- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

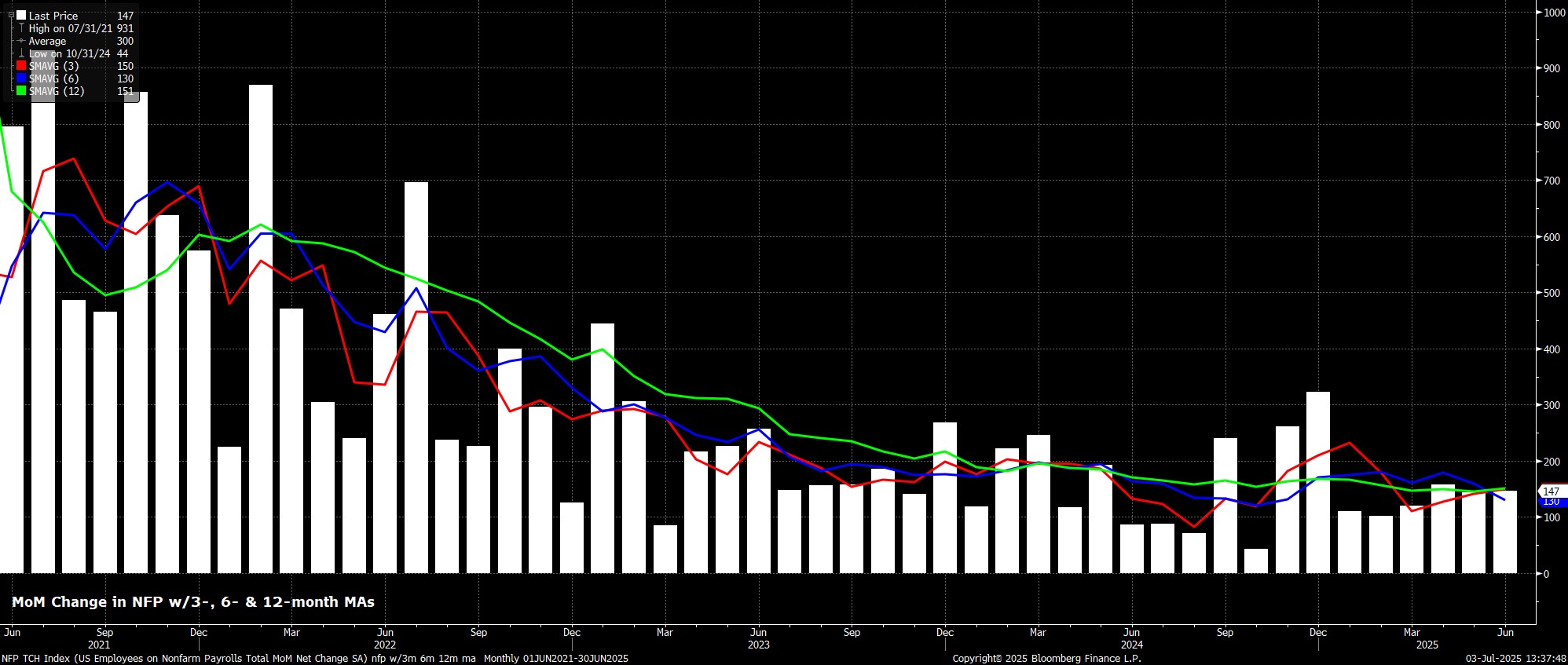

Headline nonfarm payrolls rose by +147k last month, above expectations for a +105k increase, and towards the top of the unusually tight forecast range of +70k to +160k. Concurrently, the prior two payrolls prints were revised by a net +16k, in turn seeing the 3-month moving average of job gains rise to +150k, comfortably above the breakeven rate.

