- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

Crude can't find any love in this market and the bid has literally dried up. There have been a number of fundamental triggers behind the moves (higher gasoline inventories, signs of demand destruction) but the savage decline, with US Crude now 14% off its highs, seems to have been accelerated by a liquidation of extended gross long positioning.

_Contract.png)

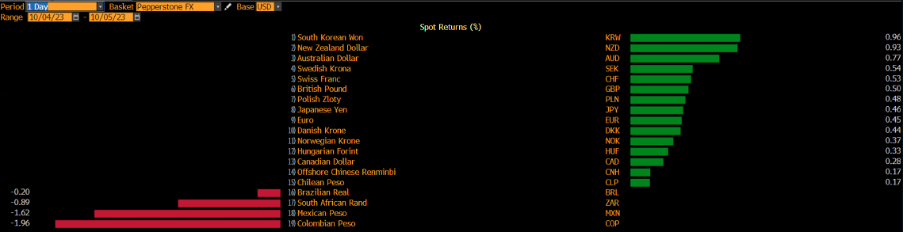

Into the $82.70 - $78.00 (US crude) and we see a strong concentration of volume transacted over the past 12 months, so this may promote consolidation after the liquidation – however, until we see better support, at this point it's hard to stand in front of this move. Gasoline has also been smacked from $2.85 and crude traders are watching this closely, with the crack spread subsequently coming in sharply. Obviously not a great environment for energy stocks, with good interest to short the XLE ETF, or doing so via long/short plays (short XLE / long XRT). Petro-currencies have also found sellers, with the CLP (Colombian Peso) and MXN (Mexican peso) getting real attention from the shorts. USDCLP requires a higher risk tolerance but while you pay a wider spread than EURUSD you pay for the movement and propensity to trend, but as we see on the daily USDCLP is on a tear.

In G10 FX, the NOK and CAD have held up well despite moves in crude, but we’ve seen the antipodeans in better shape, and NZDCAD longs are working and looking good for a further push higher.

Nat Gas also needs close attention with price re-testing and closing above the top of the range it's held throughout 2023. We also saw a firm close above the upper Bollinger Band after a period of heightened compression, and this won’t have gone unnoticed by the trend traders. News of smaller-than-expected inventories from the IEA and forecasts of colder temperatures in the Northwest and upper Midwest in the US have been a trigger. Technically, we’ve had a number of false starts, but price trends start with breakouts, and this may be a chart that has come up on a few momentum and trend accounts. I like long positions but would stop out if price reverses back into $2.98.

FX moves on the day

On the USD, we’ve seen back-to-back daily declines in the DXY, and longs are part reducing exposures in US nonfarm payrolls (NFP) We’ve seen some buying in US Treasuries with 2-yr -3bp into 5.01% and US 10s a tick lower into 4.71%. In rates markets, we see just 6bp of hikes priced for the 1 November FOMC meeting and 9bp cumulatively for the December meeting – essentially, the market sees a great probability that the Fed is done hiking here. We are seeing a modest increase in implied rate cuts further out into 2024, with a focus on 3-month SOFR futures. Here we can see an 89bp of cuts now priced for 2024 – the equation on TradingView to see this is CME:SR3Z2023-CME:SR3Z2024 – should this build then we may see USD longs looking to reduce exposures further.

NFPs are the obvious near-term risk - The market looks for 170k jobs created in Sept with the range of estimates set between 250k and 90k. The unemployment rate is eyed at 3.7% (from 3.8%) and again the participation rate could play a factor here, Average Hourly earnings are expected to remain at 4.3% YoY.

It's hard to consider a playbook on the jobs report, as we have a number of key variables to consider. I do think we’re moving to a world where the U/E rate matters and could be the more important aspect of the NF payrolls report. Clearly, the USD bulls want an NFP print above 200k, and U/E at or below 3.7%. Those short would be hoping for a U/E rate above 3.8% and NFP below 160k. It may not be that clear cut though.

Next week’s US CPI remains the marquee event risk, with US Q2 earnings also coming into play.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.