- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

5 charts - Currencies in freefall as US dollar index breaks the 100 level

I explored the cash grab for USD in yesterday’s piece on the plummeting AUDUSD, but the crux of it is that the world’s largest economy (the US), which is less dependent on global trade than other countries, can better withstand global headwinds than its peers. The best house in a bad neighbourhood, perhaps.

So even though the US is headed for a recession, the USD is in hot demand and should hold at the eye-watering high levels until global markets stabilise. Although technicals don’t mean a great deal in markets near record-high volatility, it’s worth noting the 14-RSI on the USDX is barely in oversold (>70) territory yet, reinforcing the prospect of a move higher.

As markets make some fast, sharp moves, here’s some trading opportunities that have been on our radar.

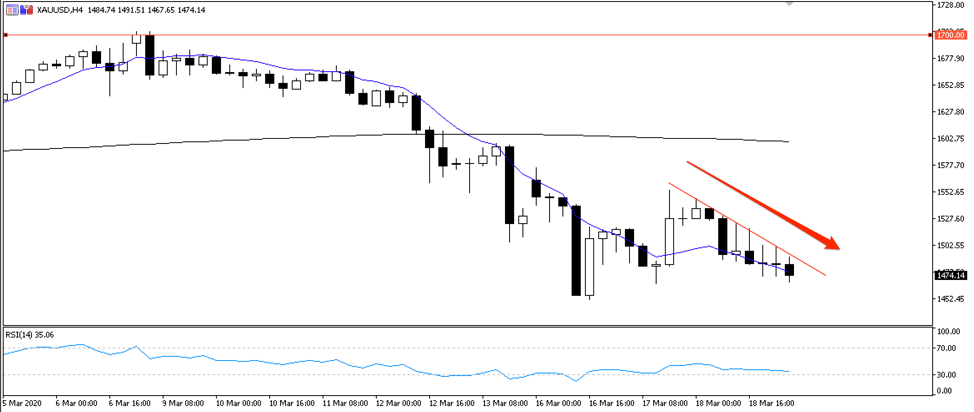

Gold (XAUUSD)

The safe haven that isn’t...for now at least.

As markets pursue a USD cash grab, investors are liquidating even gold to get cash in hand.

It might take markets a few weeks to decide what to do with all the USD cash it’s holding, but the outlook will be uncertainty in another low-rate world. When the dust settles, cash will have very little yield and this should, theoretically, work in gold’s favour. There’s even talk that global low rates could propel the precious metal to new record highs once markets stabilise.

Gold isn’t the only safe haven suffering. Precious metals across the board have sold off, as have currency safe havens like the JPY and CHF.

For now though, cash is king and gold stays low.

