- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

December 2024 ECB Preview: Policymakers More Pessimistic Than Projections

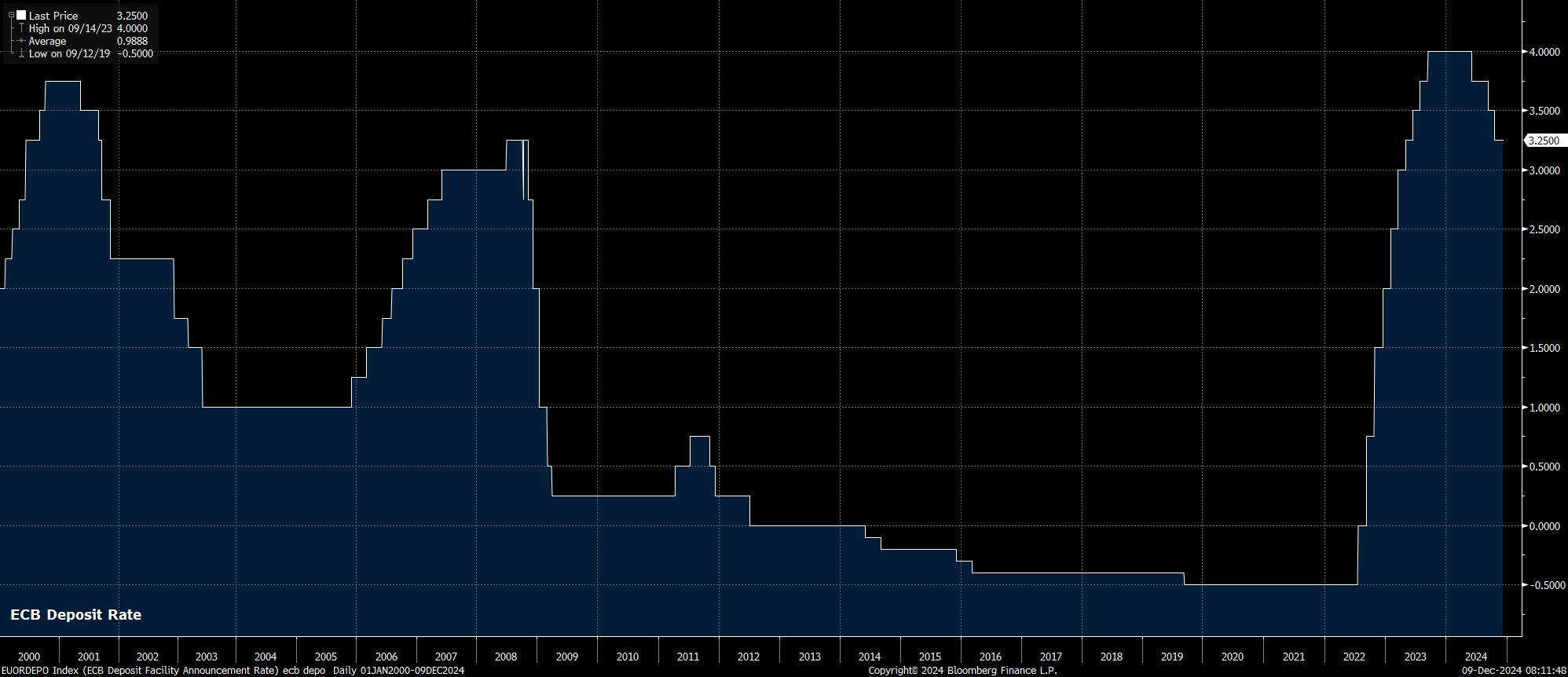

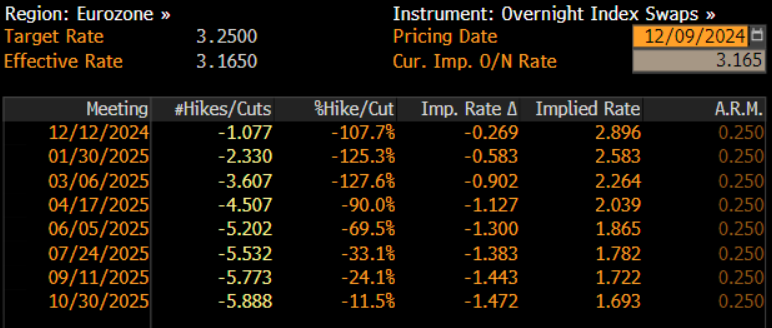

As noted, the ECB’s Governing Council will likely deliver a 25bp cut at the December meeting, bringing the deposit rate to 3.00%, and marking the fourth cut of this cycle. Money markets, per the EUR OIS curve, fully price such a move, while also discounting around a 10% chance that Lagarde & Co., deliver a larger 50bp cut.

