Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

The Daily Fix: US data converging with the message portrayed by equities

We got as high as 3153 in the S&P 500 cash, just shy of filling Monday's gap lower into 3181, although we closed at 3124, but holding the 5-day EMA. Digging below the surface we see cyclicals outperforming defensives sectors, growth has outperformed value and we see solid turnover through both the cash and futures market (2.97m contracts traded).

With that background, I can certainly paint it as a fairly rosy picture. Although, consider S&P 500 futures were up a sizeable 3% just before the S&P 500 cash open (at 11:30am AEST) and we were staring at far more prolific gains. So the bulls just haven’t quite made it count and if we go cross-asset we can paint a somewhat hazy picture on the day.

Asian equity futures are a mixed picture and again we should consider that S&P 500 futures were +1.4% when we closed off yesterday in Japan and Australia, so equity markets were already pricing in an upbeat US session. Hence when we look at Aussie SPI futures, they are up just 0.6%, while we see modest downside in Nikkei 225 and Hang Seng futures. My bias remains that the ASX 200 will reclaim 6000 near-term, perhaps not today, but certainly this week.

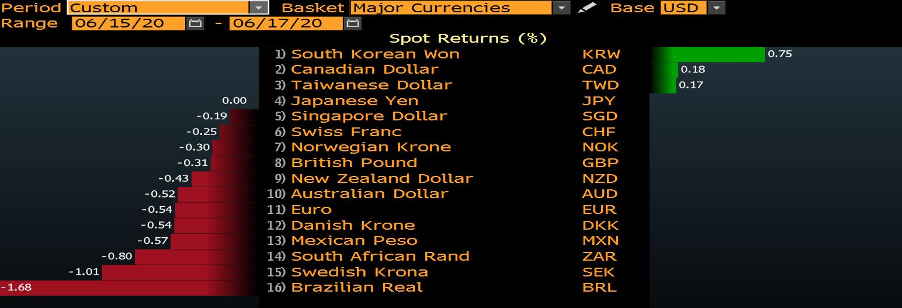

In FX markets, we’ve seen some covering of USD shorts and the greenback is up vs nearly all major currencies on the session. Some have labelled this risk aversion, perhaps driven by headlines that China is closing a number of schools, as well as headlines on casualties in the India-China border clashes, all at the backdrop of North Korea blowing up an intra-Korean liaison office.

(Source: Bloomberg)

In reality, I am not sure these headlines really have worried FX markets too greatly though. Consider that FX implied vol has actually moved on the session in 1-week and 1-month vols, so it’s hard to say this was a sell-off driven by panic – that is untrue.

I would be watching for the BRL to act somewhat independently of broad risk semantics, with the country recording 34,918 new COVID-19 cases in the past 24 hours. I have no exposure, but I wouldn’t rule out upside for USDBRL in the near-term.

We see a slight move lower in equity vol too, with the VIX index settling -0.73 vols at 33.7% - so broadly, there has been no bid in traders making a play in hedging downside risk and anticipating greater movement in the market over a short- to medium-term period. This is true in credit, where credit spreads haven’t really moved on either investment grade or high yield, and there is no doubt equity investors would have liked to have seen real follow-through to see ever tighter spreads to spur further life into the equity move. In fact, LQD ETF (investment grade credit ETF) closed 0.3% lower after hitting a record high of 134.90.

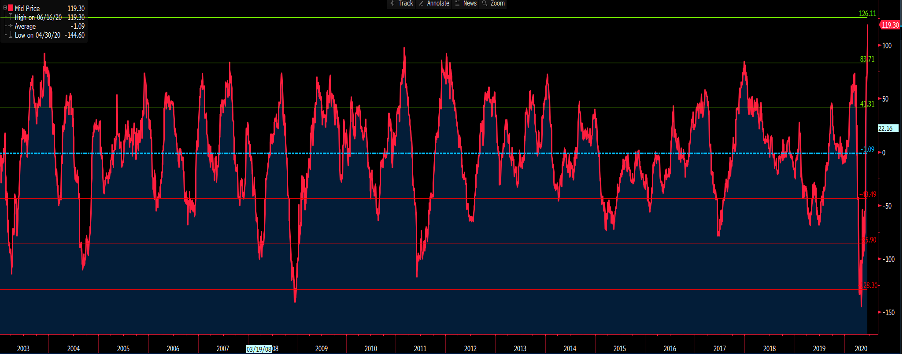

In Treasuries, there has been a slight sell-off in 10s and 30s, resulting in a slightly steeper yield curve. Perhaps this has driven a slight short covering in the USD and in years gone by, I’d argue this with conviction, but times have changed – however, consider May retail sales destroyed expectations with a +17.7% MoM increase (consensus +8.4%MoM). We can look at it on a year-on-year basis and see a decline of -6.1%, however, this is clearly a strong improvement from the -19.9% seen in April and fits nicely with the rebound seen in the US labour market. In fact, if we look at the broad trend in US economic data, we can see the Citigroup economic surprise index at an all-time high – this index effectively goes up when data is beating consensus expectations and vice versa.

(Source: Bloomberg)

The cynics will, of course, say this is because economists have been so poor at forecasting. Perhaps, but the more interesting issue is that the recovery story that equities and credit have been portraying is coming to fruition and the massive disconnect between asset values and the real economy is converging; albeit there is a lot of room to move.

The question then is with global stocks at current levels, having priced in a decent element of recovery is what happens now? Do earnings start to matter?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.