- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

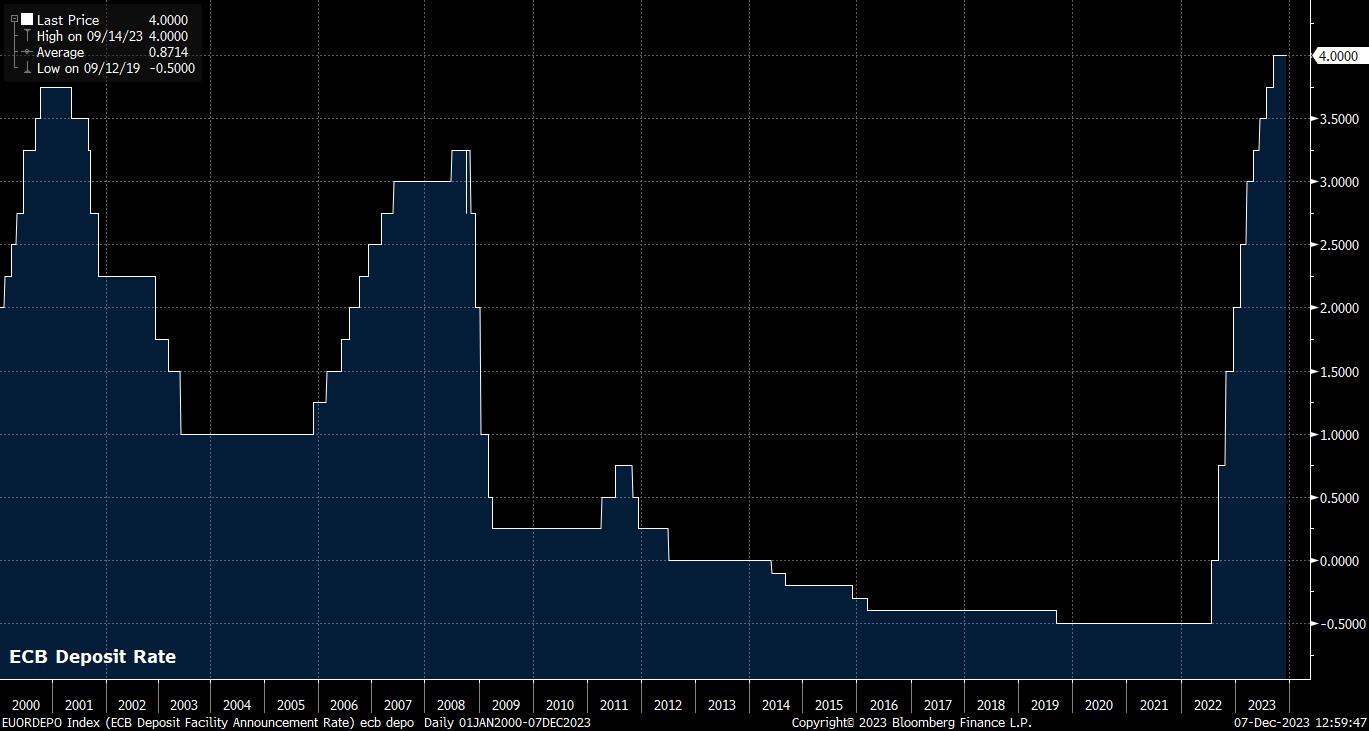

As noted, the ECB seem all-but-certain to keep rates unchanged at the conclusion of the December policy meeting, with markets implying no chance of any further tightening here, or for the remainder of the cycle. Furthermore, almost all recent Governing Council speakers have noted that rates are now at their terminal level.