While a larger cut cannot be entirely ruled out, it seems unlikely that a ‘jumbo’ 50bp cut would be delivered just yet. The plethora of ECB speakers in the run-up to the December meeting have signalled no explicit desire to deliver such a move at this stage, though a more rapid pace of policy easing can’t be ruled out in early-2025, where the multitude of downside risks facing the eurozone to intensify further.

Reflecting this, the accompanying policy statement is likely to reiterate the ECB’s now extremely familiar rhetoric. As such, it will be stressed that policymakers will follow a ‘data-dependent, meeting-by-meeting approach’ to future rate decisions, and that there is no ‘pre-commitment’ being made to a particular course of policy action. Nevertheless, the EUR OIS curve discounts a total of 150bp of easing by next autumn.

Clearly, the macroeconomic backdrop facing the ECB as 2024 draws to a close is a tricky one.

Headline inflation has re-accelerated since the October meeting, having stood at 2.3% YoY in November, per Eurostat’s ‘flash’ reading. Much of this increase, though, was driven by a rise in energy prices, which policymakers will likely look through. Progress on eradicating underlying inflationary pressures, however, also appears to have stalled – core CPI held steady at 2.7% YoY last month, while services inflation continues to hover around the 4% mark.

All three metrics, clearly, remain above the Governing Council’s 2% price target, though the ‘bumpy’ progress back to said target has been broadly in line with the path that policymakers had previously guided towards.

