- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

Where We Stand – Andrew Bailey was once again the happiest man in the City of London yesterday, though the emergence of some surprise mid-October sunshine helped to put a smile on most faces.

The reason for Mr Bailey’s happiness stems from the latest UK inflation figures, which pointed to a more rapid than expected pace of disinflation having taken hold last month. Headline CPI rose by 1.7% YoY, below the BoE’s 2% target for the first time since April 2021, while measures of underlying inflationary pressures also eased – core CPI rose 3.2% YoY, its slowest pace in three years, while the closely-watched services CPI metric rose 4.9% YoY, below 5% for the first time since April 2022.

Clearly, all of that is very good news for the Old Lady, with the MPC now all-but-certain to deliver another 25bp cut at the November meeting. Yesterday’s figures also raised the likelihood of the BoE becoming, as Bailey termed it, “a bit more activist” in removing policy restriction, with the GBP OIS curve discounting around a 4-in-5 chance that another 25bp cut will follow in December. My base case, for now, is that it will be a case of ‘November and done’ for cuts in 2024, though if the inflation outlook evolves better than the Bank’s forecasts in upcoming releases, the case for more aggressive action becomes much stronger.

Naturally, the pound took a battering on this dovish repricing, and sharp rally in front-end gilts, with cable dipping under the 1.30 figure for the first time in a couple of months. Risks to the quid do seem tilted to the downside here, particularly with the risk of dramatically tighter fiscal policy looming large on the horizon.

In a parallel universe, Prime Minister Sunak would now be touting inflation having fallen below the 2% target on the general election campaign trail, and nobody would be waffling about an imaginary £22bln “black hole” in the public finances. Sadly, that ‘black hole’ remains the topic du jour in Westminster circles, with reports indicating that it could amount to £22bln, £25bln, £40bln, or even £100bln depending on your newspaper of choice. Making things up as you go along isn’t an especially coherent way to run a country, and markets appear to be reflecting the risks associated with such approach.

In brighter news, I hear Greggs’ are to open a Parisian-inspired champagne and sausage roll bar – so at least we have somewhere to drown our sorrows!

Back to markets, the GBP’s underperformance also makes sense in the face of an FX market which is once again in the mood to buy growth; and, obviously, punish those currencies where growth is either anaemic, or non-existent.

To those ends, it wasn’t particularly surprising to see the EUR take another leg lower yesterday, surrendering the 1.09 figure, and trading below the 200-day moving average for the first time since early-August. A break here is likely to embolden EUR bears, with notable support now not found until the 1.08 figure, which we could test in relatively short order. I remain bearish and favour selling the EUR on rallies if and when they occur.

The common currency’s woes came as the dollar strengthened broadly against its G10 peers, despite Treasuries rallying across the curve, which bull flattened a touch. The DXY rose north of 103.50 for the first time in over two months, with the pound having borne the brunt of the buck’s strength, though notable softness also came through in the Aussie dollar, where the RBA increasingly look like an outlier among G10 central banks.

Elsewhere, yesterday was a day lacking in major catalysts.

Some fragility does look to have emerged in the US housing market, though, with mortgage approvals having fallen a chunky 17% WoW last week, the biggest such decline since April 2020. Of course, Hurricane Milton might well be distorting the figures, and 30-year mortgage rates having risen 40bp since the end of September shan’t be helping the demand situation much, though the figures are perhaps a warning sign for the sector more broadly – incoming MBA figures probably deserve a little more attention than they typically get in the weeks ahead.

Meanwhile, stocks spend most of the day in tight ranges, though the S&P did ultimately end the day in the green.

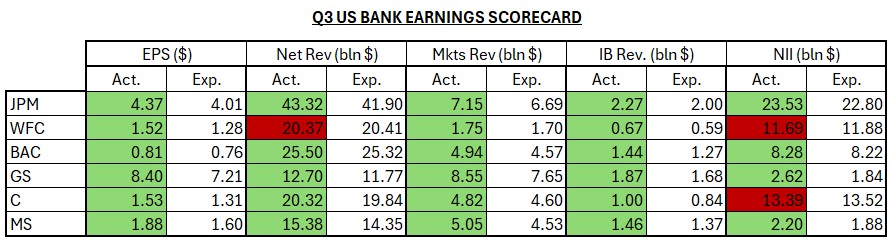

On the earnings front, Morgan Stanley beat across the board, rounding out a solid reporting season for the banks (see below table), with the industry likely setting the stage for a strong earnings season overall. That, coupled with solid economic growth, and the continued ‘Fed put’, should keep the path of least resistance continuing to lead to the upside on Wall St.

Look Ahead – ‘ECB Day’ is upon us, with Lagarde & Co set to deliver a second straight 25bp deposit rate cut, an outcome which money markets fully discount.

Having, 5 weeks ago, all but ruled out back-to-back cuts, a 25bp reduction today is now all but certain, given the faster than expected disinflationary process, and rapid loss of economic momentum, seen since the prior confab. Accompanying the cut will likely be a repeat of the now-familiar refrain that policy will follow a “meeting-by meeting” and “data dependent” approach, with the Governing Council making no pre-commitment to any pre-set future rate path. That said, another cut in December is all but nailed on. Full thoughts on the ECB can be found here.

Meanwhile, stateside, a busy docket awaits.

September’s retail sales report stands as the most notable macro release of the day, with both headline and control group sales set to have risen by 0.3% MoM, the latter being the basket of goods which is broadly representative of the GDP basket. The weekly jobless claims figures are also due, with initial claims set to have risen by 260k last week, the period which coincides with the October NFP survey week, though risks to this figure are skewed to the upside owing to the impact of Hurricane Milton. Industrial production, and the Philly Fed’s manufacturing survey, are also due.

Elsewhere, earnings season rumbles on, with Netflix set to report after the close. NFLX’s recent post earnings performance has been somewhat patchy, with four losses after the last six reports. Of course, past performance is not a reliable gauge of future results, though options price a move of +/- 7.6% in the 24 hours following tonight’s release, where EPS is seen at $5.12, on revenues of $9.8bln.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.