- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

January CPI Recap: Hot Inflation Sparks Hawkish Repricing

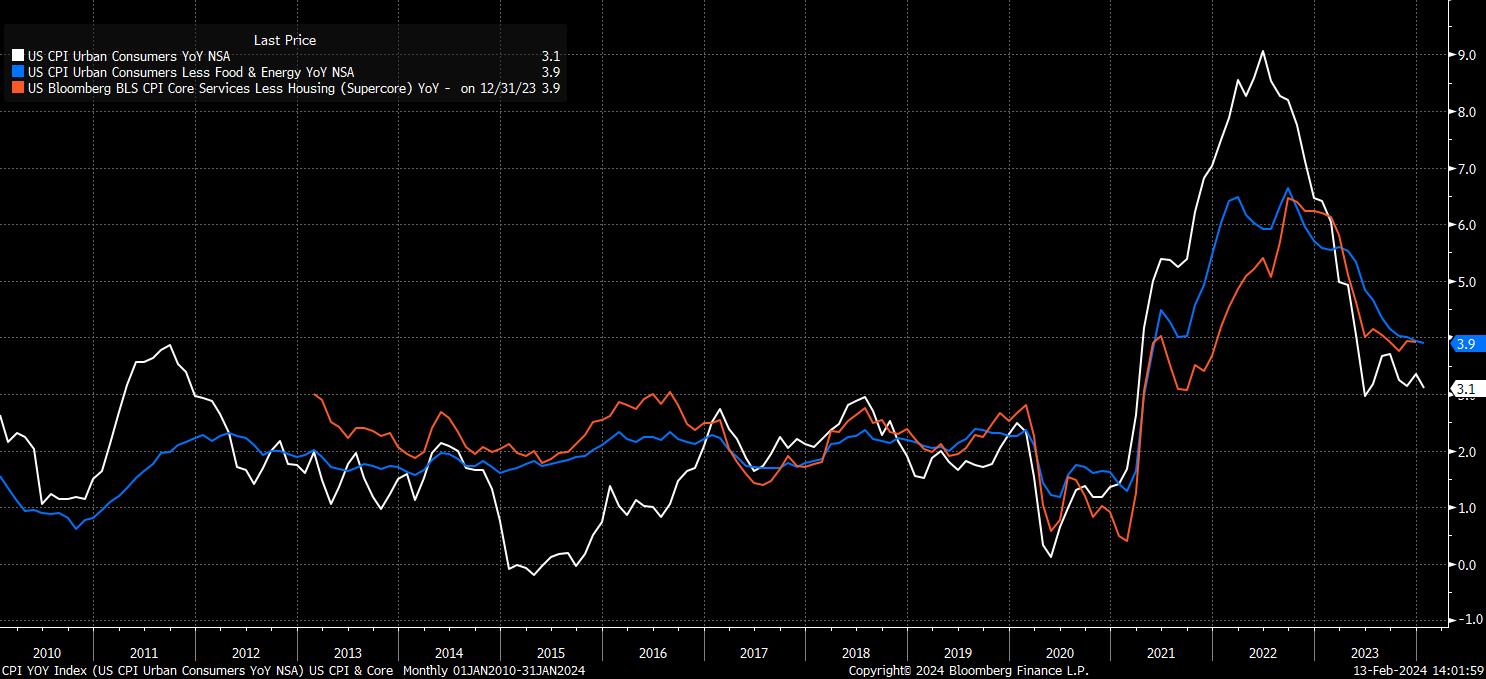

Headline CPI rose 3.1% YoY in January, down from the 3.4% pace seen at the tail end of last year, though significantly hotter than the 2.9% consensus, making this the second straight inflation print to surprise to the upside. Core prices, more worryingly, remained unchanged on an annual basis, rising 3.9% YoY for the second month running, likely raising some concern over the potential ‘stickiness’ of inflation, particularly with ‘supercore’ inflation also remaining unchanged on the month at 3.9% YoY.

