- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

The S&P 500 closed +0.7% higher, where we can also see a +0.3% net change in the S&P500 futures from 16:10 AEST (the official ASX 200 close). So, while Aussie SPI futures are down 6p from the cash close (hence the flat ASX200 call), we can look to the US and see the index giving us some belief of support at the open. Although I’m really clutching at straws here, and would obviously want to see price looking more constructive before hitching a ride, it’s also positive that we’ve seen US small caps outperform, with the Russell 2000 closing up 1.2%. Breadth has also been pretty good, with 82% of stocks (in the S&P500) closing higher, and the only sector lower being utilities (-0.3%).

Yield curves suggest sustained bullish move in risk is limited

There have been limited moves in the fixed-income world, although we’ve seen a slight outperformance from the front end, with two-year US Treasurys closing -2bp at 1.50%. This has created a slight steepening of the twos vs tens US Treasury curve. But when this is still inverted by 2.6bp, the message we continue to hear from the yield curve is hardly one that suggests the S&P 500 is going to see a topside break of the 2943-to-2822 range, where price is currently in the 53rd percentile.

As I’ve suggested before, perhaps the best curve to focus on is the US three-month versus US 5Y5Y forward rate. Why? Because the three-month Treasury is close enough to the Fed funds effective rate, while the forward rate is the market's interpretation of the longer-term neutral rate. That being, the implied policy setting in Fed funds future for the anticipated levels of inflation and growth. With the 3m Treasury yield now 58bp higher than the forward rate, it quantifies how the market sees Federal Reserve policy as being too tight, and the Fed needs to cut by 50bp just to get to the neutral setting — that’s neither stimulatory nor restrictive. Again, it's hard to see equities rallying too intently in this environment.

Inflation expectations will keep the Fed from getting ahead of the curve

What we’ve seen moving is crude — with WTI closing up 1.6%, Brent +1.5%, and gasoline +2.7% — driven by a monster 10 million barrels in crude and 2.09 million in petrol draw seen in the weekly Department of Energy inventory report. This was somewhat reflected in the price, given we saw an 11.1 million barrel draw in the private API survey yesterday. This has helped push US five-year inflation expectations (swaps) up another 7bp. At 1.98%, it seems unlikely the Fed will do anything other than a further insurance 25bp cut, when the FOMC next meets 18 September.

The US data certainly doesn’t give the Fed scope to ease by 50bp. The 8% probability of a 50bp cut implied in rates markets reflects that. Certainly, if we look at yesterday’s US consumer confidence print, we’re yet to see the consumer feeling the world is a darkening place, even if business investment, trade volumes and manufacturing have been a red flag. Consider, then, the next ISM manufacturing report comes next week, ahead of the August retail sales report on 13 September. That could be a market volatility event.

FX intervention unlikely for now

In FX markets, the USD has rallied against all G10 currencies and had some bullish moves against emerging-market FX, too. The USD index is into the top of its range, and would be higher if it weren’t for the fact EURUSD closed the session down a mere 12 pips at 1.1078. It’s interesting that US Treasury Secretary Steven Mnuchin has said the department doesn’t intend to intervene in the USD for now.

With USD intervention such a hot topic and the smoking gun for those calling for a future currency war, the use of “for now” will be debated on the floors. We’ve got a decent idea of how intervention looks like, but what are the triggers that’ll change “for now” to “right now”? Is it a trade-weighted USD some 3% to 5% higher; or the USD index pushing towards 103, with EURUSD into 105; or USDCNY moving markedly higher? Perhaps it’s these factors married with a higher rate of change. However, a market that feels US FX invention is coming is a market one step closer to buying FX vol in size as their play on currency wars and gold will be above US$1,600 in a flash.

GBP the wild west of FX

GBPUSD has been the talk of the town, though, with the price falling from 1.2286 to 1.2157 as British Prime Minister Boris Johnson is requesting to prorogue (suspend) Parliament — something that was later approved by Her Majesty the Queen. The betting markets now have a no-deal Brexit at 45%, although a general election, perhaps after a short A50 extension, still seems the base case for now. One thing is for certain, however: We’re in for a lively period of headline risk for GBP traders to navigate, when Parliament comes back from recess on 3 September through to when they go back on recess on 9 September.

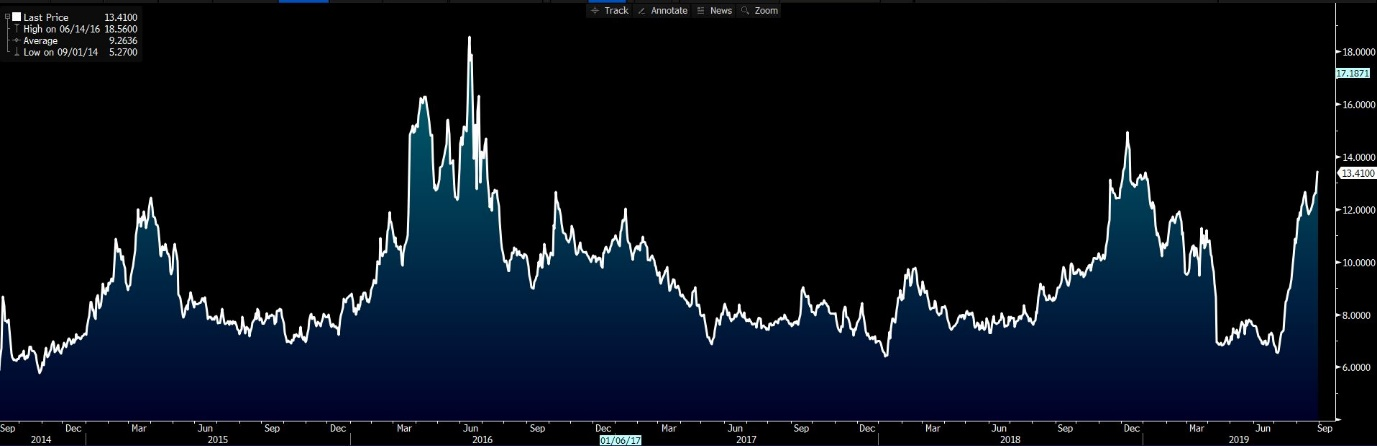

"GBPUSD three-month implied volatility"

As many have commented, this is an incredibly tight window to pass new legalisation from the Remainer camp. A no-confidence vote, therefore, seems incredibly elevated to be enacted through this period. Of course, if neither plays out, when Parliament comes back on 14 October, and with the Queen due to address the nation, given the limited time until the Brexit deadline on 31 October then, the risk of a no-deal Brexit will become the market’s base case. GBP is the Wild West of G10 FX from here. Consider your position size and risk tolerance above all when trading the quid.

Also, keep an eye on the AUD with private CAPEX data out at 11:30 AEST. Weak number in the planned spend could push AUDUSD for a further test of 67c, which has acted as huge support of late.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.