- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

WHERE WE STAND – It was, frankly, a bit of a dull end to the week for financial markets on Friday, with price action akin to a random meander as we cruised into the weekend.

Fundamental catalysts were relatively light during the day, though we did receive news very late on that Moody’s had finally downgrade the US to Aa1, being the final ratings agency to strip the US of its AAA credit rating.

This is great for headline writers, those wanting an easy narrative, and folk seeking clicks/views on the internet, but in reality it makes no difference to anything whatsoever. Everyone knows, and has known for some time, that the US is on an unsustainable fiscal path, just like most other DM economies around the world. Concurrently, there remains little-to-no desire to resolve the situation, especially with the GOP on track to pass about $5tln in tax cuts, and a $4tln increase in the debt limit. Clearly, fiscal conservatism is dead.

It is painfully obvious that the US won’t ever default on its debt obligations, no matter what collection of random letters the ratings agencies decide to label them with. Plus, if in some incredibly unlikely scenario, a default were to occur, then we would probably be in a situation of ‘real world’ and financial Armageddon, making the whole thing an almost entirely futile exercise.

Futility also sums up the UMich consumer sentiment survey, which appears to now be doing its sampling in some hyperinflation-ridden state like Venezuela or Zimbabwe, as opposed to the US. The headline sentiment metric fell to 50.8 in May, the 2nd lowest reading on record, while year-ahead inflation expectations shot higher to 7.3%, from a prior 6.5%, to the highest level since the early-80s. If anyone seriously believes that the current macroeconomic situation is going to resemble something like the Weimar Republic, then I will happily be taking the other side of your bet.

If you want an example of something we should care for – how about President Trump, at the weekend, telling Walmart that they should ‘eat the tariffs’ and not raise prices to pass on increased costs. If you’re thinking that a leader ordering a firm to sacrifice profits to cover up for that leader’s dismal economic policies sounds a lot like some form of communism, then you’d be right. Let’s hope we don’t hear much more of this rhetoric from the Oval Office.

Anyway, all that aside, markets didn’t really do much as the week wrapped up.

Stocks ground higher through the session, seeing the S&P take its weekly gain to just over 5%, having closed in the green every day last week. I remain bullish here, with peak tariff uncertainty and trade noise in the rear view mirror, leaving the market on course to test 6k, with a break of that figure setting us up nicely for new highs. Dips remain buying opportunities, in my mind, such as the one we see this morning as the new trading week gets underway.

In the FX space, it was a day of choppy and indecisive trade, with any notable moves given back in relatively short order, and little by way of ‘signal’ coming from any of what we saw. It remains interesting, though, that the dollar hasn’t really tagged along with the rebound seen on Wall Street – a very crude overlay suggests that the DXY should be closer to 108, than to 101, if the pre-Liberation Day relationship with the S&P 500 were to still ring true.

This leads me to suspect that, as previously flagged, those international investors who trimmed their US exposure during ‘peak fear’ in early-April have yet to return to the fray. If they were to do so, which given the FOMO-driven nature of markets at present is a distinct possibility, that could be the catalyst that the buck needs to kick higher once more. Still, short-term, we need to see a convincing break north of 101.60, the 50-day moving average, before getting too excited on that front.

On the subject of significant levels, probably the most significant of all right now is 5% on the 30-year Treasury, which this morning has been broken for the first time since April, though anyone selling Treasuries on the ratings downgrade should probably be giving their head a wobble. That said, fiscal concerns are genuine, and the ‘bond vigilantes’ do seem to want their brief moment in the sun once again, especially given the number of notes I’m reading mentioning “Liz Truss” and “treasuries” in the same sentence!

I was, though, asked on Friday what we see first – 4.50% or 5.50%. My answer was pretty definitive in favour of the 4.50% mark coming next because, even if further selling pressure at the long end remains likely, it is equally likely that we would get a policy pivot from the Trump Admin. way before we got to 5.50%.