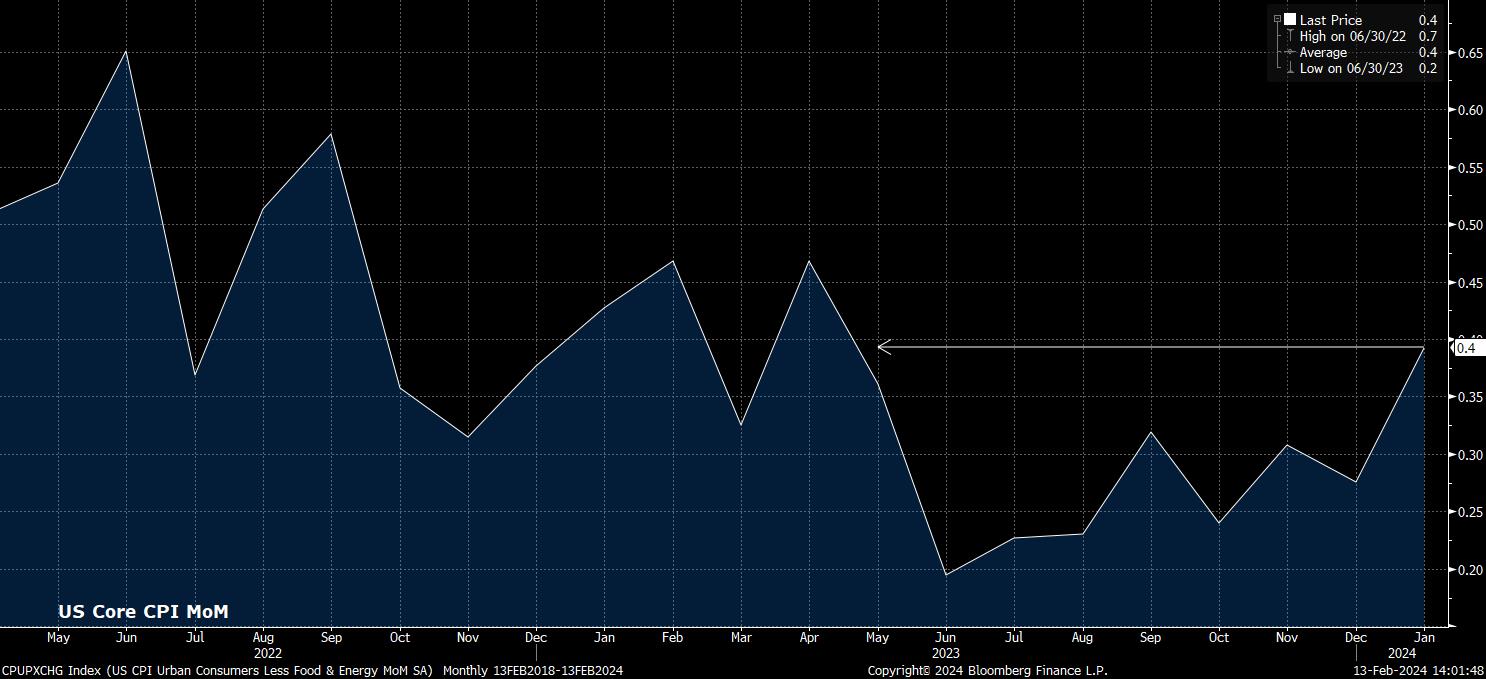

Meanwhile, on a monthly basis, which helps to remove the base effects involved in the YoY calculation, the picture was similarly disappointing for those hoping the ‘immaculate disinflation’ narrative would continue.

Headline prices rose 0.3% on the month, modestly hotter than the 0.2% seen in December. Of more concern, though, is again the core (ex-food and energy) measure, which rose 0.4% MoM, the fastest monthly rise since last May.

Annualising these MoM rates helps to paint a ‘truer’ picture of underlying inflationary pressures.

Once again, these are likely to raise some concern among FOMC members, with the 3-month annualised core CPI rate now running at 3.9%, its highest since last June, and the 6-month rate now running at 3.5%, its highest level since September.

Unsurprisingly, this hotter than expected data sparked a knee-jerk hawkish reaction across financial markets, with the figures casting some significant doubt on the disinflation narrative which had been dominant since the turn of the year, while also, once again, raising the prospect that rates will have to remain ‘higher for longer’ in order to finally squeeze inflation out of the economy. As had been previously flagged as a risk, the ‘last mile’ of returning inflation to the 2% target does indeed look as if it may well prove the hardest.

