- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

In fact, the tide is already beginning to turn in favour of rate cuts as 2023 draws to a close, with the number of rate cuts across the globe outnumbering hikes in both October and November, for the first time since early-2021, though the bulk of these have been delivered by emerging market central banks. In DM, most have not long since brought their tightening cycles to a close, with the full impact of said hikes still yet to be felt, given the ‘long and variable’ lags with which policy shifts impact the broader economy.

Nevertheless, even as those lagged policy effects continue to feed through into the economy, and as policymakers continue to bang the drum for the ‘higher for longer’ mantra, markets are already thinking about when the first rate cut will come, and the magnitude of the cuts that will be delivered, along with which of the G10 central banks are likely to be the first to move.

While policymakers are still loath to even raise the possibility of cuts, owing to the risk of inadvertently loosening financial conditions, almost all incoming economic data points to the next move for the majority of G10 central banks as being lower. Once more, and is so often the case, the Bank of Japan are the exception to this rule, with expectations growing that 2024 will prove the year that the BoJ finally bring decades of ultra-easy policy to an end, leaving them as the hawkish outlier among DM authorities.

_2023-11-28_13-02-53.jpg)

More broadly, though, the continued disinflation process, along with the gradual loss of economic momentum, and continued signs of softness beginning to emerge in global labour markets, all point to rates being lowered over the medium-term. Importantly, though, and in contrast to prior cycles, it seems unlikely that policymakers will seek to pre-emptively cut rates as ‘insurance’ against an economic slowdown, likely waiting for inflation to return back to the 2% target before seeking any rate moves.

