- English (UK)

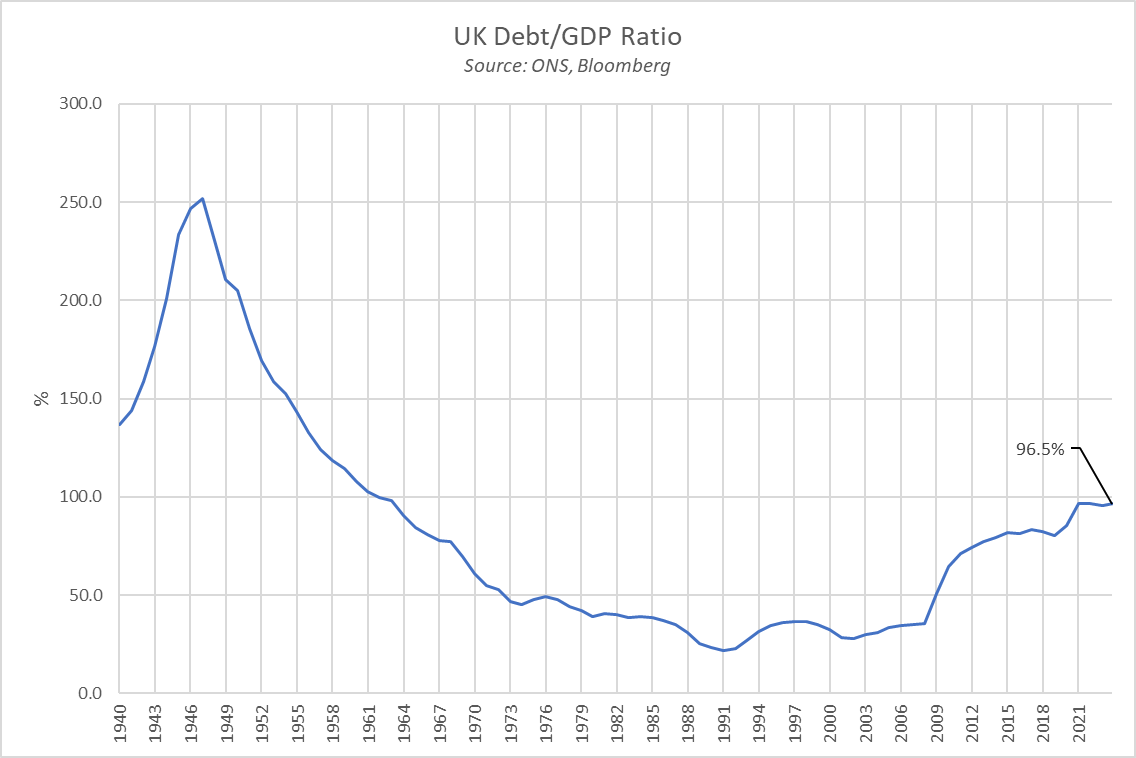

It feels as if the UK has a ‘fiscal event’ on an almost continual basis at the moment, barely have we moved past the prior package of policy tweaks before trial balloons for the next round are being floated in the press. There has, perhaps, at least in recent times, never been as significant a focus on the public purse as there is at present, owing largely to the debt/GDP ratio (ex-banks) standing at 96.5%, its highest level since the ‘60s, while the tax burden, when measured by receipts as a share of GDP, stands at a postwar high.

Clearly, with all this in mind, the state of public finances remains, at best, fragile. Despite this, and fiscal ‘headroom’ being relatively limited, the Chancellor is still likely to bring forward a relatively significant package of tax cuts, probably worth between 0.6% and 0.8% of GDP.

It remains unclear precisely how such a package will be structured, or its exact size. Nevertheless, given recent history, the ‘temporary’ freeze on fuel duty, which has now been in place since 2011, and 5p per litre cut announced in 2022, are both likely to be extended, probably eating up around £4bln of the roughly £25bln of fiscal headroom that the Chancellor is likely to have as a result of the latest OBR forecasts.

That ‘headroom’, incidentally, is calculated according to how the OBR see borrowing, and debt, evolving compared to the Government’s fiscal rules. These are, at present, for public sector net debt to be falling as a proportion of GDP by the fifth year of the forecast, and for public sector net borrowing to not exceed 3% of GDP by the same year of the OBR’s projection.

These rules have a couple of consequences.

Firstly, particularly given the perilous state of the public purse, even minor shifts in the OBR’s GDP projections can result in rather dramatic changes to the amount of headroom available, with in particular downward growth revisions raising the potential that said rules will be breached, and reducing the amount of fiscal easing that can be delivered.

Secondly, the five year horizon part of the rules means that, as was seen in the Autumn Statement, it is possible for the Chancellor to meet the fiscal rules by delivering significant tax cuts in the short-term, ‘paid for’ by pencilling in significant spending cuts later in the forecast horizon – conveniently, well after the next general election.

In any case, there are other tax cuts that seem likely to be delivered in addition to the aforementioned fuel duty freeze. It seems likely that either a cut to the basic rate of income tax, or employee national insurance contributions will be delivered, with the latter – according to media reports – more likely, presumably due to its marginally lower cost.

Other measures reportedly under consideration include an increase in the threshold at which 5% stamp duty is paid – likely to further juice the property market into election season – in addition to some tweaks to child benefit rules, and a likely further freeze on alcohol duty, to which we can all raise a toast! Naturally, this all remains highly uncertain until the Chancellor steps up to the despatch box on Wednesday lunchtime; though he will, presumably, do so without a tipple in hand, as used to be the case some years ago.