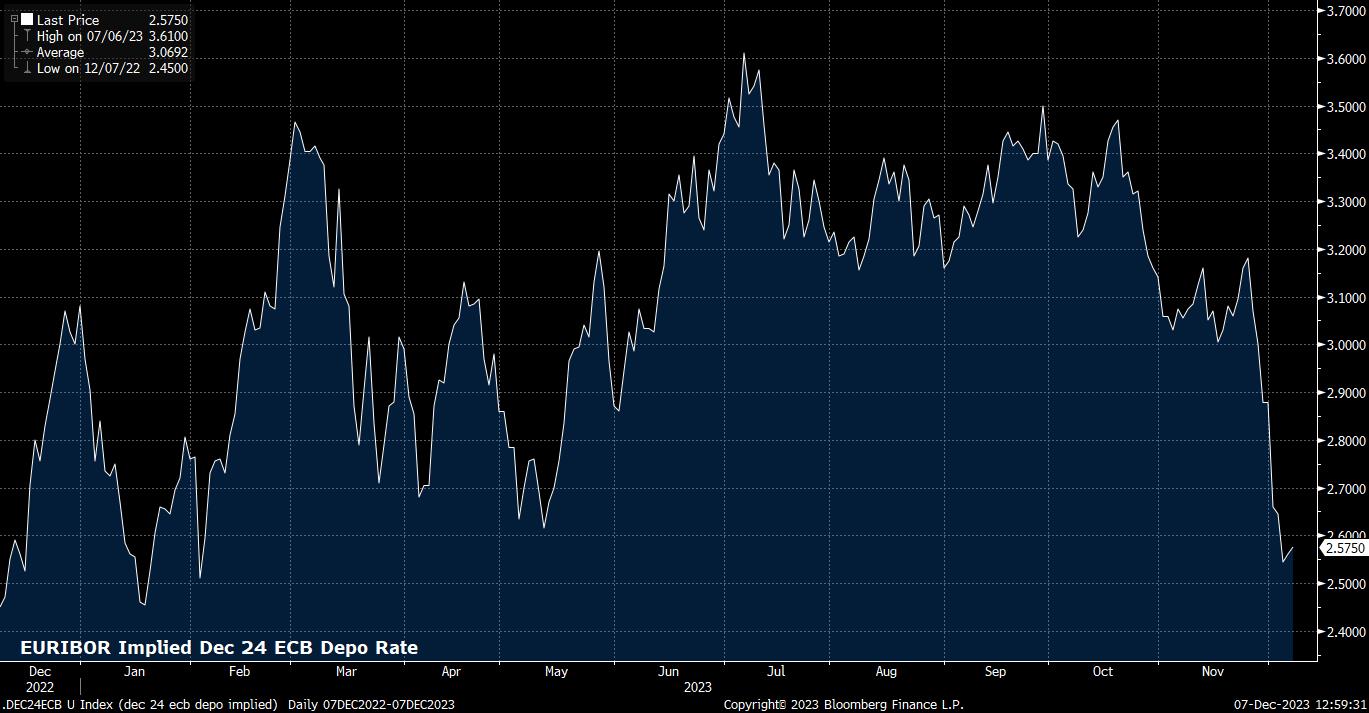

Nevertheless, when it comes to the ECB policy outlook, the question is no longer whether further hikes are delivered, but instead is one of when the first rate cut is delivered. Money markets currently price as much as 130bp of easing over the next 12 months, with the first 25bp cut to the deposit rate seen as a 2-in-3 chance by March, being fully priced in by next April.