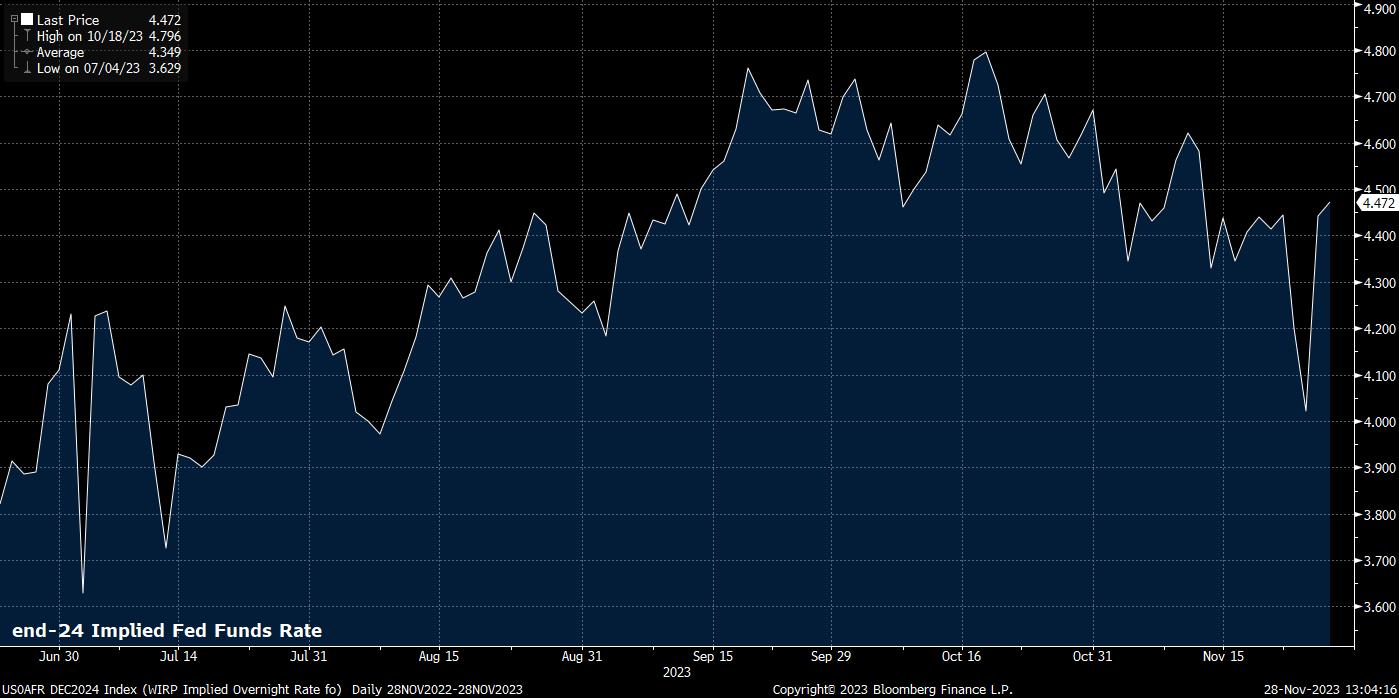

Such a return, however, is clearly well underway, albeit with both core (ex-fuel and energy) and services inflation remaining relatively sticky. Consequently, money markets have begun to price an aggressive – perhaps too aggressive – pace of rate cuts throughout the next year.

Fed fund futures imply around 100bp of cuts to the fed funds rate by January 2025, with the first such cut priced for June 2024. Elsewhere, OIS implies around 50bp of BoE cuts in the next 12 months, while also pricing around 80bp of cuts from the ECB, who are also pencilled in to deliver their first cut next June.

It’s important to recognise, however, that central banks cutting rates next year, at least to the relatively modest (50-75bp) extent that consensus currently expects, would not represent an outright easing in the overall policy stance.

This is because as inflation fades throughout the next year, assuming central banks maintain overnight rates at unchanged levels, real policy rates will actually rise, leading to a net tightening in financial conditions as the year progresses. Of course, such a tightening would come right at the tail end of the economic cycle, as the lagged effects of hikes already delivered continue to bite, and as economic momentum continues to wane. Consequently, even to keep the relative stance of monetary policy unchanged throughout the next calendar year, central banks will be required to cut rates, at least to some degree.

Of course, this is likely to present ample opportunities for traders to exploit, as market participants attempt to second-guess who will cut first, who will be last, who will cut the most, and who will cut the least.

While, at a broad level, risk sentiment and the direction of travel in fixed income will both be largely dictated by how the FOMC act in the year ahead, the FX market provides more scope for divergence between individual G10 central banks to be exploited. As already mentioned, the BoJ finding themselves as the hawkish outlier may allow the JPY to reverse course, having been the worst performing G10 in 2023, losing over 10% against the greenback.

_2023-11-28_13-05-07.jpg)

Conversely, having been one of the first to bring their tightening cycle to an end in May, and with signs of rather rapid labour market deterioration already beginning to emerge, the RBNZ may be one of the quickest to ease as 2024 progresses. Well-documented structural issues within the eurozone, along with continued fragility in core bond markets, also make the ECB standout as one of the most likely to live up to present market pricing, particularly with price pressures now fading rapidly, and with leading indicators now pointing to a rather rapid softening in demand.

_Daily_01_2023-11-28_13-05-36.jpg)

The pound is also an interesting one, with the UK perhaps being the one place where market participants are taking most heed of the BoE’s protestations that Bank Rate will remain at its current 5.25% level for ‘an extended period’. The historic stickiness of UK inflation, compared to DM peers, is one of the likely drivers here, and could indeed compel the ‘Old Lady’ to deliver on the woolly forward guidance that has been laid out.

However, doing so would likely come at the expense of the growth side of the equation, with consumer spending already slumping as the impact of higher mortgage rates is increasingly felt, and the housing market likely to face increasing headwinds as the next year progresses.

In many ways, the dilemma faced by the BoE epitomises that faced by all DM central banks – whether to focus on ensuring the ‘last mile’ of returning inflation to target, or whether to pre-emptively attempt to insulate the economy from an impending slowdown.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.