Of course, the key question for market participants is what this fiscal package will mean for markets, and the monetary policy outlook.

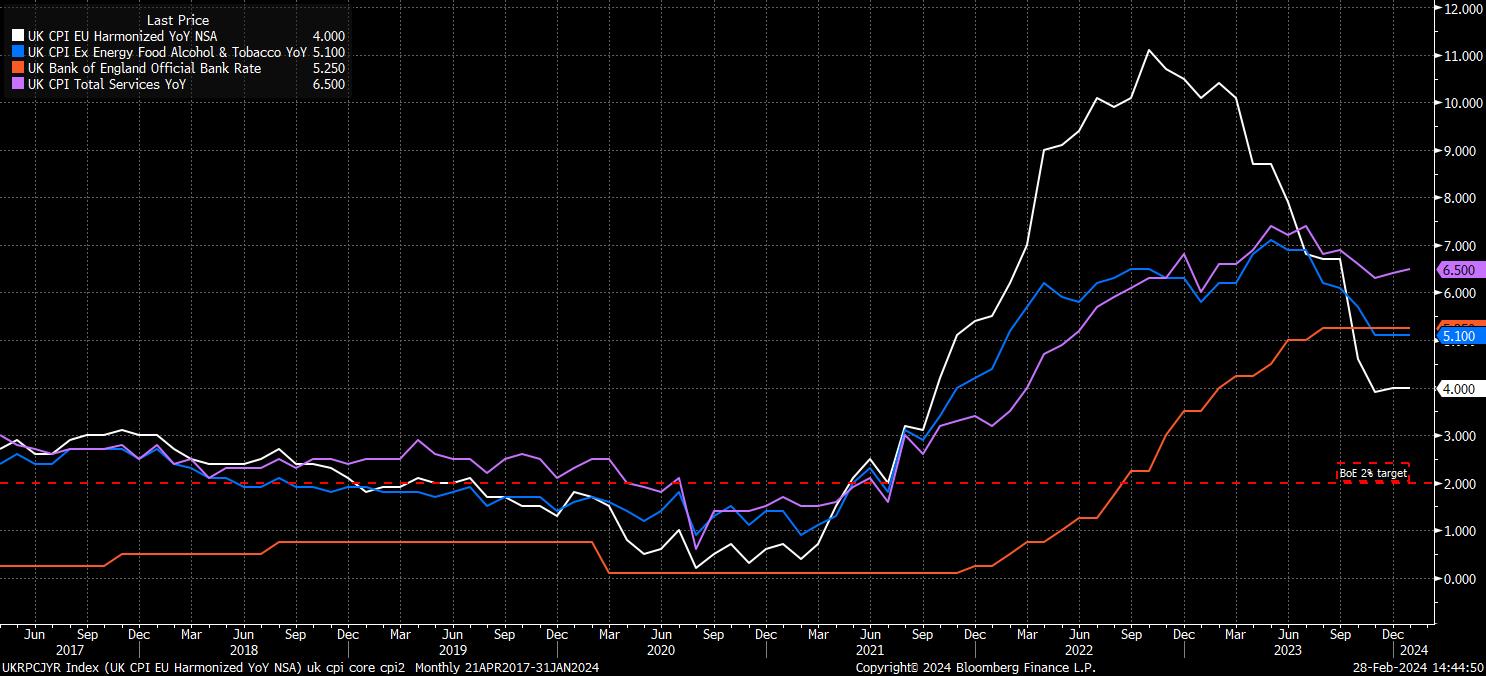

To tackle the latter part of that question first, such significant fiscal easing is highly unlikely to prevent the MPC from delivering cuts to Bank Rate this year. However, said easing is likely to make policymakers rather more nervous than they are at present, particularly the hawks on the MPC, two of whom continue to dissent in favour of further tightening, citing particular concern over the persistence of services inflation, which may be further spurred by a substantial further loosening of fiscal policy.

The SONIA curve currently fully prices the first 25bp Bank Rate cut for August, a touch more hawkish than the sell-side consensus, which currently sees such a reduction coming in June. There is, however, some degree of hawkish risk associated with the Budget, with a larger than expected package of measures likely to see a further pricing out of the 61bp of easing still in the curve for the year as a whole.

Of course, gilts will also have to digest any monetary policy implications of the Budget, but also need to grapple with how announced measures impact issuance over the medium-term. Though any violent reactions akin to those seen in the aftermath of Liz Truss’ infamous ‘mini-budget’ seem highly unlikely, some selling pressure does seem likely to emerge on any significant issuance uplift.

In the FX space, the impact of any fiscal event on the GBP (or any DM currency and fiscal event, for that matter) is always somewhat questionable. There is generally a tendency for these events to be billed as major market risks, only for them to eventuate as something of a ‘damp squib’.

_2024-02-28_14-44-22.jpg)

Despite that, if the fiscal easing likely to be delivered in the Budget does provide some support to growth, as the economy continues to emerge from recession, that may – at the margin at least – provide some medium-term support to the pound. The effect of this would likely be amplified if, as noted above, the Budget also results in a more hawkish BoE outlook, though any gains are likely to be more significant in the crosses, owing to the continued ‘US exceptionalism’ narrative underpinning the greenback.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.