Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

What is the VIX

VIX stands for Volatility Index. The VIX looks to measure the level of fear and stress within the market. As a rule, when the VIX is high stocks will fall. When the VIX is low, stocks are normally on the rise. It is commonly referred to as the Fear Gauge.

Produced by the Chicago Board Options Exchange (CBOE), it measures the 30-day expected volatility derived from S&P500 Call and PUT options (US500).

A PUT option is the right to buy a stock at an agreed price and time. A CALL option is the right to sell a stock at an agreed price and time. When PUT options outweigh Call options, this is regarded as indication investors are nervous.

Inverse relationship to the SP500

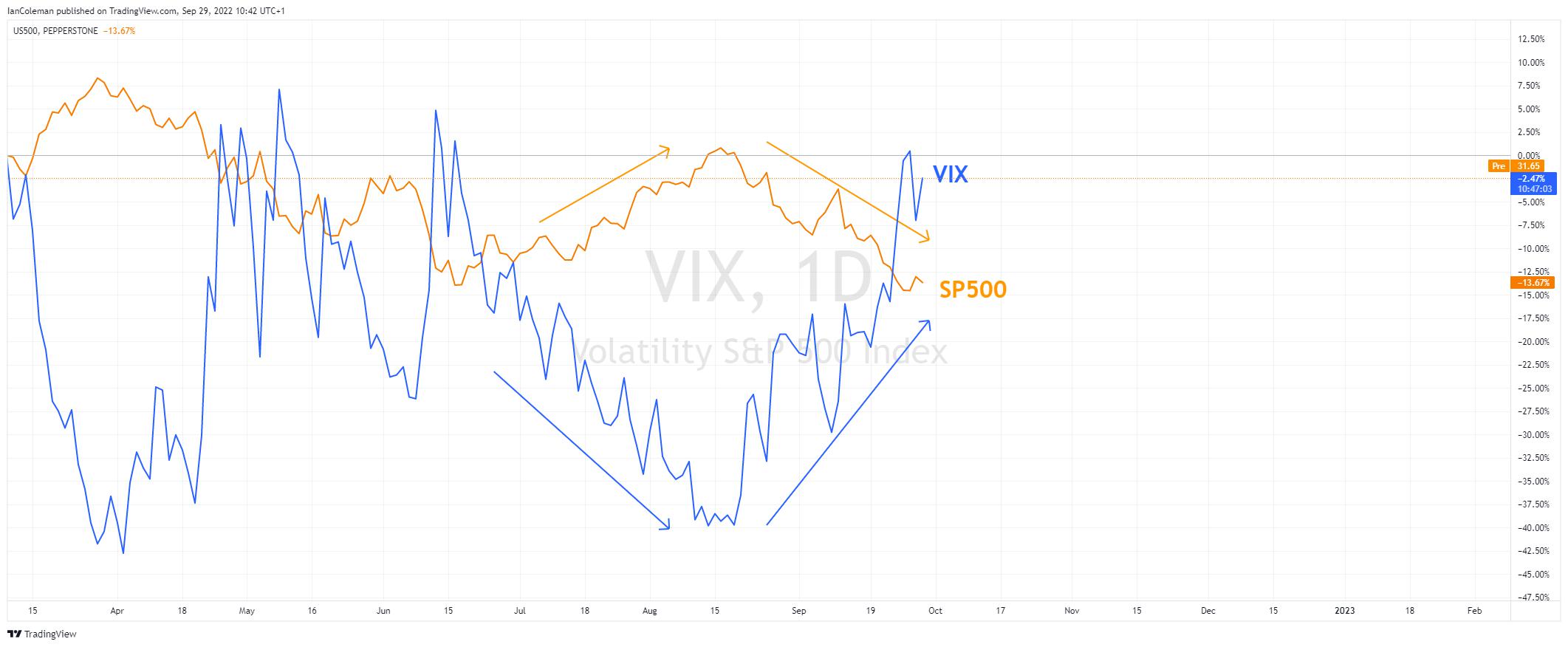

Figure 1 Trading View VIX SP500 overlay

For most of the time, the VIX index will move inversely to the SP500. It should be noted that this is not always the case.