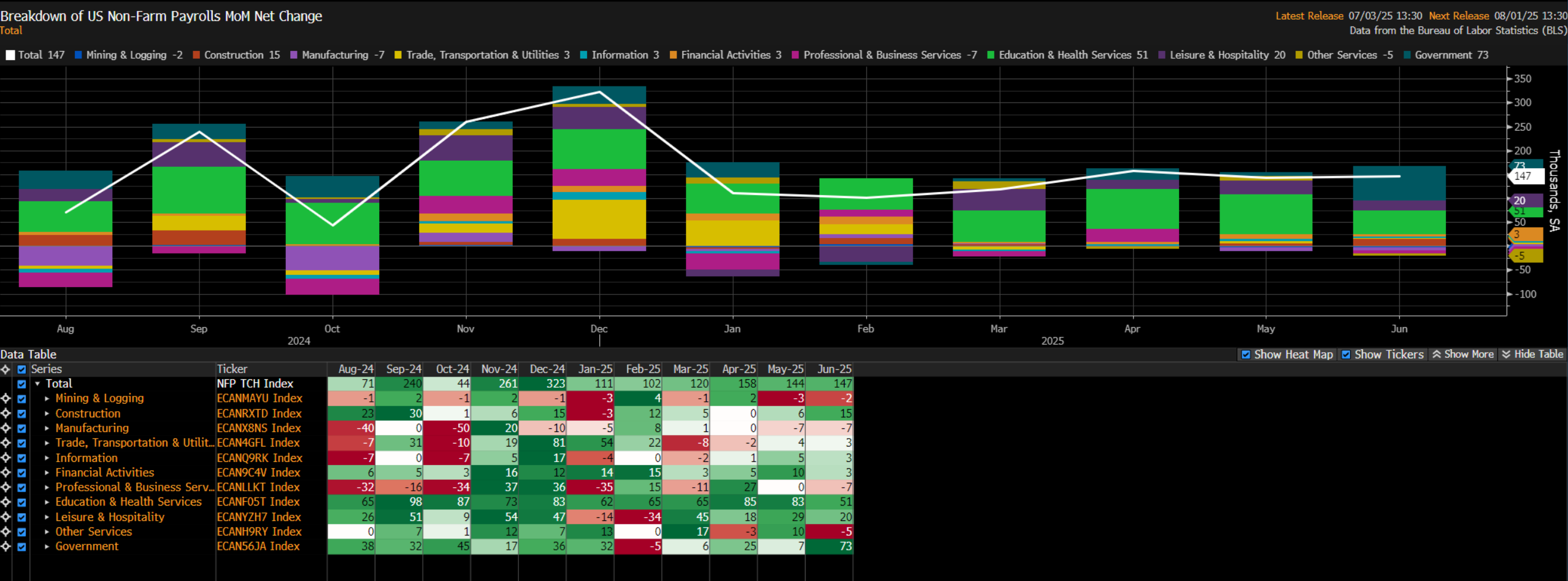

Taking a look under the surface of the payrolls print, job gains were relatively broad-based, though led by Government employment, primarily driven by hiring at the State and Local levels. On the flip side, net job losses were seen in Manufacturing for the second month running, and in Professional & Business Services for the first time since March.

