Why the JPN225?

The JPN225 (Nikkei 225) is a benchmark index tracking the top publicly traded companies in Japan. It’s a favorite among CFD traders due to:

High

liquidity and volatility

Strong

correlation with Asian market sentiment

Opportunities

for short-term and swing trading

Benefits of trading Index CFDs with Pepperstone

Razor sharp pricing, from multiple Tier 1 banks and Liquidity Providers, with competitive fixed spreads as low as 7 points.

Trade all opportunities, 24 hour pricing from Monday to Friday.

Get 99.62% fill rate^ and fast execution.

Award-winning customer support, available 24 hours 7 days per week**.

What is index trading and how to trade major indices?

Index trading involves speculating on the price movements of a group of stocks represented by a market index (like the S&P 500 or FTSE 100), without owning the underlying assets.

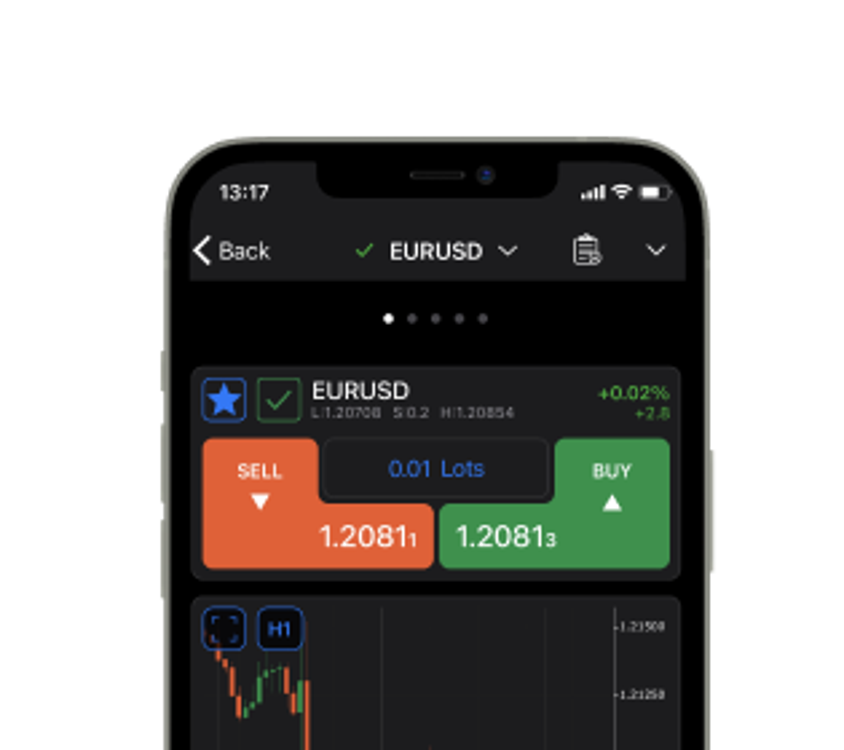

Traders often use Contracts for Difference (CFDs) to trade indices. This allows them to profit from both rising and falling markets by taking long or short positions.

Index trading with leverage can amplify both gains and losses. It’s crucial to manage risk through tools like stop-loss orders and to understand the potential for rapid market movements.

Common strategies include scalping (very short-term trades), day trading (positions opened and closed within the same day), and position trading (long-term holding based on broader trends).

Indices provide a snapshot of market sectors or economies, making them useful for diversification and gauging overall market sentiment.

*All spreads are generated from data between 01/07/2024 and 31/07/2024(This to be updated on a regular basis) . In line with our Client Terms and Conditions, if you were introduced to Pepperstone by a third party your prices may differ from the published prices. For more details please reach out to Support Pepperstone support@pepperstonepartners.com.

^99.62%. Fill rates are based on all trades data between 01/07/2024 and 30/09/2024