How can the VIX help with my analysis

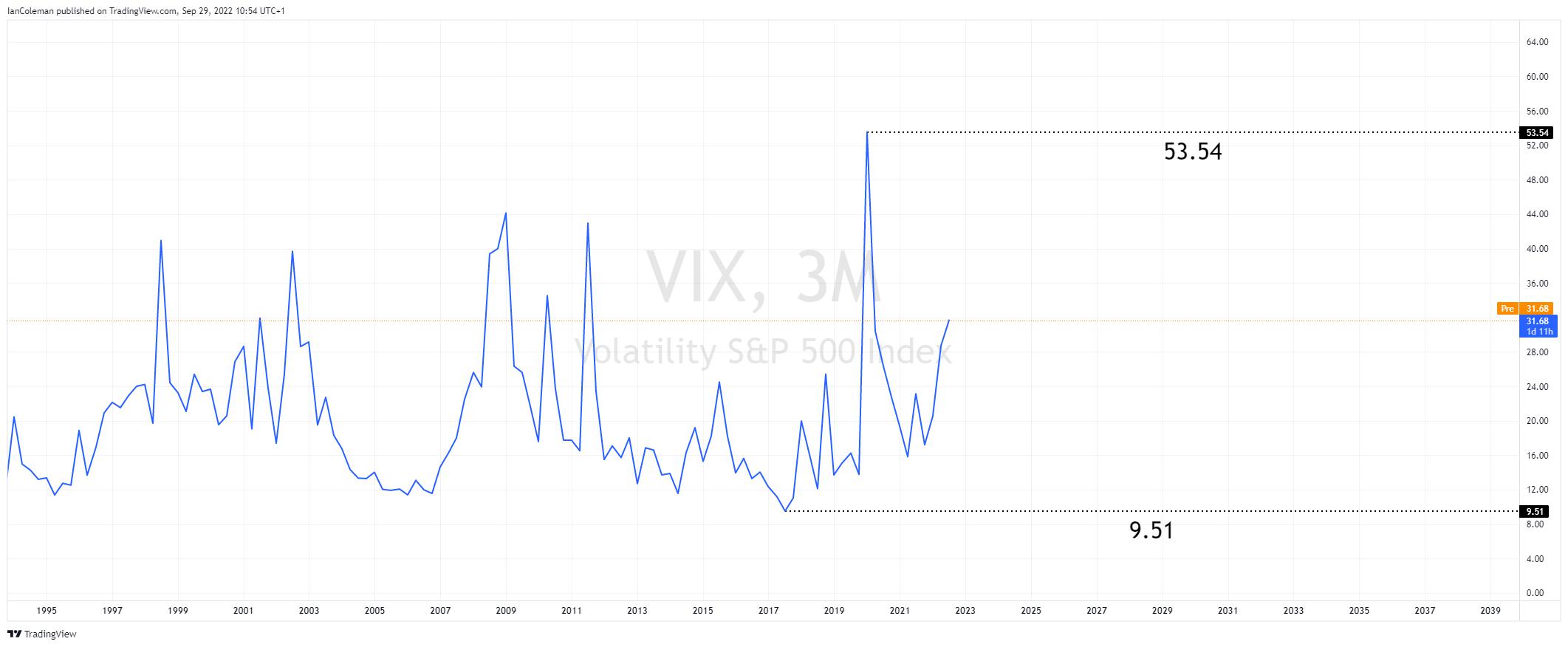

The last peak of the VIX index was in January 2020 with a reading of 53.54. On the 5th of January 2022, WHO (World Health Organization) published their first Disease Outbreak News on the COVID-19 virus. We should remember that the VIX is a 30-day forward indicator.

Figure 2 Trading View VIX 2020 peak

From the 10th of February 2022 the SP500 (US500) declined over 30%. The VIX Fear Gauge ‘predicting’ the selloff.

Figure 3 Trading View SP500 selloff February 2020

Combining technical analysis with the VIX

Noting a high VIX reading with a potential bottoming formation in the SP500 could be a great opportunity to explore.

Can I trade the VIX directly

You cannot trade the VIX directly through the Chicago Board Options Exchange. However, spread betting brokers offer derivatives from the underlying product allowing traders to speculate if they believe the index is too high or not high enough. Pepperstoneoffers trading on the index.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.