- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

Bitcoin to $100K: Understanding the Market Flows Driving the Next Breakout

Clearly, there is much more to the recent rally in Bitcoin than just those factors, but the crypto market has been blessed with so much positive news flow of late, that we may need new news emerge to fuel the beast – that said, the price is the price and while sentiment is as positive as it's been for years, I am guided by the aggregation of all market beliefs and views over my own, and that means respecting the price action that is put to me.

CoinMarketCap Crypto Fear and Greed at extreme levels

Therefore, an upside closing break of $94k naturally opens a move to the illustrious $100k mark and one suspects it may act like a magnet, pulling in buyers into the big number. The break, in my opinion, is there for chasing. Conversely, a closing break below the rising trend support at $90k would suggest turning a touch more cautious, as it would signal a change in momentum that has essential fuelled the FOMO chase. A break of $86k – should it play out - would likely lead to more intense drawdown, where as the saying goes “If you’re going to dance in the disco, make sure you're closest to the exit when the fire breaks out”.

For now, the prospect of a decent drawdown seems low as there has been such solid demand seen in recent bouts of weakness that won’t likely disappear until the news flow and sentiment shifts. Subsequently, the skew in directional risk remains titled towards an upside break.

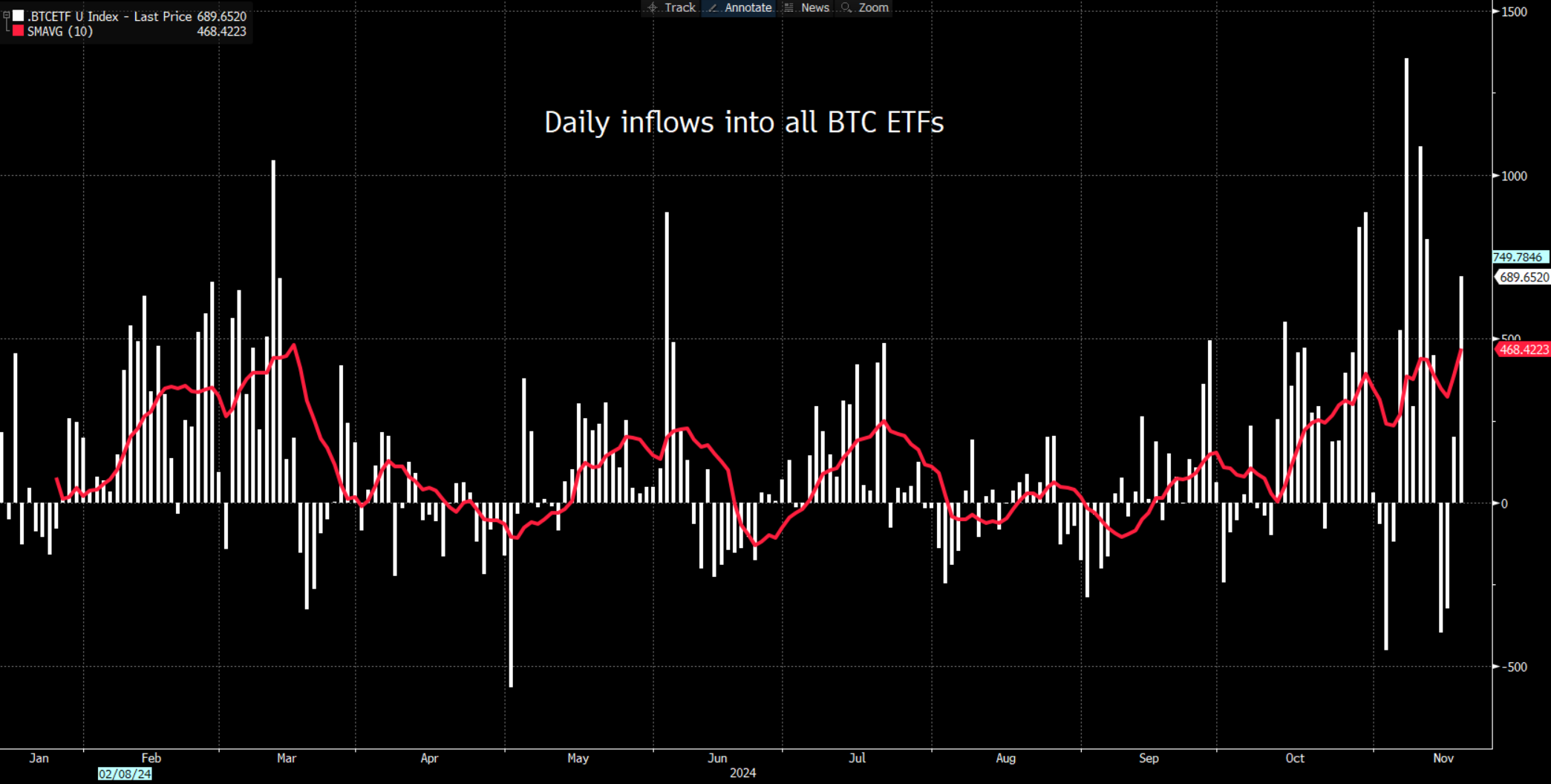

Flow-based dynamics support this more constructive view, with the 5-day average inflow into the various BTC ETFs at a record $484m. The IBIT ETF (iShares BTC ETF), which attracts the greatest share of attention in the ETF complex, is seeing reduced daily inflows, but with traders now able to trade options over the ETF, this offers an alternative expression to capture upside in Bitcoin and on the day, we saw the total number of call options outnumber puts by 4.4 to 1.

Buying calls in the IBIT ETF is expensive (given the high implied volatility), but it takes a brave soul to fade the vol and sell calls, knowing that the potential for a rip-your-face-off rally is ever-present – subsequently, if the underlying price in the IBIT ETFs increases it brings in a whole new world of options market maker hedging activity into the mix. A factor which would only perpetuate the rally in Bitcoin.

Just ask any Nvidia or GameStop investor about that….

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.