- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

As noted, haven demand was in evidence upon markets re-opening on Monday morning, as traders sought shelter amid surging geopolitical uncertainty. Gold, interestingly, proved the haven of choice as the week got underway, bouncing convincingly from the February lows, and bottom of the recent downtrend, at $1,810/oz, to rally back above the 50% retracement of the Q4 22 – Q2 23 declines, giving the bulls back the upper hand in the short-term.

_xa_2023-10-10_14-19-49.jpg)

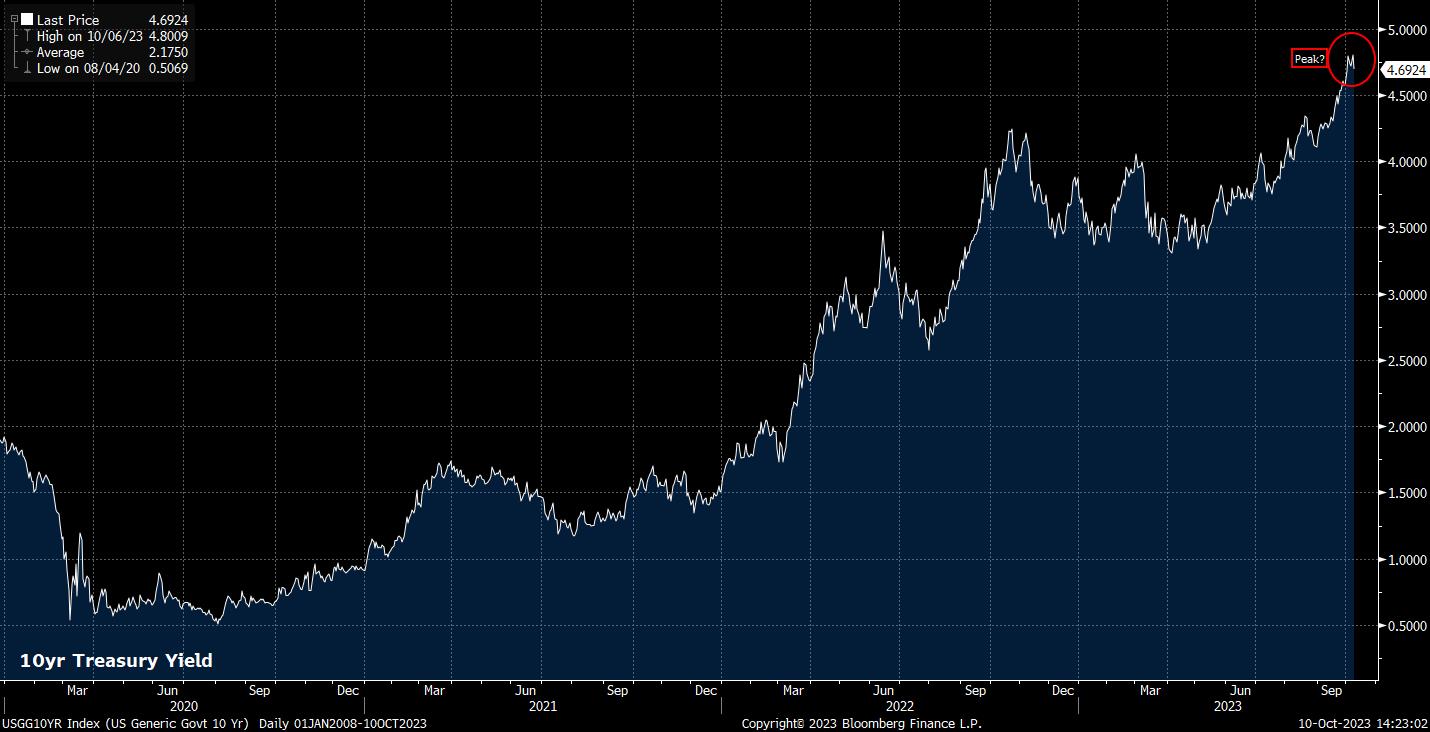

The yellow metal not only benefitted from haven demand, but also from a dovish round of Fedspeak, with officials increasingly flagging the importance of taking into account the recent sell-off in Treasuries when determining policy. This softened the dollar, with the DXY breaking back below the 106 handle, and the prior YTD high at 105.90, in addition to allowing Treasuries to rally across the curve, as shorts covered positions, and longstanding bulls sought their long-awaited opportunity to enter the market.

_D_2023-10-10_14-20-39.jpg)

Outside of gold, it was perhaps crude which displayed the largest reaction to the resurgence of tensions in the Middle East. Both WTI and Brent gapped around 5% higher at the futures open, and largely held onto those gains, having not yet filled the gap, and with the former continuing to trade north of the psychologically key $85bbl handle.

The rally in crude is interesting, particularly off the back of a double-digit fall a week prior, which saw WTI rapidly back away from near one-year highs at $95bbl. There are a couple of factors that are important to note here, namely that the Levant region – where conflict is currently taking place – is not a significant producer of crude.

Consequently, one must view the recent rally as a reflection of two risks. Firstly, that the US no longer turns a blind eye to sanctioned Iranian oil exports, which have been increasing in volume of late, given Iran’s reported backing for Hamas’ actions. While a large proportion of Iranian oil is currently transported to China, greater sanctions enforcement would further tighten crude supply, likely exerting upward pressure on prices, action which longs may now be attempting to front-run.

The second, broader, risk that crude appears to be pricing is the potential that events in Israel and Gaza spiral into a more wide-ranging regional conflict. Such a spiral could result in, for instance, a blockade of the Strait of Hormuz, and a series of other tit-for-tat measures, posing a much greater threat to global oil flows. It is important to note, though, that markets have historically displayed a tendency to over-estimate the impact of regional tensions on crude, with proof of significant, and prolonged, supply disturbances likely needed to exert sustained upward pressure on prices.

Escalation, principally a spread of conflict bringing other Middle Eastern nations into the mix, or even resulting in a proxy war. Were conflict to remain within its current confines, its market impact is likely to fade relatively rapidly, besides the obvious negative consequences for local assets.

Were any escalation to occur, traders are likely to reach rapidly for the classic safe-haven playbook, as we saw at this week’s open – buying the USD, the JPY, gold, and long-end Treasuries, while trimming exposure to riskier assets such as equities, and high-beta FX; a subsequent rise in implied and realised volatility would almost certainly follow. The sustainability and duration of any such moves would likely hinge on the scale of any escalation, in addition to the potential involvement of other nations. Current signs, however, and rhetoric from leaders on both sides of the conflict, would suggest that a rapid de-escalation is an unlikely outcome at present.

On a macroeconomic level, conflict here represents the latest move in the geopolitical climate towards a significantly more unfavourable direction. Furthermore, the inflationary impulse and growth headwind caused by a spike in oil, and other commodity prices, on the global economy should by this stage be well known, as was evidenced during the early stages of the Russia-Ukraine war early in 2022.

However, the impact of both, as well as any longer-run moves towards further deglobalisation, on both the economy, and policymaking, will only become clear in the fullness of time. As the situation on the ground evolves, and remains incredibly fluid, markets are likely to remain volatile, with agility key for traders.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)