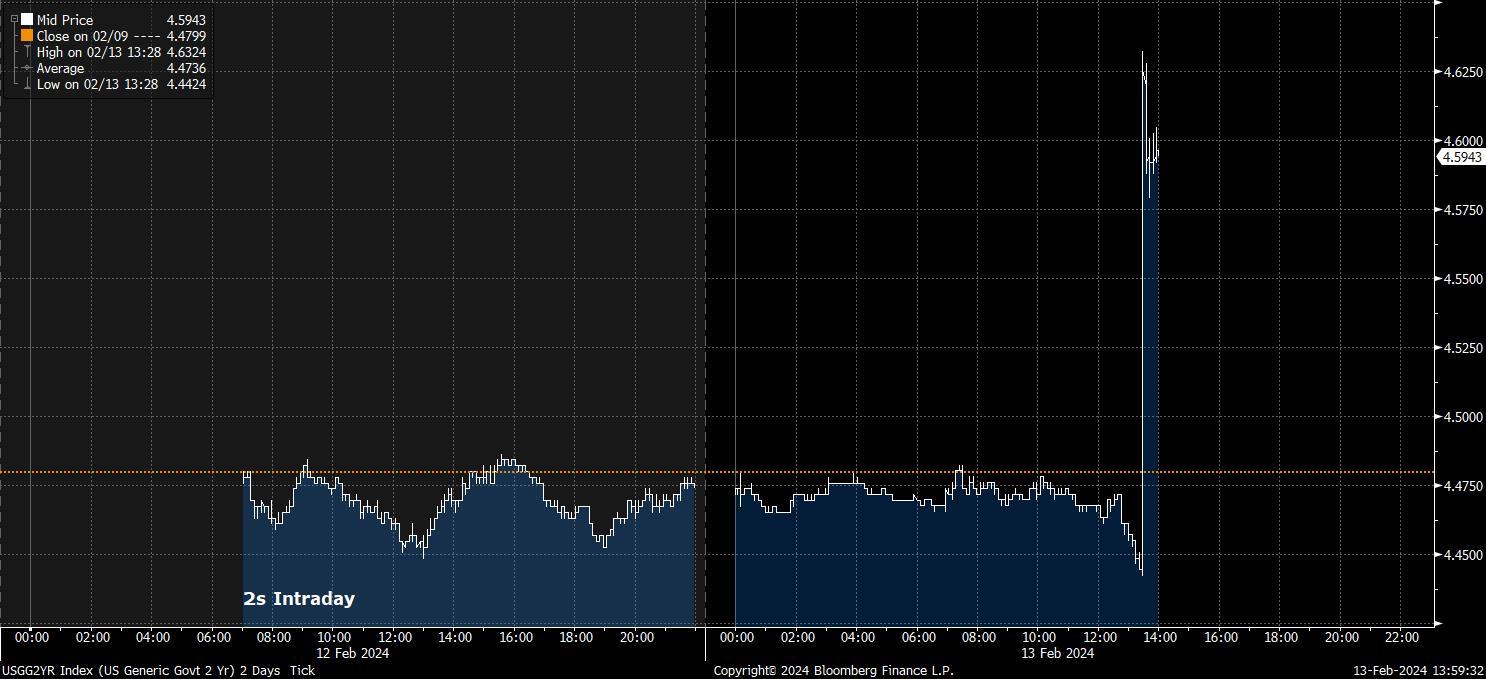

This hawkish repricing was most evident in the USD OIS market, with money markets having now pushed back the timing of the first 25bp rate cut to June (and briefly into July), while also pricing fewer than 100bp of cuts this year.

Taking into account Chair Powell’s rhetoric at the January FOMC presser, and the desire for the Committee to seek more ‘confidence’ in incoming data that inflation is indeed on its way back to target, the hawkish repricing of rate expectations was unsurprising. Nevertheless, it’s important to recognise that policymakers will be focused on the trend in the data, rather than a single print, and are unlikely to over-react to one month’s worth of data.

Nevertheless, as is all too common, markets are prone to over-reaction, as was in evidence as the CPI report dropped, and the ‘soft landing’ ideal begun to turn into a ‘no landing’ scenario.

Treasuries, of course, epitomised this, with rates selling-off across the curve, led by the front-end, as 2s rose over 15bp from pre-release levels, briefly trading north of 4.6%, while 10-year yields comfortably cleared the 4.25% barrier. Presumably, positioning helped this move along, with many on the sell-side having likely been positioned for a cooler than expected print before the data dropped.

In any case, the Treasury sell-off in turn sparked sizeable demand for the greenback across the G10 board, with the DXY rising to a new YTD high north of the 104.80 mark. Gains in the buck were broad based, with cable slipping beneath the 1.26 handle once more, the EUR probing 1.07 to the downside, and USDJPY surging north of the 150 figure – though, any BoJ/MoF intervention seems unlikely at this point, with the move in line with underlying macro fundamentals.

_D_2024-02-13_13-59-54.jpg)

It remains the case, in my view, that there is little else worth owning in the G10 universe other than the greenback at the present juncture, particularly against lower yielders such as the JPY and the CHF, especially the latter as the chances of the SNB cutting as soon as next month rise after substantially cooler than expected CPI figures (in contrast to the US) on Tuesday morning.

Meanwhile, in the equity space, the hawkish repricing sparked sizeable downside on Wall Street, with the S&P future falling over 1% to break back below 5,000, and the tech-heavy/rate-sensitive Nasdaq tumbling almost 2%.

It will be interesting to see if, or indeed when, the dip in equities is bought. Monday’s price action displayed some warning signs, with spoos flat on the day, yet the VIX ticking 1pt higher, not a common combination. Given the strong performance seen YTD, it would not be entirely surprising to see some longs use this as an opportunity to take profit, particularly considering this week’s bumper data docket (retail sales, PPI, UMich sentiment still to come), and as markets look ahead to NVDA earnings next week.

Despite this, I remain bullish over the medium-term, and would expect the market to continue to perform well, benefitting from what is clearly an incredibly resilient, and well-performing, US economy.

In summary, the phrase ‘one swallow doesn’t make a summer’ springs to mind as markets digest the latest inflation figures. While, clearly, hotter than expected at a core level, and moving in the opposite direction to that which policymakers seek, one print alone should not be over-interpreted, especially given how prone to revisions the data remains. Policymakers are unlikely to over-react to one print, and nor should market participants.

The fact remains that this is a flexible FOMC. They can cut whenever they feel they have enough evidence of inflation being set to return to 2%. After this data, that shan’t be in March, though that was always unlikely to be the case, particularly after the blowout January NFP print; any cut at that meeting would now be 50bp or more, and likely the result of some degree of financial instability.

Policymakers remain data-dependent, and naturally so do financial markets; one poor jobs figure and/or a cool inflation print next month, and all of a sudden, we’ll all be talking about a May cut once more.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.