- English (UK)

These measures should flood the market with USD and weaken the currency, right? That might happen in normal times, but in times of crisis the opposite tends to happen. Here’s why the USD continues to strengthen after 150 basis points of rate cuts in two weeks.

Temporary USD weakness

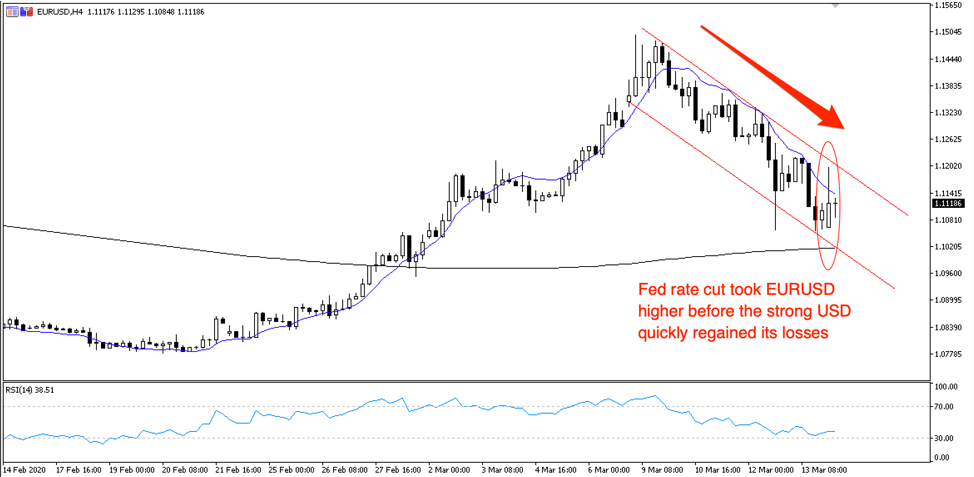

Markets responded to this morning’s emergency rate cut with a knee-jerk weakening of the USD, but it was quickly reversed. On the announcement, EURUSD rallied from 1.1060 to 1.1190 but a few hours later had settled around 1.1100. On the 4-hour chart, you can see that despite the volatility, EURUSD price action remains in the downtrend since 9 March as the USD strengthens.

4-hr chart: EURUSD strengthened on the Fed rate cut but the USD quickly regained its losses and pushed EURUSD lower again. The downtrend that started 9 March continues.

Similarly, AUDUSD spiked 150 pips on the news from 0.6140 to just above 0.6300, but in a few hours had wiped its gains already.

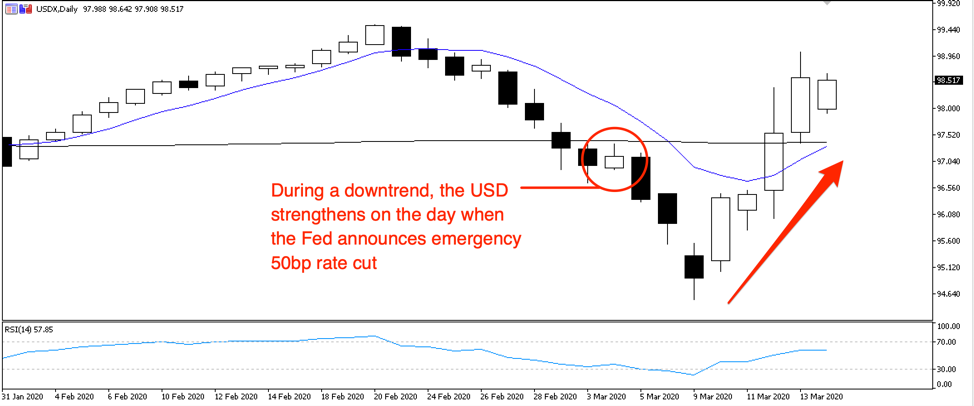

The US dollar index, which measures the USD against a basket of six currencies, opened at 97.99 this morning and has surged as high as 98.64. So how high can this go amid the coronavirus pandemic? The high on February 20 got to 99.50 - and getting above here to the 100.00 level would take significant USD strength, although it isn’t off the table. At the 100 level though, the USD will begin to feel rather expensive. We know President Trump wouldn’t like this, he would see it as anti-competitive for US exports, which would start the conversation around a potential USD currency devaluation. That’s a drastic measure.

Daily chart: The US dollar index (USDX) has bounced back despite Fed rate cuts and rallied as the global outlook deteriorates. The 200-day MA (black line) is flat.

The Fed has ruled out negative interest rates but QE is next, which will flood the markets with cash as the central bank embarks on a path of asset purchases.

So despite substantial Fed easing policy, demand for the USD remains high.

USD demand in crisis times - the best house in a bad neighbourhood

When volatility picks up and risk aversion kicks in, demand for the USD tends to pick up. The US is a strong, resilient economy and less dependent on global trade than other countries. Private consumption accounts for almost 70% of US GDP, higher than the global average. It’s also the world’s largest economy.

So when crisis sweeps the globe, the US is expected to fare better than other countries where the economic fallout will be worse.

Add to this that the Fed has made two crisis-level rate cuts now and is resuming quantitative easing. The USD weakened initially on news of the emergency cuts but quickly turned around and continued to strengthen. The US is showing a willingness and ability to take insurance measures against the downturn. Compare that to the eurozone, say, where the European Central Bank (ECB) is already in negative rates and unable to cut further, and the USD feels like a safe place to put money amid the crisis, so it strengthens.

The widening FRA-OIS spread

The Forward Rate Agreement Overnight Index Spread (FRA-OIS) indicates how expensive or cheap it will be for banks to borrow in the future, determined by LIBOR relative to a risk-free rate (such as US Treasuries). The spread is widening, which shows mounting concerns that companies will struggle as the coronavirus takes hold. This makes interbank lending more risky, which puts greater stress on the US interbank markets.

The FRA-OIS spread is spiking, although nowhere near the levels of the GFC. The Federal Reserve will need to be ahead of the curve here: the more the spread widens, the closer we get to a GFC-style credit crunch.

Again, the USD ticks up here as investors flee to a quality cash asset.

Global easing

Finally, consider that all major central banks are making drastic rate cuts. The Fed had higher interest rates than its major global counterparts so had more room to ease, but when everyone is easing, currencies weaken together so the strong USD holds.

Major global policy responses so far

- 3 March - RBA leads with 25bp cut at scheduled meeting to historic low 0.5%

- 3 March - US Fed slashes rates by 50bp in first emergency meeting since the GFC

- 4 March - Bank of Canada cuts 50bp to 1.25%

- 11 March - Bank of England cuts by 50bp in coordination with UK government 30bn fiscal package and 600bn for mass infrastructure by 2025

- 11 March - Speaking from the White House, President Trump disappoints markets with lightweight fiscal response

- 12 March - Already in negatives, ECB offers no rate cut but increases QE and lending options. Calls on EU governments for fiscal stimulus.

- 13 March - The Bank of Canada cuts by 50bp to 0.75% in an unscheduled rate decision

- 16 March - RBNZ cuts rates by 75bp to record low 0.25%, next step will be QE

- 16 March - US Fed cuts by 100bp to near zero rates and announce large scale asset purchases: $500bn in Treasuries and $200bn in mortgage-backed securities

- 16 March - Bank of Japan ramps up easing policy, including purchases of Japanese government bonds (JGBs) and active purchases of exchange-traded funds (ETFs)

- 16 March - RBA reveals QE is coming, will we see a token rate cut to 0.25% on Thursday?

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.