CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Tariff Turbulence: Trading the Market Countdown to “Liberation Day”

As the sky begins to bruise and darken, and the atmospheric pressure builds within the capital markets, market players question if it's time to batten down the hatches in preparation for a storm of uncertainty set to be unleashed on markets. Many will also see the risk that this known unknown could ultimately prove to be yet another episode of maximum headline noise that fails to really shake things up, at least without the economic data flow raising the risk of economic fragility and a repricing of US recession probability. We can make assumptions on how hawkish the tariff headlines and public statements from Trump, Bessent, Lutnick and Musk will prove to be and the possible impact on consumption, inflation and business confidence - however, the reality of these new tariff rates won’t be truly realised in the data for a period.

Pricing Tariffs is an Incredible Challenge

The reality is the ability to price the tariff impact into assumed future economics and markets is incredibly challenging. Not just because there are a number of different tariff policies to consider: Reciprocal, matching VAT-levels, universal and country-level targeted tariffs (China, USMCA). But we then need to understand the legalities and the possible implementation dates. We need to price whether the tariff rates kick in in full or in a staggered/phased approach, and the response from the receiving country is critical for the prospect that Trump increases, reduces or even delays the initial proposals.

After 2 April there will be a period of intense negotiation where the ‘noise’ from the headlines will be deafening – subsequently, this will only further impede and disrupt our ability to price risk and certainty. With market players having seen so many episodes in 2025 of tariffs being walked back, carved out or delayed, despite Trump et al substantially building up “Liberation Day” as a defining moment, many will question if this time will be any different.

Trading the Flow of Risk – Price is the Only Fundamental

The uncertainty manifesting in markets and the potential for statements and headlines out through the week and ahead of 2 April could feasibly limit the would-be buyers of risk and promote a further trimming of extended portfolio exposures. This raises the prospect of further upside in the USD this week, with USD positioning held by real money and leverage FX accounts still at highly elevated levels.

EURUSD and GBPUSD look heavy on the higher timeframes and already portray a change in short-term momentum, so we’ll see if that can build as we look to clear several key EU and UK economic data risks through the week. USDJPY eyes an upside break of channel resistance, with the daily chart showing FX players have recently been content to sell rallies above 149.35 and buying below 148.60.

US Treasuries are carving out a consolidation range, with US 10s holding a trading range of 4.35% to 4.15%, and US 2’s 4.10% to 3.85%. In equity land, the NAS100 sees a similar set-up as US Treasuries with a range of 19,900 to 19,200 in play, while the US500 tracks 5700 to 5550 - a closing break of these levels could set off a trend into 2 April, however, the risk of a holding pattern and chop through the week is one that looks probable.

In volatility markets, G10 FX implied volatility (vol) is on the rise (I’ve looked at 2-week expiries), but not at levels that suggest traders expect real venom in the USD moves. We’ve seen some a reduction in the implied levels of equity volatility across the options term structure, and there has been very little evidence of hedging demand in S&P500 puts options for expiries post 2 April. The VIX index has come back to below 20%, with S&P500 1-month implied vol now at 16.7% and a 4 volatilities discount to S&P500 20-day realised volatility (at 21%) – we’ll see if that changes through the week, and for any change in the put-call skew as traders look to increase the relative demand for put protection, as this could be a telling gauge on sentiment going forward.

EU, HK, and China equity indices seem more at risk of a near-term downside move through the week than the ASX200, NKY225 or US500. It’s in these equity markets where we’ve seen big outperformance of late, with the market building a sizeable short-term long exposure. Much of this capital has been deployed on a longer-term structural view, but those who are far more price-sensitive may cut back more intently, as and when the price action dictates.

Gold remains a clear hedge against any tariff fallout, especially if tariff uncertainty increases the perceived US recession risk, although there are a multitude of other tailwinds behind the gold move above $3000 and they aren’t going away – there is a risk of a blowoff top and an increasing risk of profit taking, but uncertainty is a friend to the gold market and pullbacks this week should be limited into the $2970/50 region.

Copper doesn't see the sort of volume from clients that we see in gold, but many have seen the copper price on a tear of late, and is one of, if not, the best performing risk-adjusted market in 2025 – again, we see indecision expressed in the price action, and there is a battle from the bulls/bears that will need to reconcile through the week.

Key Event Risks to Consider

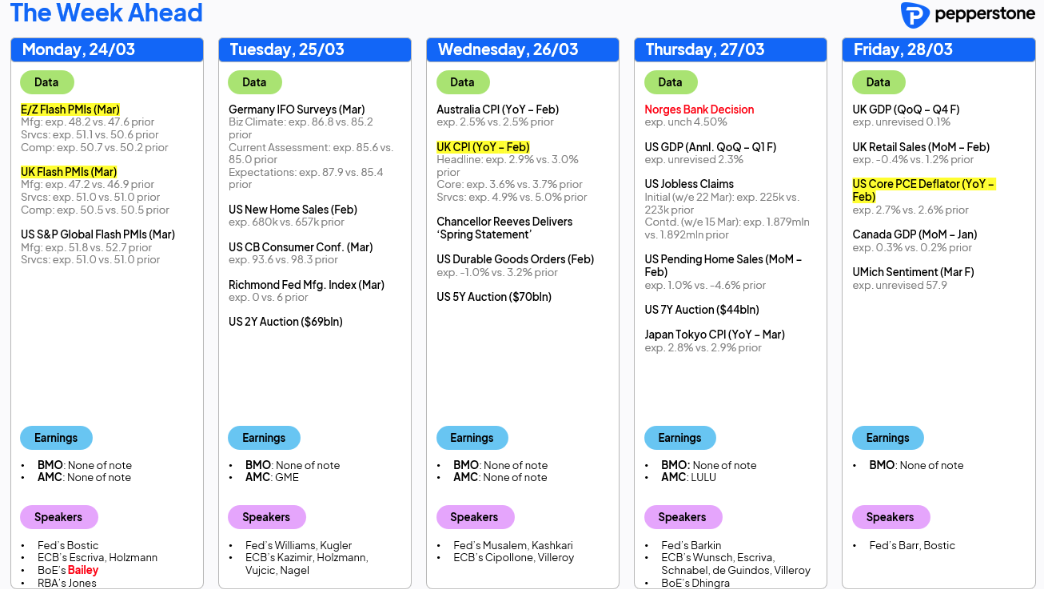

Outside of an impending tariff storm, there are of course other key scheduled risks that could affect market sentiment and cross-asset price action, and that will need to be managed by traders. We get PMIs in the EU, UK, and US, with the EUR and GBP susceptible to increased movement on today’s PMI services and manufacturing prints. We get inflation readings in Australia, Japan (Tokyo). the UK, and the US, with the inflation data set to impact interest rate swaps pricing, where we see the market currently implying a 65% chance that the BoE cut rates at the next meeting in May, while the Fed is expected to ease again in June.

The RBA may well wait until the May RBA meeting to cut the cash rate by a further 25bp, with the Aus swaps implying a 75% chance of easing at this meeting. To some cries of "why wait?", the RBA would have an increased understanding of tariffs, and the Aus Q1 CPI (due 30 April) print. UK retail sales, and the government’s ‘Spring Statement’ keep GBP lively through the week and we also hear from BoE gov Bailey on Tuesday.

On the central bank meeting side, we see the Norges bank (Norway) meeting on Thursday, with the deposit rate set to be held at 4.50% - a factor for FX traders to consider, given the strength of the NOK of late, with some solid trends seen in EURNOK and the NOK FX cross rates. The Mexican central bank (Banxico) also meet on Thursday and should cut rates by 50bp to 9%.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.