- English (UK)

Traders can take advantage of Pepperstone’s extensive range of US share CFDs on the MT4 platform, with the marquee names tradeable on MT5, cTrader and soon on TradingView. Pepperstone offers access to trade a range of stocks in the post-market session and given so many of the marquee names report in during this period, traders can react in real-time to breaking news – long or short and never miss the opportunity.

Importantly, while our commission rate is a low 2c per share, there's no minimum commission charge. This means higher frequency traders will not be clipped $8+ for doing small size notional like some brokers charge. For scalpers and day traders this can be advantageous in helping lower costs, which can prove to be the biggest drag on performance.

Netflix - daily chart

(Source: TradingVIew - Past performance is not indicative of future performance.)

By way of movement, we’ve already seen the stage being set with Netflix clearly disappointing the market with woeful subscriber numbers both for realised numbers in Q4 realised as well as guidance for Q1 – as we see on the chart, the stock has been hammered and is trending strongly lower – in an environment of impending rate hikes and reduced liquidity companies with high valuations who are missing the mark will be savaged, and having a strong understanding of short selling could be highly advantageous - see our guide for more information here.

(Source: Pepperstone - Past performance is not indicative of future performance.)

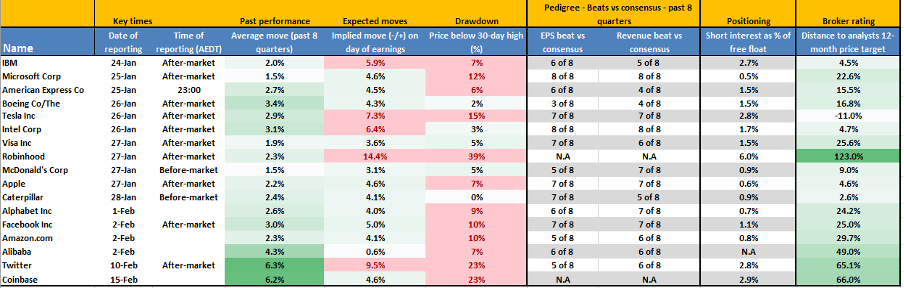

What’s important for traders is the expected movement on the day of earnings – we can look at the options market here to see the implied move and I've put this into a table showing the marquee names that clients trade above all others. We can also see the typical movement (over the past 8 quarterly earnings). Short-term traders – whether they are scalpers, day or swing traders - like movement, range expansion and often one-way directional movement and this matrix helps understand where the market is looking for that movement.

We can also see their respective pedigree at earnings – this is important for shareholders because they like to have confidence in a management team who typically under promise and over-deliver. Obviously, there's much more to earnings than just the reported quarter and their outlook is often far more important, especially when valuation is elevated.

But for traders, when the numbers do drop, we need to be able to capture that movement as efficiently as possible – being able to dissect the earnings numbers and outlooks relative to expectations is often difficult to do. However, life doesn’t have to be such a challenge and the market will tell us quickly enough how they feel about what they’ve heard, and price action is what we react to, where our edge is being able to react and trade the flow, in real-time, whatever the strategy.

This is not a market that will tolerate a poor corporate outlook or missed guidance – the US earnings season should see some big moves in stocks and therefore opportunity that needs to be on traders’ radars.

For information on trading US share CFDs with Pepperstone visit here for details.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.