- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

A trader's weekly playbook – inflation takes centre stage for risk managers

The US500 eyes channel support and its own 50-day MA – we see equity volatility on the rise, with the VIX into 17% - a close above 20% would be welcomed by most day traders and would almost certainly open better shorting opportunities for those happy to trade a two-way price. EU equity has fared slightly worse, with the GER40 -3.1% for the week. We start the week with a modest downside skew in the risk for equity.

We saw big volatility on the week in 10 and 30-year US Treasuries, largely as a function of additional supply, and with a price insensitive buyer (central banks) removing themselves from the system, the private sector will be asked to take down a lot of issuance over the coming quarters.

The USD benefited from higher long-end Treasury yields, although after Friday's reversal in 10yr Treasury yields, I now see modest downside risk in the USD – that said, fundamentally, it feels like any sell-down in the USD should be modest.

The AUD remains the weak link in G10 FX – I am biased for EURAUD higher and AUDCHF lower but would be selling rallies in the latter. China's data flow this week matters for the AUD, and if USDCNH can squeeze higher, it will help push the Aussie lower. Gold printed a bullish outside day on Friday, and those long will be hoping for a squeeze through $1946.74 for a rally into $1966, possibly even $1981. Crude looks well supported, and a test of $83.46 looks likely.

US CPI remains the marquee risk this week, and there are some signs the risk is for an above-consensus print, which would not be taken well by risk assets – if bond and rates volatility can lift because of the CPI print, then it will spill into increased movement in equity, FX and commodity markets and affect our trading environment. Expect the unexpected and keep an open mind – it will serve you well in these markets.

The marquee event risks for traders to navigate:

US CPI (10 Aug 22:30 AEST) – The marquee event risk of the week. The market looks for both headline and core CPI inflation to increase by 0.2% MoM, and one can assume a range of 0.15% to 0.30% MoM as a guide as to how the USD could react to the data. The year-over-year (YoY) pace is eyed at 3.3% (up from 3%) for headline CPI and 4.8% (unchanged) for core CPI, respectively. The market should pay more attention to the MoM metric, with used vehicles and airfares likely to weigh on the basket. Core services are expected to rise 0.34% MoM and could influence the USD and risky assets.

By way of a guide, the Cleveland Fed Nowcast model estimates core CPI coming in at 0.4% MoM, which is above consensus and, if correct, should see the USD trade higher. It would likely see expectations of a hike from the Fed in November priced closer to 50% (currently 30%).

China CPI/PPI inflation (9 Aug 11:30 AEST) – the consensus is we see China’s CPI print pull into outright deflation, with consensus expectations set at -0.5% YoY. PPI inflation is expected to print -4%, which is a slight improvement from the -5.4% seen in the June data. USDCNH will be the FX cross to watch, and a break of trend resistance could see 7.2500 come into play, which would support the USD vs other FX pairs.

US PPI (11 Aug 22:30 AEST) – coming a day after US CPI, the market sees PPI inflation at 0.7% YoY (from 0.1%) and core PPI at 2.3% YoY (2.4%). The outcome could shape expectations of the core PCE deflator inflation print due on 31 Aug.

Mexico central bank (Banxico) meeting (11 Aug 05:00 AEST) – all 20 economists surveyed by Bloomberg see rates on hold at 11.25% - the CPI print could influence expectations here.

Mexico CPI (9 Aug 22:00 AEST) – the market sees the July headline CPI inflation coming in at 4.78% (from 5.06%) and core CPI at 6.66% (6.89%). With some 177bp of cuts priced into Mexican rates markets over the coming 12 months, a weaker CPI print could further increase these expectations and see USDMXN break key resistance at 17.4000.

Japan Labor cash earnings (8 Aug 09:30 AEST) – the market sees wages increasing 3% (from 2.9%) – there is the possibility of JPY volatility on this data point, especially if the 10yr Japan govt bond (JGBs) rises above 75bp – however, unless it’s a blowout number, I would have no issues holding JPY or JPN225 exposures over this data point. The consensus view is Japan should start to see more aggressive disinflation through late 2023 and into 2024.