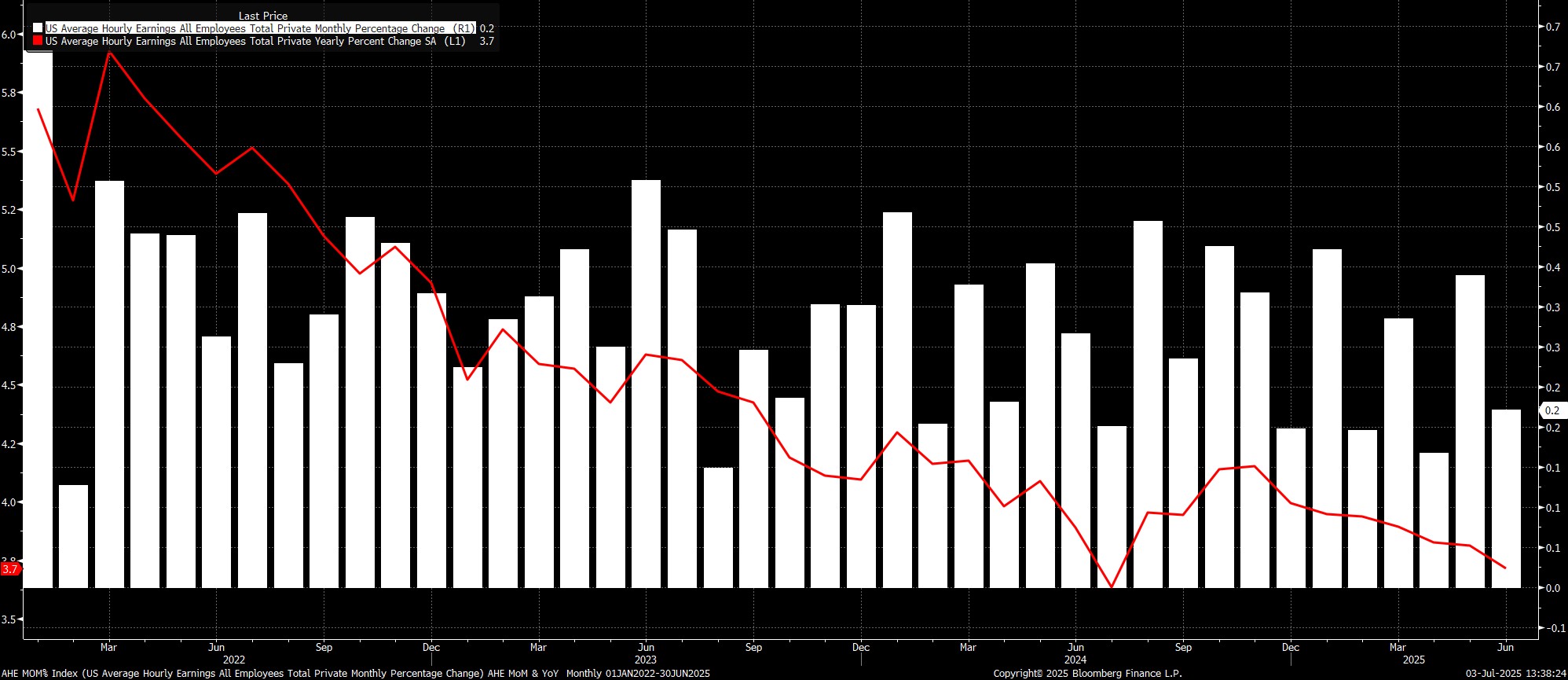

Staying with the establishment survey, the report pointed to earnings pressures remaining contained. Average hourly earnings rose 0.2% MoM, a touch softer than consensus, which in turn took the annual rate to 3.7% YoY, also a touch cooler than expected.

This data serves to reinforce the FOMC’s longstanding view that, at present, the labour market is not a source of significant upside inflation risk, though those risks are of course still present, primarily stemming from the Trump Admin’s trade policies, even if the full pass-through of tariffs has yet to be seen.

