- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

The USD has found some fine form in a backdrop of US rate expectations repricing and US yield premium working in its favour, and we see the DXY closing higher for a fifth consecutive week. We have seen some big technical breaks in the USD pairs and the upside would likely have been even more pronounced had we not seen the S&P500 push to new highs and the VIX index remain below 14%.

With the yield premium commanded for US 2yr Treasury over German 2yr bonds rising to 180bp we’ve seen EURUSD close at new run lows in the trend that started on 11 Jan – we see price testing the channel lows, subsequently longs need a bounce here or we risk testing the 8 Dec pivot low of 1.0723. While much of the USD flow has been driven by US rates repricing (notably with SOFR futures Dec23 – Dec 24) rising to -131bp, the prospect of a further widening of US-GE yields spreads seems likely and therefore further downside in EURUSD could be a theme this week.

The NOK was the weakest play in G10 FX last week, with a weaker Brent tape part impacting here – flick to the daily chart of SpotBrent and we see the series of higher lows from the 13 Dec breaking down and price pulling into the heavy congestion zone – consolidation may be on the cards but further weakness in crude would likely weigh on the NOK.

NZDUSD is also of note having completed a bear flag pattern, with the flow arguing for a continuation towards 0.5900. AUDUSD has completed a head and shoulders reversal, offering a target towards 0.6250. USDJPY eyes a test of the January highs, where a break of 148.81 would suggest a move to 150 is on the cards.

Gold ended a run of consecutive days higher on Friday but the set-up on the higher timeframes remains choppy – that said, a renewed push higher in both the USD and US real rates this week and $2k could easily be on the cards. We can look at US 10yr real rates (i.e. the 10yr US Treasury minus 10yr expected inflation) on TradingView (code: TVC:US10Y-FRED:T10YIE), and a break of 1.90% should put 2% back on the table.

On the equity front, the ASX200 was a stellar performer last week and will be a key focal point this week with ASX200 1H24 earnings starting to trickle in and the RBA statement also in focus. The US500 and US30 also performed well and pushed to new highs – pullbacks are tight in this bull market and while it remains hard to put new money to work on the long side up here, shorting for those who are not scalpers or day traders remains a low probability outcome at this stage.

Good luck to all.

The marquee event risks for traders to navigate:

Tuesday

US ISM services report (02:00 AEDT) – The market looks for the services index to come in at 52.0 (from 50.6), once again showing resilience in the US service sector. Solid expansion (i.e. a reading above 50 shows expansion from the prior month) should further price out the chance of a 25bp cut in the March FOMC and support USD upside.

The ‘SLOOS’ report - US Senior Loan Officers Survey on bank lending practices (06:00 AEDT) – with US regional bank concerns in the spotlight this report on bank lending standards may get some focus from the market.

Japan nominal and real cash earnings (10:30 AEDT) – After a weak read in the November data, economists expect some improvement in real wages. Although should it come out as expected at -1.5%, it will further delay calls for the BoJ to move away from negative rates.

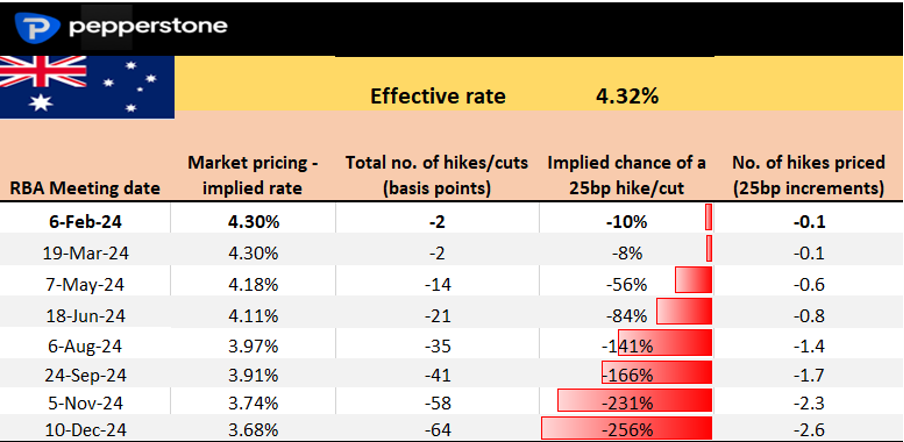

RBA meeting & Statement on Monetary policy (both 14:30 AEDT) – The start of a new regime of communication for the RBA with the bank releasing its quarterly economic projections and Gov Bullock following the statement with a press conference. The RBA won’t cut interest rates at this meeting but should move to a move balanced statement. The move in the AUD will come from the tone of the statement relative to pricing in the interest rates curve. See my preview here.