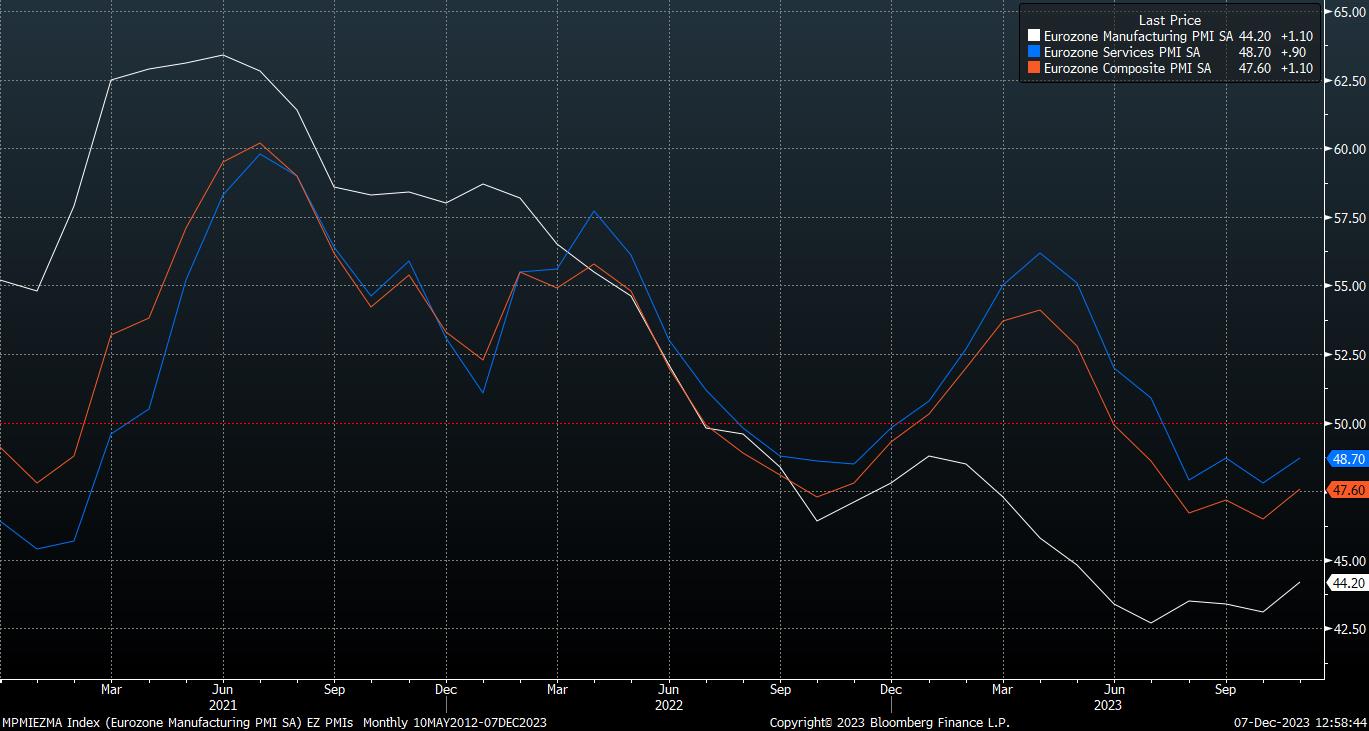

While such a pace is likely more aggressive than the ECB would want markets to be implying, the problem facing policymakers is that there is little in incoming economic data that points to a less dovish path. Inflation continues to recede rapidly from the highs seen earlier in the year, both on a headline and core basis, while economic momentum continues to wane rapidly. Consequently, the prior comment that inflation is “expected to stay too high for too long” no longer seems as just as it did even six weeks ago, likely spelling the end of the ‘higher for longer’ mantra on rates that has been the narrative for policy during H2 23.

There is a chance, however, that the Governing Council prefer to err on the side of caution with any potential guidance tweaks, seeking not to declare a premature victory over inflationary pressures, remaining somewhat scarred by the experience of having referred to price pressures as ‘transitory’ before embarking on the just-concluded hiking campaign. Perhaps ironically, this could lead to a policy mistake in itself, were rates to remain at a restrictive level for too long a period of time, significantly denting growth in 2024.

In any case, the ECB’s latest round of staff macroeconomic projections will be watched with interest in light of recent data.

As already noted, inflation has continued to recede from its late-2022 peak across the eurozone, with headline CPI falling to 2.4% YoY in November, the lowest level in over 2 years, while the core gauge fell below 4.0% YoY for the first time since last July. While some of this decline has been driven by base effects, and may marginally reverse in early-2024, a return to the 2% target is now well within reach in the short-term, with the so-called ‘last mile’ of the disinflation journey thus far having progressed relatively smoothly.

With that in mind, a downward revision to the prior round of inflation forecasts is likely, with core CPI also likely to have returned to 2% by the end of next year. Once more, however, for the reasons outlined above, policymakers may seek to err on the side of caution here, in order to avoid implicitly endorsing the market rate path. The labour market remaining relatively tight, with earnings pressures strong, and no noticeable uptick in unemployment having been seen, may help underpin this, to some degree.

Meanwhile, on growth, the September forecast for 0.7% GDP growth this year, and 1.0% growth next, now seems far too optimistic. Incoming data points to, at best, an anaemic pace of economic growth, and at worse – for instance, in Germany – a rather sharp pace of contraction, concentrated in the manufacturing sector.

Furthermore, risks to economic growth remain tilted to the downside, not only owing to the weakness noted above, but also due to external risks – with geopolitical tensions remaining elevated, and China’s economy continuing to face stiff headwinds. Nevertheless, the 2025 growth forecast of 1.5% may remain untouched, owing to the positive effects that policy easing will likely have had by then.