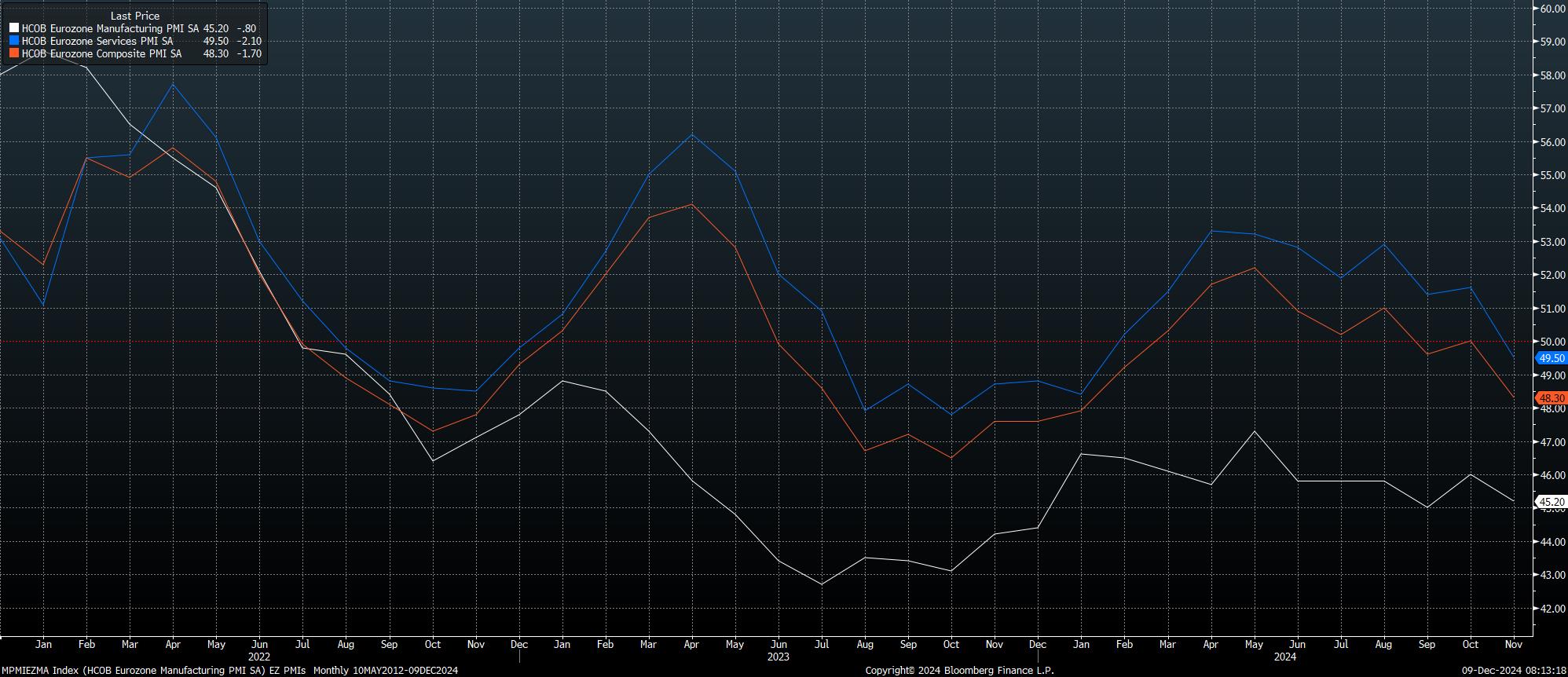

At the same time as progress back towards the 2% target appears to stall, the eurozone growth backdrop is becoming increasingly pessimistic.

Having already lost significant momentum since the summer, recent PMI surveys have pointed to a further deterioration in economic output into the final quarter of the year. November’s data pointed to a contraction in output across all three gauges, with the composite PMI slumping to 48.3, its lowest level in 10 months. Furthermore, leading indicators suggest little sign of a pick-up in momentum being on the horizon, with new orders having fallen for a 6th consecutive month, and business confidence having slumped to a 12-month low.

This softening in economic activity comes as downside risks facing the bloc continue to mount.

The well-documented Chinese economic slowdown shows little sign of turnaround in the near future, particularly with authorities there appearing to focus primarily on stabilising financial markets, as opposed to propping up the real economy, while also seeking to keep some fiscal powder dry to insulate the nation from the potential impacts of a second Trump presidency. Of course, the eurozone is also likely to find itself in the crosshairs of the incoming Trump Administration, with there being an extremely high likelihood of substantial trade tariffs being imposed early in 2024, as well as the possibility of a tit-for-tat trade war ensuing once more.

On top of this, geopolitical risks remain, with the eurozone still considerably more exposed to developments in the Middle East, and in Ukraine, than DM peers. Furthermore, the domestic political backdrop has become increasingly unstable in recent months, with first Germany, then France, seeing governmental collapses. The latter is likely of more concern to policymakers, particularly with the budget deficit on track to balloon as high as 6% of GDP, roughly double the EU’s ostensible limit.

Policymakers, however, face an extremely difficult task in modelling the impacts of the above, particularly when the latest staff macroeconomic projections must assume a ‘status quo’ continues in both France and Germany, despite political tumult, and considering that the specifics of Trump’s trade policies are not known, hence can’t be accurately forecast.

In light of this, the latest macroeconomic projections are likely to be broadly unchanged from those released in September – albeit, with risks tilted to the downside for both growth and inflation. Hence, the projections will likely forecast an overly punch 1.3% pace of real GDP growth next year, and an even more ambitious 1.5% in 2026, while also pencilling in a return to the 2% inflation aim in the second quarter of 2025.

This presents an interesting divergence between the projections, and the likely views of Governing Council members, who are probably considerably more pessimistic about the economic outlook than the forecasts will imply.

Hence, while President Lagarde will likely ‘stick to the script’ of data dependency at the post-meeting press conference, she is unlikely to explicitly rule out larger cuts in the future, while post-meeting sources reports could indicate that such a move was discussed this time around. Lagarde will also likely seek to steer clear of any explicit commentary on recent political events.

The base case, then, remains that the ECB will deliver 25bp cuts at each of the next five meetings, taking the deposit rate back to a neutral level of 2% by early-June 2025. Risks, of course, are tilted in a dovish direction here, and the potential for much more rapid rate cuts. In any case, the key debate for policymakers in 2025 will be whether rates must fall below neutral, and into explicitly ‘loose’ territory. Such a move seems likely for the time being, barring a surprising and substantial pick-up in economic activity, and reduction in downside risks, by the middle of next year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.