RBA Gov Bullock speaks (15:30 AEDT) – Following on from the RBA statement Gov Bullock’s comments could impact AUD, especially given she will be probed on some key issue in the presser – a clear risk event for AUD exposures.

ECB 1- & 3-year CPI expectations (20:00 AEDT) – there is no consensus to work off here, but there should be downside risks to the prior estimate of 3.2% (1yr) and 2.2% (3yr). Notably, look for the 1-year CPI expectations to be revised to 3.1%, possibly even 3%.

Wednesday

NZ Q4 employment report & wages (08:45 AEDT) – the market looks for the Q4 U/E rate to rise to 4.3% (from 3.9%) – a higher unemployment rate will solidify the case for the RBNZ to cut at the May meeting. Favour NZDUSD downside this week given the current technical set-up.

Thursday

Mexico CPI (23:00 AEDT) – The consensus is we see headline CPI at 0.90% MoM, taking the year-on-year pace to 4.89% yoy (from 4.66%). Core CPI is eyed lower though with calls for 4.72% from 5.09%), but perhaps not substantial enough to see Banxico cut the overnight rate from 11.25%. No firm bias on USDMXN, but I look for EURMXN downside.

China CPI/PPI (12:30 AEDT) – The market looks for China’s consumer prices to fall 0.5% in January marking the fourth consecutive month of deflation. Producer price inflation is expected to fall 2.6% (from -2.5%). It’s unlikely to be a volatility event for markets but it could reinforce the notion that internal demand is soft and that the PBoC has scope to do more.

Friday

Banxico meeting (06:00 AEDT) – the Mex CPI print (due on Thursday) may alter expectations for a cut, but the core view from economists is that rates should remain at 11.25%, although there is a small risk of a 25bp cut. Mexican forward rates price 181bp of cuts over the coming 12 months, with March the likely date of a cut.

China new yuan loans and aggregate financing (no set time through the week) – this data can be important for Chinese markets, and notably this time around we see expectations for a big increase in credit extension in January. The market looks for new yuan loans to come in at RMB4.5t in Jan, which if correct would be the second largest monthly credit extension ever.

US CPI revisions – Each year the Bureau of Labor Statistics tweak the weightings of the inputs that feed into the CPI calculation, which can affect prior seasonally adjusted prints. It won’t be a volatility event, but economists will be looking out to see how the new weights impact the future trajectory for inflation expectations.

Canada employment report (Sat 00:30 AEDT) – the market looks for 15k net jobs to have been created in January, with the unemployment rate eyed to tick up to 5.9%. The market has pared back expectations of imminent easing with June now seen as the most likely month for a 25bp cut from the BoC – a weak employment report could see that pricing brought forward. The CAD has been a solid performer in G10 FX of late, notably vs the AUD and NZD, and I am seeing a higher probability of further downside momentum in NZDCAD.

Other event risks that could impact sentiment:

China Lunar New Year (Friday)

Fed speakers – this week we hear from 14 Fed members. See the line up here.

BoE speakers – Huw Pill (6 Feb 04:30 AEDT), Breedon (7 Feb 19:40 AEDT), Catherine Mann (9 Feb 02:00 AEDT).

ECB speakers – Wunsch, Lane (9 Feb 02:30 AEDT), Nagel (9 Feb 21:30 AEDT), Cipollone (10 Feb 01:15 AEDT)

US earnings – we move past the marquee week for US earnings, and the big market cap names have hit us with numbers, so bottom-up factors will fade, and the macro will fully dictate sentiment once again. 46% of S&P500 companies have now reported, 78% of beaten on the EPS line (by an average of 7.1%), with 53% beating consensus sales expectations. We’ve seen 4% aggregate EPS growth. This week 10% of the S&P500 market report – McDonald’s and Caterpillar are a couple that may get a focus from traders.

ASX200 earnings – ASX200 1H24 earnings start to trickle in with names like Amcor, Mirvac, Transurban, AGL and REA due to report. CBA report on 14 Feb.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.