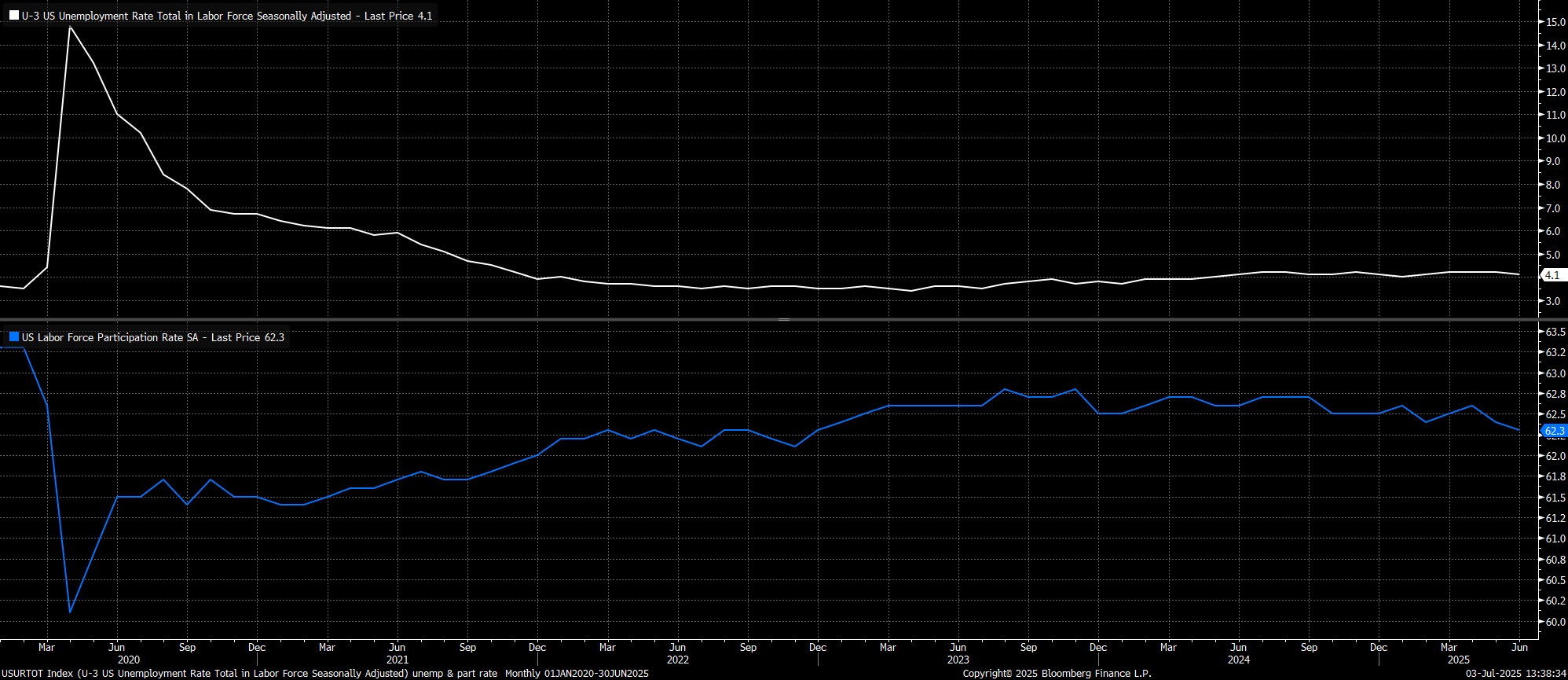

Turning to the household survey, unemployment unexpectedly fell to 4.1% last month, though this came as labour force participation declined to a cycle low 62.3%, presumably a result of increased immigration enforcement during the month.

This data, though, must continue to be interpreted with a degree of caution, given the unusually volatile nature of the labour force this cycle, and as the BLS continue to grapple with declining survey response rates.

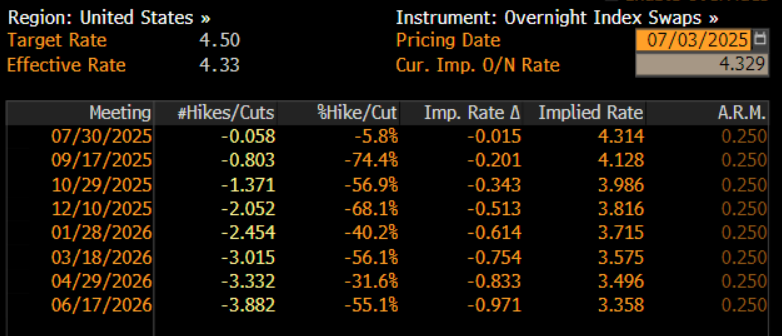

In reaction to the jobs report, money markets ditched their bets on a July Fed cut, which had been seen as a one-in-four chance pre-release, pushing back the timing of the next 25bp cut to October, and now discounting just 50bp of easing this year (vs. 66bp pre-release).

Taking a step back, the June employment report shouldn’t materially alter the Fed’s thinking on the near-term policy trajectory, with the FOMC set to stand pat at the end of this month, as the labour market remains resilient.

There remain, in my mind, two potential scenarios for the FOMC in the second half of the year. If inflation remains contained, Chair Powell will likely use the late-August Jackson Hole Symposium to pivot in a more dovish direction, before delivering cuts in September and December; on the other hand, if tariff-induced inflation emerges, the present ‘wait and see’ approach will persist, probably resulting in just one cut this year, in December. For the time being, my base case remains the latter.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.