CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Daily Market Analysis: Tariff Developments, Equity Trends, and Key Trading Opportunities

In what has been a largely positive session for the risk bulls, looking around the markets we see that there’s been no shortage of moves for traders to cut their craft in, with headlines pinging off liberally resulting in some lively price action.

The central talking point has been on the extent of future tariff risk, with the Washington Post reporting that Trump’s tariff plans could be concentrated on “critical imports” and perhaps not on the “universal” basis that was campaigned on. The article quickly made its way around desks and through socials and resulted in some solid buying in EU equity, with the DAX closing at +1.6% and on session highs. NAS100 and S&P500 futures followed suit with buyers pushing NAS100 futs into 21,896, with good buying seen in the MXN and EUR.

Trump later refuted the claims, posting on Truth that his tariff policy won’t be scaled back – an action which has pulled capital back to the USD and resulted in sellers in US equity and equity futures off the highs.

The fact is most on the Street feel his 10-20% universal tariffs were always seen as unlikely to eventuate in such stringent form - so the reporting from the Washington Post has cemented this widely held view, even if Trump has played it down. Clearly, the last thing Trump wants at this point is to lose his leverage and credibility going into negotiations and will want to go to work from day one, front loading tariffs through the many executive orders, sending a defiant message that his threats are real – so, even if the WaPo reporting becomes the reality over time, for now, he simply cannot lose that edge.

News that Michael Barr, Fed Vice Chair for Bank Supervision, was stepping down initially saw bank stocks finding a solid bid, with regional banks firing up with the KRE ETF hitting $61.98 (+2.4%). Who replaces Barr will be a subject of debate for bank equity traders/investors, but for now, it feels like few are getting overly excited by these developments and we’ve seen the KRE ETF roll over, in line with the broader equity market.

Canadian PM Trudeau’s resignation as PM after a 9-year stint hasn’t surprised too many, as it was seen as a ‘when’ not an ‘if’. Speculation of his departure was doing the rounds through Asian trade, resulting in some early buying of the CAD, with the WaPo tariff talk giving the CAD buying (USD selling) additional legs, with USDCAD pull down to 1.4280. The set-up in USDCAD was one firmly on the radar yesterday, with the spot rate eyeing a bullish break out of the 1.4450 consolidation range highs – clearly, the news flow worked against that bullish technical development, and conversely, we now watch for a close through the consolidation range lows of 1.4338, as a potential signal to run shorts into the US data flow this week and the Canadian jobs report (on Friday).

We also saw a fairly weak $58b US 3yr Treasury auction, and this matters because of the deluge of net Treasury issuance and the $60b in US Investment Grade corporate supply seen through the week. With US long-end Treasury yields rising sharply of late many are trying to find an exact reason for the selling. To put context on this, on the one hand, we have seen the markets implied terminal Fed pricing rise to 4%, and there are some concerns that the US Treasury Department may look to roll some of its upcoming maturing T-bills into longer-dated coupon issuance (which would cause bond yields to rise). However, it's the level of near-term Treasury issuance and supply being asked to be mopped up by private investors that is the most likely driver of why we’re seeing such a rise in the 10-year and 30-year Treasury. That said, the rise in US bond yields – despite many calling for it to weigh more heavily on equity risk – is having very little effect on market sentiment at this stage.

The wash-up as we roll into the close is that the S&P500 is off earlier highs of 6068 and now sits +0.5% - 48% of stocks are higher, led by Comms Services, tech and materials. REITs, Utilities and Staples sit in the red. Despite pairing back some of the earlier weakness, the USD is lower against all major currencies except the JPY. We see modest weakness in gold and crude, while Nat Gas is up an impressive 10%, while copper is +1.9%.

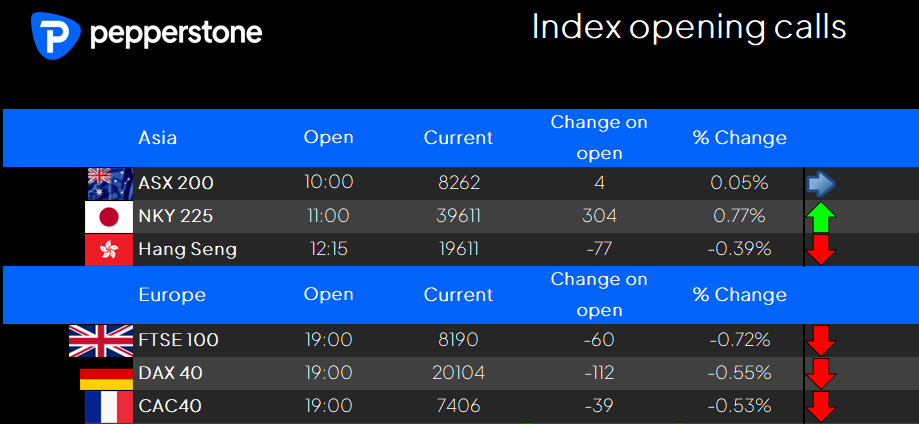

Turning to Asia and taking in the various leads, we see that our calls suggest a mixed reaction for the respective opens. The NKY225 should outperform and lead Asia higher, with a flat open-eyed in the ASX200, while HK and China may open on a soggier note.

By way of event risk, in just under 6 hours’ time we look for Nvidia CEO Jensen Huang to offer a keynote address at the CES20025 Conference in Vegas - our 24-hour Nvidia share CFD's are the default place for traders to capture any moves that stem from Huang's likely highly upbeat rhetoric. We also get EU CPI (21:00 AEDT), which may spur some short-term vol into the EUR, while in the US we get the JOLTS job openings report and ISM Services index (both 02:00 AEDT).

So, there is plenty for traders to navigate in the session ahead.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.