Speaking of which, anyone remember Bessent wanting to ‘term out the debt’? Yeah, that was a funny joke while it lasted.

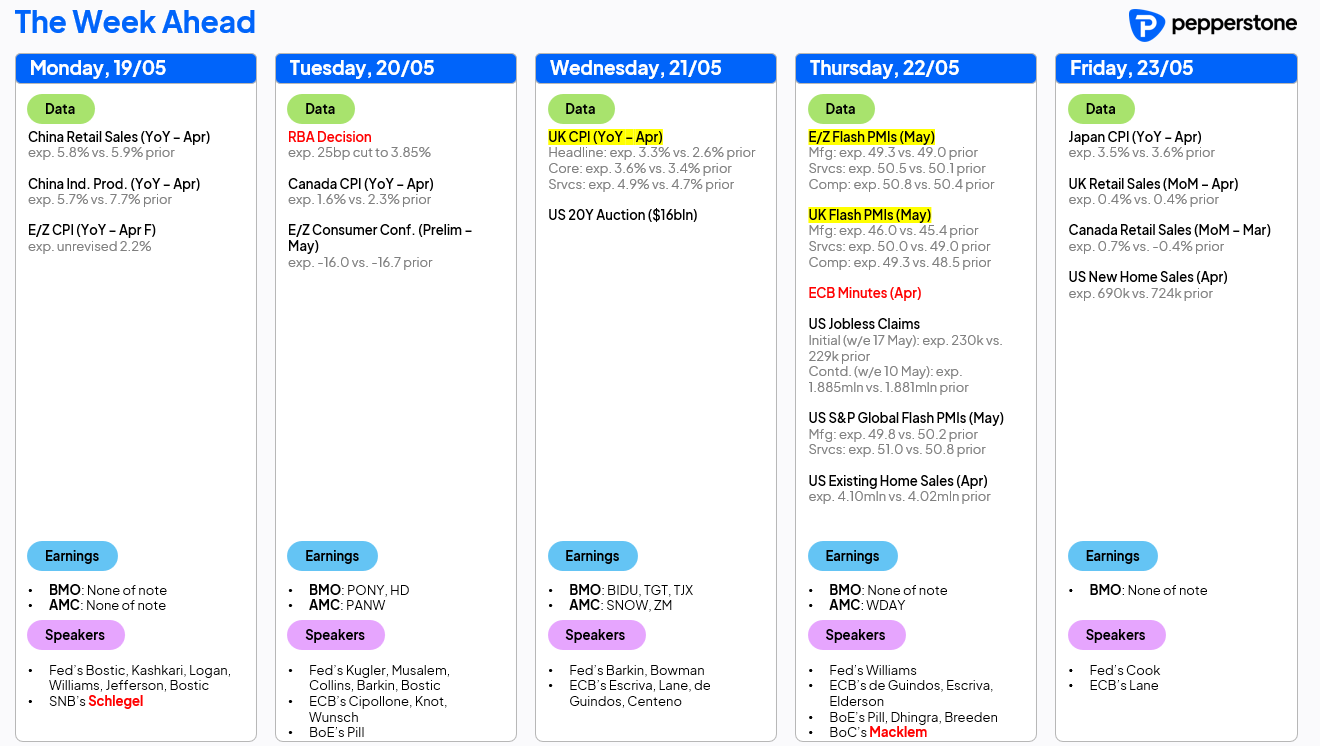

LOOK AHEAD – A bit of a lighter data docket this week, though focus will naturally also remain on trade and geopolitical developments.

As for scheduled events, Thursday’s slate of ‘flash’ PMIs are probably of most interest, as participants continue to gauge how the economy is evolving in light of the recent US-China trade truce, though it may well be too early for the full effects of that to show up in the data just yet. Other notable prints include CPI and retail sales here in the UK, with inflation set to rise north of 3% after a whole host of annual price hikes kicked in last month.

Meanwhile, on the policy front, the RBA are set to deliver their second cut of the cycle, while a torrent of central bank speakers is slated once more – oh, joy!

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.