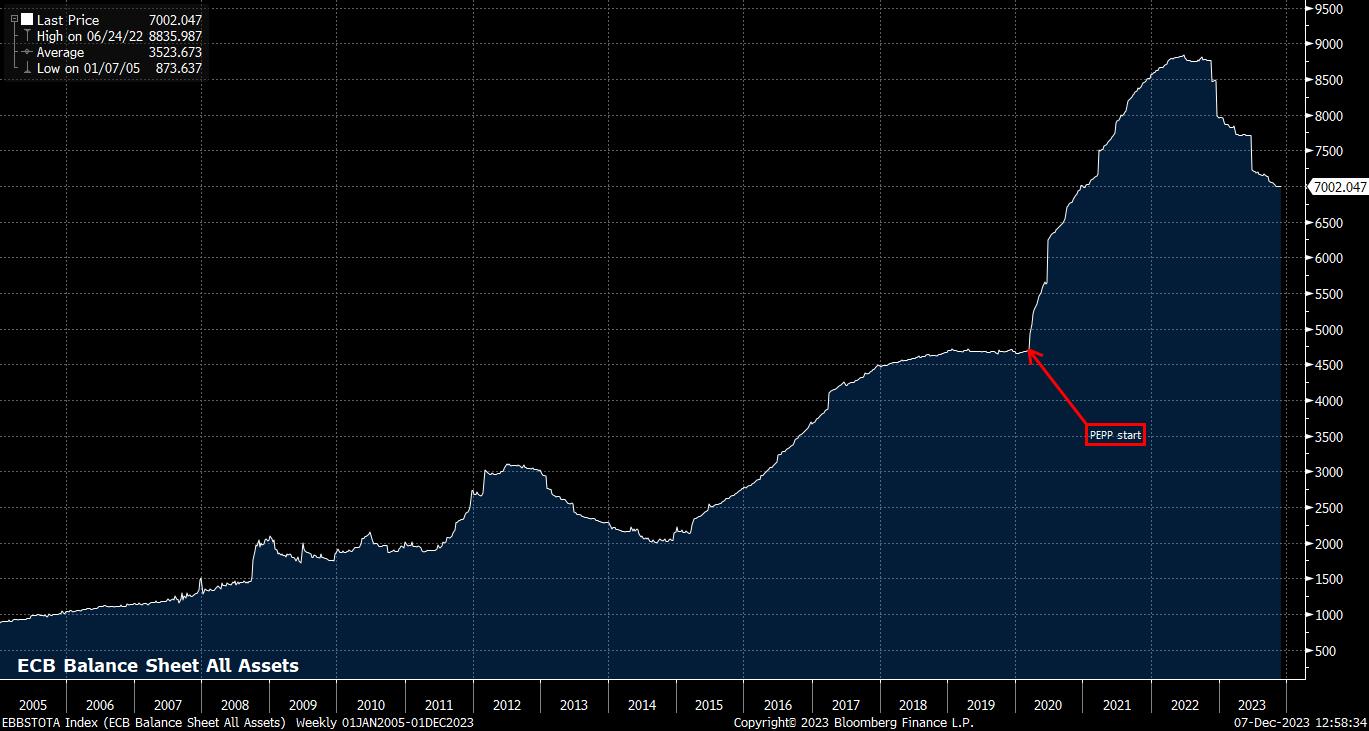

There is also the matter of the ECB’s balance sheet to ponder at the December decision, with an early end to reinvestments of securities bought under the PEPP scheme likely to be discussed, with both President Lagarde and Executive Board Member Schnabel having hinted at this of late. While currently set to conclude at the end of 2024, it seems increasingly likely that – barring a spike in eurozone bond yields, or a sharp widening in core-periphery spreads – reinvestments will come to an end much sooner, perhaps next March.

While a firm decision and timetable on this is not likely until early next year, Lagarde is likely to at least confirm that the matter was discussed at this meeting, while possibly also providing some hints as to how the early end to reinvestments may come about.

In any case, the most significant driving factor for the EUR is not the balance sheet, nor the forecasts, instead being where the deposit rate heads next year. So long as explicit pushback on the current OIS pricing appears unlikely, and incoming data continues to point towards rapidly waning economic momentum, along with continued disinflation, the common currency is likely to continue facing relatively stiff headwinds.

_Daily_07_2023-12-07_12-57-29.jpg)

This may, however, ultimately prove to be a ‘blessing in disguise’ for the EUR. Were these factors to lead to earlier, and more aggressive, policy easing than that delivered by other G10 central banks, H2 24 could see the common currency benefit were the economy to prove more insulated from a deeper growth shock than DM peers.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.