- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

As of the 14th of October 2022, The NAV (Net Asset Value) is £497.44. This is the price of one share based on the price of the underlying investments.The fund is invested in 2,083 stocks, a highly diversified fund. There is no fee payable on entering and exiting the fund. The ongoing charge is the fee payable over a year.The risk factor is 5 out of scale of 1-7. 1 being low risk and 7 being high.

Figure 1 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund

Objective

The FTSE Developed World ex-UK is an index that is composed of medium to large cap companies from developed markets excluding the United Kingdom. The fund looks to track the index by replicating the same investments as the weighted capital of the index. The fund will remain fully invested except in extraordinary markets/circumstances.

Statistics

- The launch of the fund was the 23

- FTSE Developed World ex-U.K. Equity Index Fund has share class assets of £10.9 billion.

- The fund is run by Vanguard Global Advisors, LLC., Europe Equity Index Team.

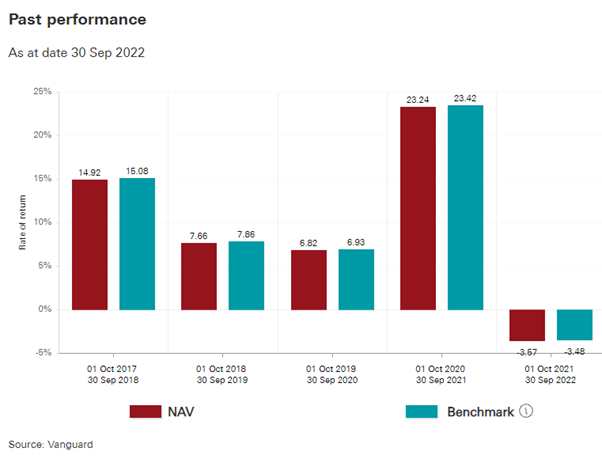

Past performance

The fund has posted net gains for four of the last five years.

Figure 2 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund 5-year performance

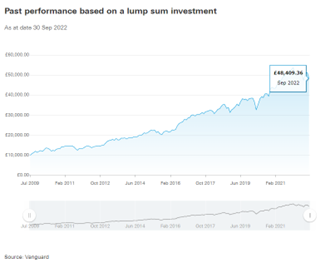

A £10,000 investment at inception (June 2009) would be worth £48,409.36 as of September 2022.

Figure 3 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund £10,000 invested

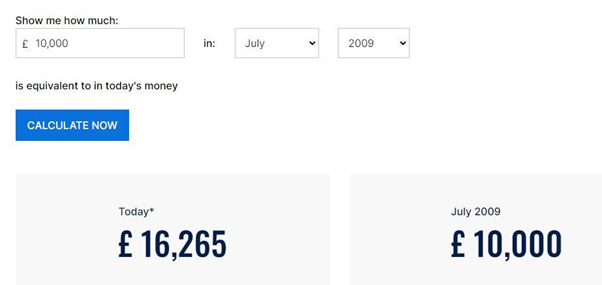

This greatly outstrips the rate of inflation according to the Hargreaves Lansdown Inflation Calculator. The cost of goods over this period would have grown by 62.7% with an annual average of 3.8%. This is compared to the fund increase of 384.09% over the same period.

Figure 3 Hargreaves Lansdown inflation calculator

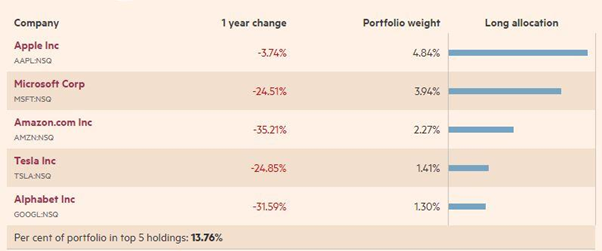

Invested stocks (top 5)

Figure 4 markets.ft.com top 5 stocks

For more information about the US FAANG stock, click here

Invested Regions

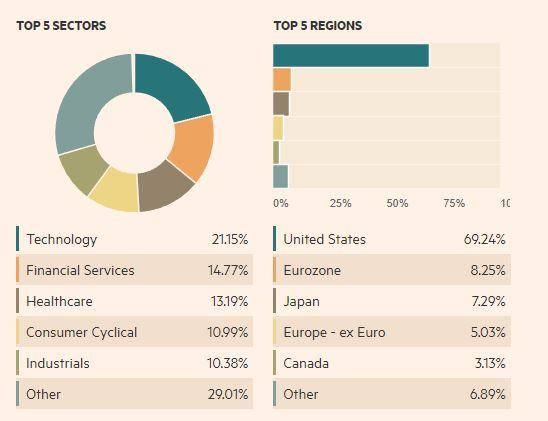

The fund is weighted towards the United States with the top 5 stocks being in the American technology sector.

Figure 5 markets.ft.com invested sectors

Conclusion

If your portfolio is heavily invested in the United Kingdom, you might consider a weighted investment in theFTSE Developed World ex-U.K. Equity Index Fund.This would offer diversification to some of the world's heavyweights, especially in the US technology sector.

For more information about available Pepperstone CFD ETFs (Exchange Traded Funds), click here.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.