Japan BoJ Summary of Opinions (7 Aug 09:50 AEST) – essentially these are the minutes from the recent BoJ meeting, where we saw the BoJ allowing some increased flexibility in YCC, placing a new hard cap at 1% for the 10yr JGB - we will explore how close the decision was. It’s hard to see this really moving the JPY, but it is an event risk for JPY traders.

China trade balance – I have little concern about holding exposures over this data point and the market has no confidence in forecasting China trade numbers, and so we seldom see much initial reaction. This time around the market sees a $68b trade surplus, with imports expected to fall 5.5%, while exports are eyed down 12.6% - again, watch the reaction in the CNH, as the yuan will likely drive the AUD and NZD.

China new yuan loans and M2 money supply (no set time through the week) – given there is no set date or time for this data this is not one to position for. After last month's blowout loan figure of CNY3049b, the market expects moderation in credit at $755b and M2 money supply at 11%.

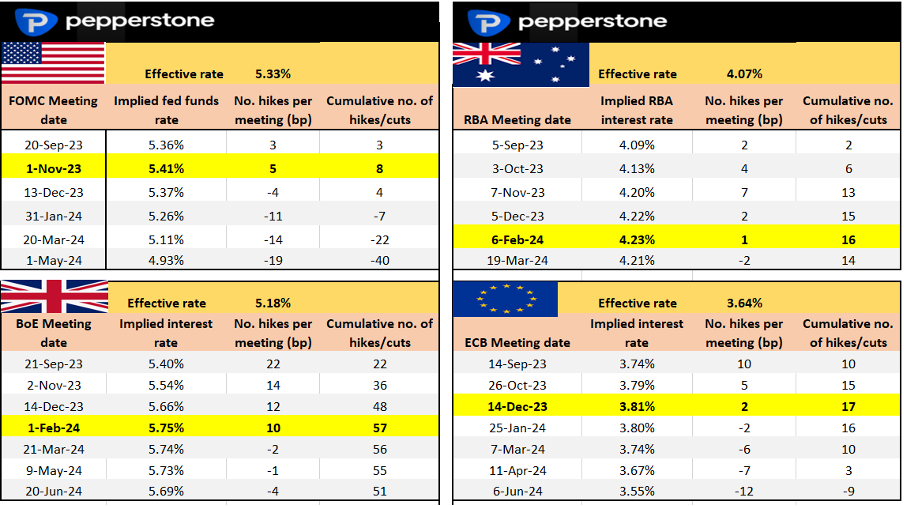

Market pricing on rate expectations – what’s priced and the step up/down per future bank meeting

Corporate Earnings

Australia – on the week, we hear from companies such as QBE (10 Aug), Newcrest (11 Aug), and CBA (9 Aug), with CBA the ASX200 stock to watch. The share price has pulled back 5% from $107.09 since 27 July, underperforming the broader ASX200 in the process. This time around, the market implies a 2.7% move on the day of reporting, so it could get lively for traders of both CBA and the AUS200 (given the influence CBA could have on the financial sector).

The consensus is we see 2H23 cash earnings of $5.014b, paying out a dividend of $2.22. We look closely at CBAs Net Interest Margins (NIM), with the market seeing NIM at 2.02% (-8bp from 1H23). Guidance on margins will be key, with deposit competition heating up and higher wholesale funding impacting. We look out for intel and guidance on asset quality, volumes, and its capital position. Any outlook in the report or the earnings call on RBA policy, demand for loans, and any views on the economy could move the dial.

HK – Alibaba (10 Aug) – Alibaba hit us with Q1 earnings, and the second biggest weighting in the HK50 will be hoping the share price breaks back above HK$ 100 – can the commerce giant make it 5 quarters in a row where they rally on the day of earnings? The market is pricing (through options pricing) a 5% move on the day so that it could get lively.

US – Berkshire Hathaway, UPS, Walt Disney, Nvidia (23 Aug)

Germany – Siemens, Bayer

Central bank speakers

Fed – Bostic *2, Bowman *2, Harker*2

BoE – Huw Pill (8 Aug 02:00 AEST)

RBA – Schwatz speaks (8 Aug 09:05)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(3).jpg?height=420)

_(1).jpg?height=420)