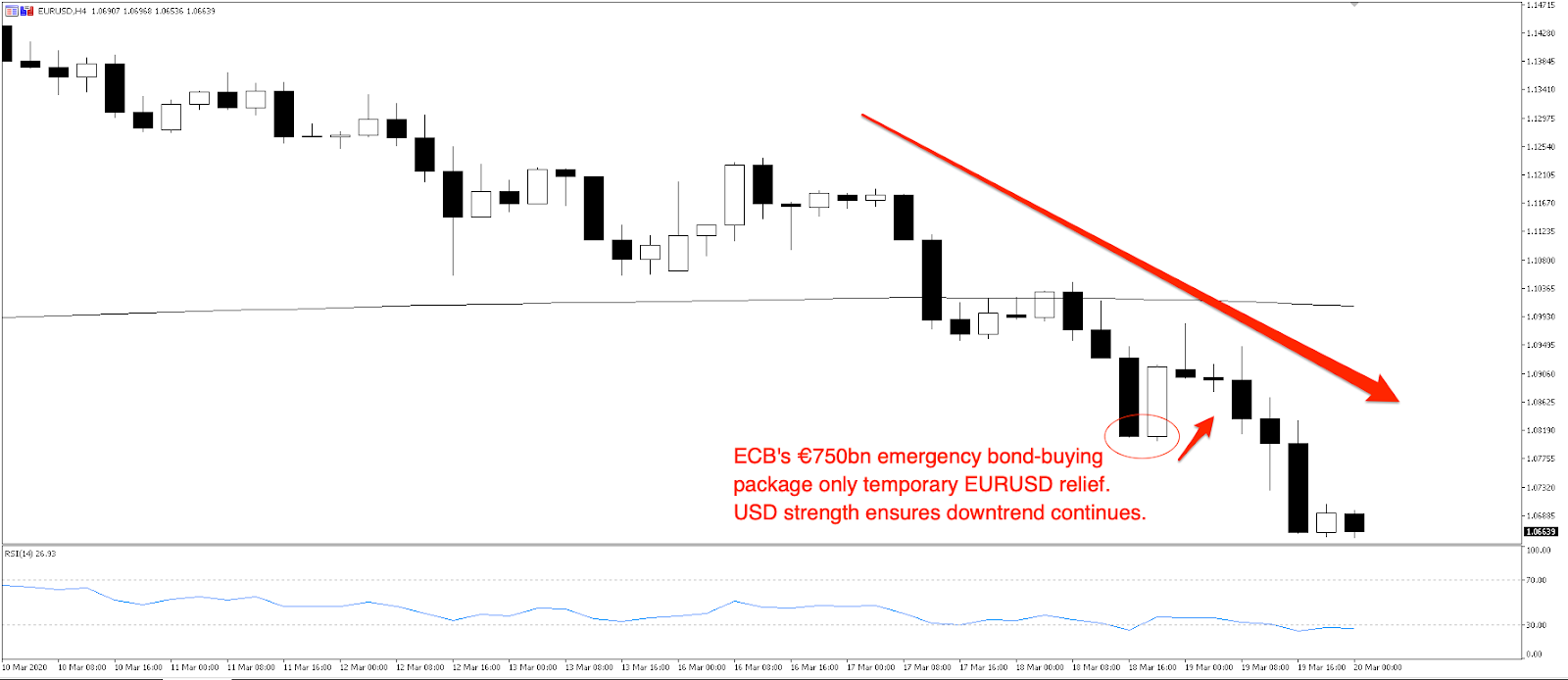

EURUSD

The euro has found only temporary relief in the European Central Bank’s (ECB) €750bn emergency bond-buying program announced overnight. ECB President Lagarde stated the central bank had no limits for its commitment to euro stability, a hint of even more stimulus if needed. Of course, flooding the market with euros makes it less valuable, and although EURUSD bounced from 1.0800 to 1.0900 temporarily, the euro faced strong selling pressure in the US session overnight.

And of course the USD remains king, so the EURUSD downtrend remains in play. EURUSD is hovering around 1.0650 in the early Sydney session (Friday). If the 1.0600 level gives way, we’re looking at a freefall to March 2017 support at 1.0500.

GBPUSD

Cable has fallen to the lowest level since 1985 as markets face the impending shutdown of London.

Over the past two weeks as the magnitude of this crisis has become more apparent, the pound has sold off considerably. Lower than the post-Brexit crash, the GBP finds itself at the lowest levels since 1985 when the USD was depreciated under the Plaza Accord.

There’s very little support from here. Cable needs little conviction to move even lower, the sharp fall so far showing markets underwhelmed with fiscal measures from Downing Street, which have fallen short compared to those taken by other nations, particularly within Europe.

USDMXN

The effect of the strong USD on emerging markets is devastating. Currencies like the Mexican peso are getting smoked by the one-way flow of US dollars.

This is devastating for developing economies who hold large US dollar debts and liabilities, a pile of debt that gets more and more expensive as the USD strengthens. You can see below on the USDMXN weekly chart just how hard and fast the change has occurred.

USDMXN had for several years been converging into a triangle pattern and had broken lower until the CoVID-19 pandemic altered its path. 40% of Mexico’s foreign debt is owed to United States entities. The higher USDMXN goes, the more crippling the credit burden will be on the Mexican economy and its peso.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.