CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

March 2025 UK Jobs Report: Continued Loosening Leaves BoE Behind The Curve

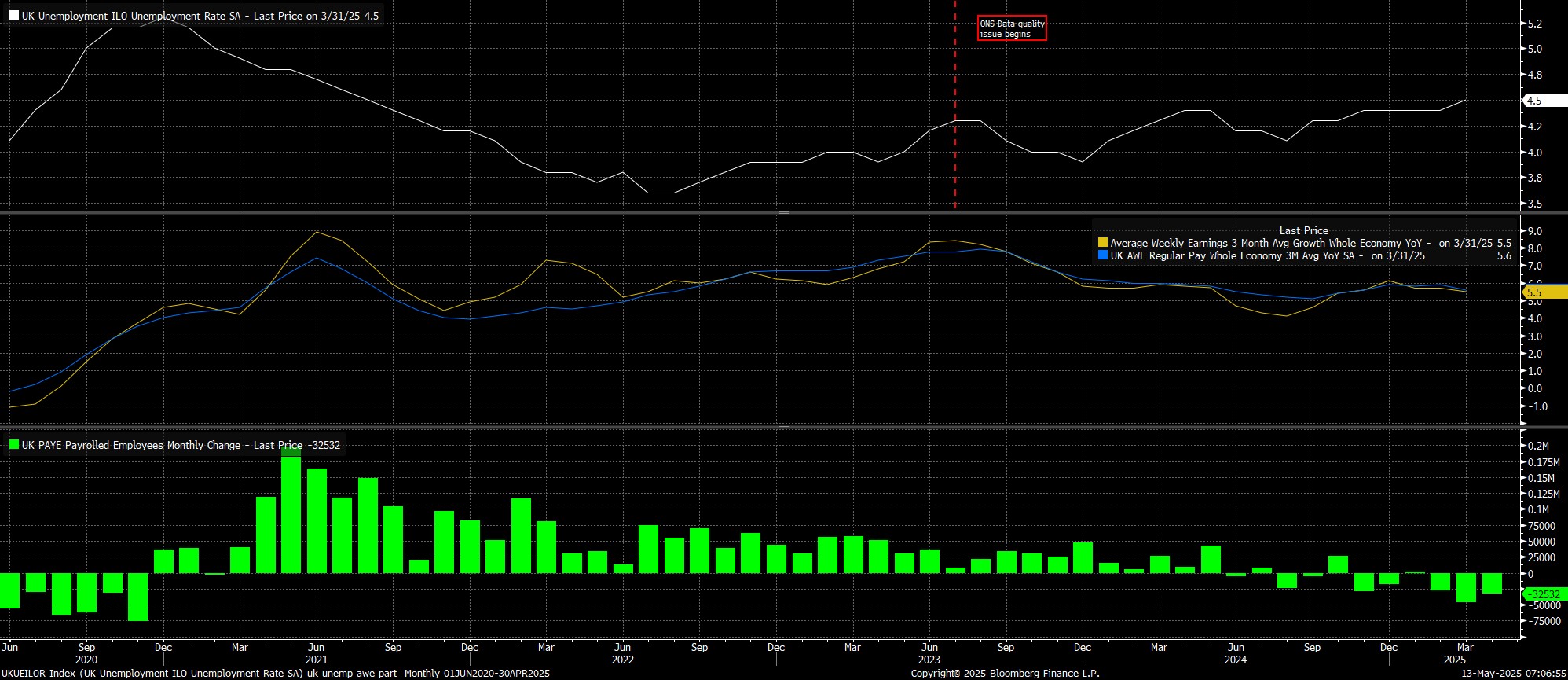

Unemployment, in the three months to March, rose to 4.5%, its highest level since the summer of 2021, having previously held steady at 4.4% since last November.

Meanwhile, earnings growth continued to cool, though remains at a pace that, for the time being, is too hot, if sustained, to be compatible with the 2% inflation target. Overall pay rose 5.5% on an annual basis, its slowest pace since last October, while private sector earnings rose 5.6% YoY, a touch cooler than the BoE's 5.76% expectation. Importantly, these pay figures don’t account for the national minimum & living wage hikes, which will skew the data higher next month, though there may be some offsetting impact from higher employer national insurance contributions.

Speaking of April, the more timely HMRC metric of payrolled employment pointed to a 33k decline in employment last month, the second straight monthly decline, and the fifth monthly fall in employment in the last six months.

On the whole, this morning’s data once again paints a picture of a labour market that continues to gradually weaken, and where slack continues to develop. Of course, this must come with the usual caveat that the data must be taken with a pinch of salt, due to the shambolic nature of the ONS, and its ongoing survey issues.

Nevertheless, the continued labour market weakness makes it even more perplexing as to why the Bank of England stuck to its ‘gradual and careful’ guidance on policy easing last week, and as to why two policymakers saw no need to ease policy at all.

With that in mind, a cut in June remains a tall order, being off the cards for all intents and purposes, with August being the base case for the Old Lady’s next 25bp cut. That said, the current policy guidance seems to be on borrowed time, with the MPC potentially finding themselves some way behind the curve by that stage. Hence, there seems an air of inevitability, so long as the inflation backdrop evolves in line with expectations, that the Bank will have to embark on a faster cutting cycle, potentially in larger clips, towards the end of the third quarter.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.