CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

RBA March Meeting: Low Cut Odds, Market Pricing, and AUD Trading Tactics

By way of expectations, only 1 of the 15 economists (surveyed by Bloomberg) see a 25bp cut playing out at this meeting.

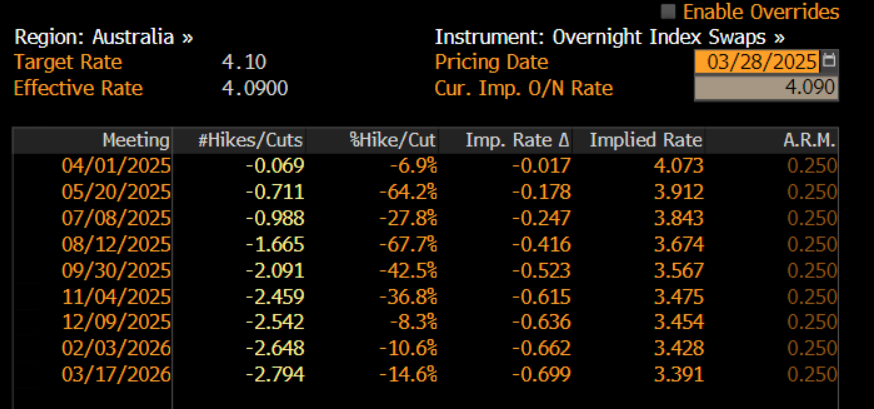

Aussie Swaps Imply a Low Probability of a Cut

More importantly – at least for driving a reaction in Aussie govt bonds, the AUD and ASX200 equities - AU interest rate swaps pricing implies a 7% probability of a 25bp cut, with swaps pricing having implied a less than 10% probability throughout all of March.

The fact that no RBA members have used the period heading into the meeting to guide market expectations towards a higher implied has raised the conviction intertest rates traders hold on its position.

Given this consistently low implied probability (priced into the swaps markets), if the RBA were to cut rates by 25bp it would be seen as a clear surprise for markets and would likely attract calls that the RBA have a communications problem. That said, one could argue that a cut is perhaps underpriced and should be implied closer to 20%, as the RBA still see policy in a restrictive setting and after the release of the February CPI print, would be feeling increasingly confident of inflation pulling towards its target range.

The engrained belief from market players is that the RBA will hold off until the 20 May meeting, where they’ll know the outcome of the March employment report, Q1 CPI and Q1 Wage Price Index.

The RBA to Wait for the Q1 CPI Data Before Easing

In essence, the RBA are most sensitive to the Q1 CPI print (due 30 April), and given the partials offered in the recent February CPI print, the risk is that Q1 trimmed mean CPI comes in at +0.6% q/q, which would take the yearly pace of inflation from 3.2% to 2.8%. Should that materialise, that would compel the RBA to ease rates at the May meeting, while another weaker employment print and soft wage data would almost guarantee it.

AU swaps price 18bp of cuts or a 71% implied chance of a 25bp cut at the May meeting, which feels fair given a hotter Q1 CPI print would give the RBA strong reservations about cutting rates.

Looking further out the AU swaps curve and at current expectations, the market assumes the cash rate could be taken to a low point of 3.5%, implying two 25bp cuts, with a debate as to a third. The schedule suggests they cut in May and again in September, with a further cut possibly in February 2026.

Trading the RBA Meeting

All things considered, the RBA meeting should be a low-impact event, as the base case is that they leave rates unchanged but lay the platform for a cut in May – an outcome which is already well-priced.

Should the RBA’s statement appear balanced, with some pushback on the urgency to cut rates in May, then we could see a positive initial reaction in the AUD, with market pricing pulled back to imply a 50-60% probability of a cut in May.

Market positioning is always a factor when considering the extent of any reaction to a central statement – however, while real money accounts (pension funds, insurance companies) do hold a large net AUD short position, these players are not traders or spectators and will not be overly sensitive to the RBA statement. Leveraged accounts (hedge funds etc) currently run a neutral position, while retail is skewed long of AUD.

Clearly, if the RBA were to cut then we could see the AUD hit hard off the bat, driven by a collapse in front-end Aussie government bond yields. One suspects the ASX200 would see heavy buying flows, however, conversely one could also argue equity investors may derisk on the concern as to the urgency behind the cut – the why behind the sooner-than-expected cut would therefore be important.

In the options market, AUDUSD 1-week options implied volatility sits at 9.96% - the 29th percentile of the 12-month high-to-low range, which highlights the options traders are not positioned for great movement in the AUD through the week. This level of volatility translates to an implied move of 75 pips (higher or lower and with a 68% level of confidence) over the week, which considering that we navigate US nonfarm payrolls and Trump’s “Liberation Day” and an impending deluge of tariffs-related headlines seems surprisingly low.

Tactically, I see a small skew in the directional risk towards an upside move in the AUD, with a more hawkish-than-expected message from the RBA being more likely than a dovish one – A ‘hawkish hold’ so to speak. While I would refrain from taking AUD longs immediately before the RBA meeting, I would consider selling rallies on the day, and notably on a move into the range highs of 0.6400.

It seems that AUD traders will most notably be tackling headline risk stemming from Trump’s tariff policies and the reaction in US and Chinese equities as well as in industrial metals than the RBA meeting – but the RBA meeting does carry a degree of risk, that does need to be accounted for.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.