overnight unsecured loans between banks. This rate is set by the Reverse Bank of Australia.

Changes in the cash rate are a closely watched event for currency traders.

Why does the RBA cash rate change?

The Reverse Bank of Australia is a Central Bank. Its role was set out in the Reserve Bank Act in 1959. The main aim of the RBAs monetary policy is to ensure market stability.

Setting the cash rate affects the ability for banks to lend at certain interest rates. This then filters down from banks to consumers. The higher the interest rate the more expensive it is to borrow and spend.

Setting the RBA cash rate is a fine balancing act. They look for the rate to be low enough rate to promote full employment, but not so a low that it results in inflationary pressures on the economy.

Source: RBA

The Reserve Bank of Australia statement and minutes

The RBA monetary policy committee meets 11 times a year. This is the first Tuesday of every month apart from January.

The RBA rate decision and statement are leased at 4.30am UK time. That is 1.30pm local time in Sydney.

How do the currency markets react to the rate decisions

A higher interest rate is normally bullish or positive for the single currency. A lower interest rate is normally bearish or negative.

It should be noted that a lot of emphasis is taken from the statement and minutes. Traders look to this information for forward guidance on the future direction of the RBA cash rate and the potential longer-term outlook for the Australian Dollar.

*as of 19th August 2022

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.