- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Markets Show Relief After Fed Meeting, But Uncertainty Remains

Amid cries that the Fed meeting was deemed to be more hawkish-than-feared, the collective wisdom hasn’t initially seen it that way and has dialled back hedges put in place for a potential lift to the 2025 dot (to imply one rate cut), taking some inspiration that the Fed is looking through near-term effects of the impending US tariffs, and who feel in control in their policy setting. Reassurance perhaps, but the ongoing path the Fed will tread remains a tight one to navigate, and the central bank remain firmly at the mercy of the incoming data, surveys that can be wholly fickle and market forces that may well still go after a firm response.

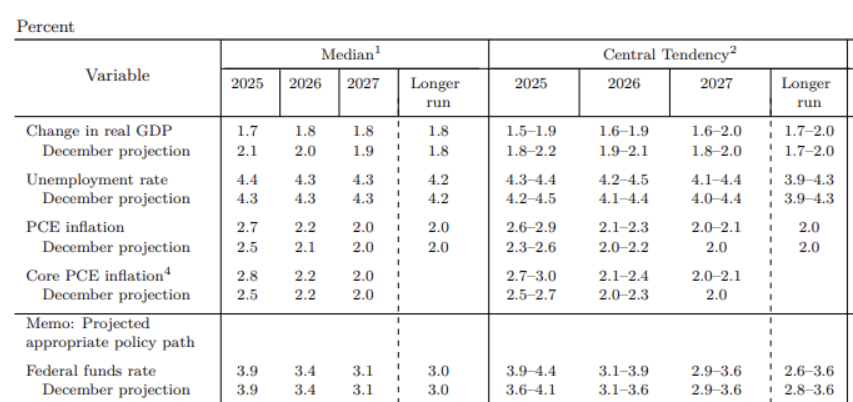

US interest rate swaps clearly haven’t taken the meeting as hawkish, and we see terminal fed pricing adding 6bp of implied cuts through this cycle into the mix. US 2yr Treasury yields fell from 4.08% to 3.96% through the Fed’s hour of power, with the US 2s v 10s yield curve bull steepening by 3bp - while this may have been partly driven by those unwinding hedges for a slight tweak in the dots, and a more ingrained concern around the inflationary impact of tariffs, the stagflation vibe that has been displayed though the updated SEP revisions – with the central 2025 core PCE estimate taken higher to 2.8% and 2025 GDP forecasts lowered to 1.7% - is clearly a positive for US rates, US Treasuries and a further negative for the USD.

A higher 2025 core PCE inflation estimate, that was adjusted for the respective Fed members best guesses on tariff impact, amid an unchanged case for two further 25bp cuts this year, implies a lower Fed real policy rate. Subsequently, US 5-year real Treasury yields have reacted strongly, falling 10bp to 1.45% on the day – a positive for risk at the margin.

That said, while the Fed’s 2025 median dot remained unchanged at 3.875%, this lack of change masks the fact that eight members have revised their call and now see one or no cuts for 2025, so holding at 3.875% is simply a function of the math involved.

Also offering tailwinds to risk was the announcement for an early reduction in the pace of runoff in the Fed’s QT and MBS program – although the news stops short of a full halt in balance sheet runoff, with the Fed taking a prudent view of gradually roll off from QT than a hard pause.

With US rates and bonds finding a firmer tone, we see relief expressed in the risky end of the capital markets, with additional upside momentum seen in gold, with the yellow metal hitting a high of $3051, and consolidating in line with the USD flows. US small caps have outperformed with the Russell 2k closing +1.6%, US high short interest equity plays have found form, with the upside in S&P500 and NAS100 underpinned by a 1.7% move higher in the MAG7 basket.

Crypto was finding already finding buyers into the Fed meeting, and notably in XRP, but we’ve seen additional buying across our suite of crypto post Fed meeting. NAS100 futures closed +1.3% and seem to be carving out a range of 20,000 to 19,200 – subsequently, a break on either side of this range could set the tone for the near-term directional trading bias. 73% of S&P500 companies closed higher on the day, with all sectors in the green led by consumer discretionary (Tesla and Amazon), energy and Tech.

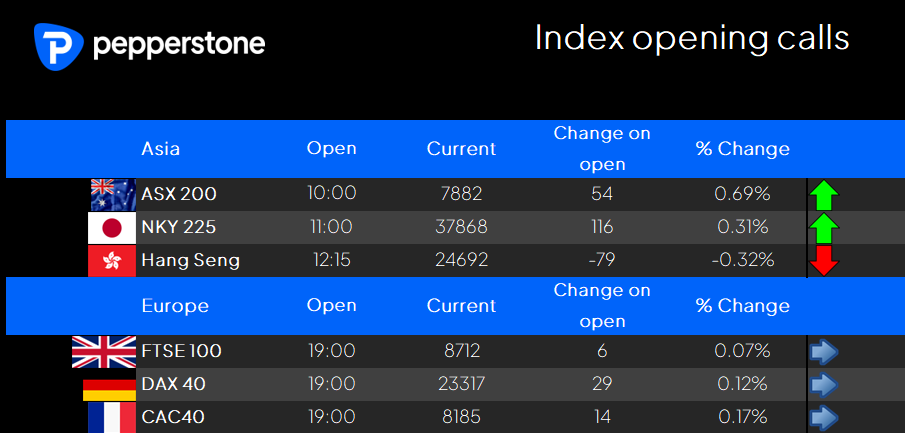

Our opening calls for Asia equity are constructive, at least for the ASX200 and NKY225, with the HK50 cash set to open modestly lower. One questions if US tech can get a wriggle on and reconvince funds to deploy global capital back to the US, and specifically into high growth and the momentum plays. It’s too early to call that trade, as we face S&P500 OPEX and of course, the fallout from the 2 April reciprocal tariff announcement, but price action is the best fundamental here, and an open mind to these flows will always serve market players well.

The reaction in the NKY225 through trade today could be most interesting, as this index would have the cleanest impact on US equity futures and could build expectations of further gain in US cash equity in the session ahead. We also watch to see how Asia trades the USD, and notably USDJPY which has printed a bearish reversal, where a further breakdown through 148.61 could see recently initiated long positions cover.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.