Traders playbook - looking ahead as the event risk is dialled up

For those trading EU and UK shares, names like HSBC, Glaxo, Lloyds, Shell, and Deutsche Bank should get a good run and may be worth putting on the radar. In the US it gets a little wild this week, but this is really the only week that counts when it comes to earnings.

So far, we’ve seen 24% of the S&P 500 report with 81% having beaten consensus expectations on EPS and 67% on sales – those that have beaten on EPS have done so by an average of 13.1%. Despite this, we’ve seen the consensus EPS estimates for 2022 taken up a mere 1.3%, so this is probably a small tick for the ‘peak earnings’ crowd.

(Source: Pepperstone - Past performance is not indicative of future performance)

Close to 40% of those who have reported have beaten their implied move (derived from options pricing), so when I look at Twitter and see an 11% move priced for Tuesday, it draws me to see the potential fireworks in the after-market. Certainly, the weight of the S&P 500 market cap reporting after-market on Tuesday and Thursday could be a risk and of course an opportunity for US index traders. Although to see real fireworks here we’d need to see the various share prices all headed in the same direction to cause real vol.

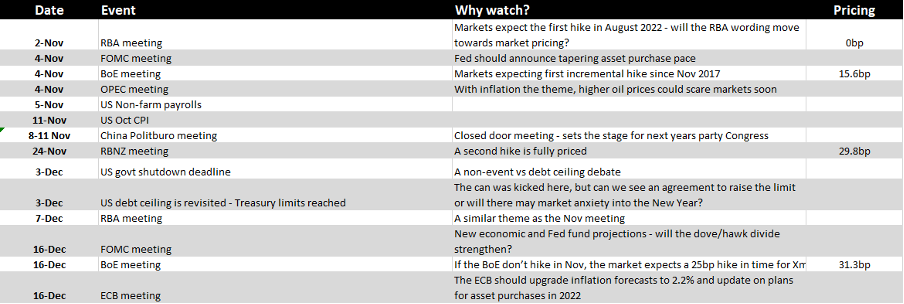

High inflation is still the hot topic and growing, perhaps given some increased prominence given Jay Powell’s comments on Friday and the weekend debate on social media about the probability that we’re actually in a hyper-inflationary regime. Stagflation remains the real risk most market participants debate and its why crude and Nat Gas are front of mind for me this week. I list some key dates that markets will trade towards in the weeks ahead, and the OPEC meeting on 4 Nov is a key near-term circuit breaker and catalyst – if Brent crude breaks $86 then the $100 callers will be feeling good about life, and inflation expectations - already at multi-year highs - will march higher, and OPEC will have to assess whether to increase output even further.

One questions when and at what level oil prices become a negative for risk, especially if real Treasury yields head further negative?

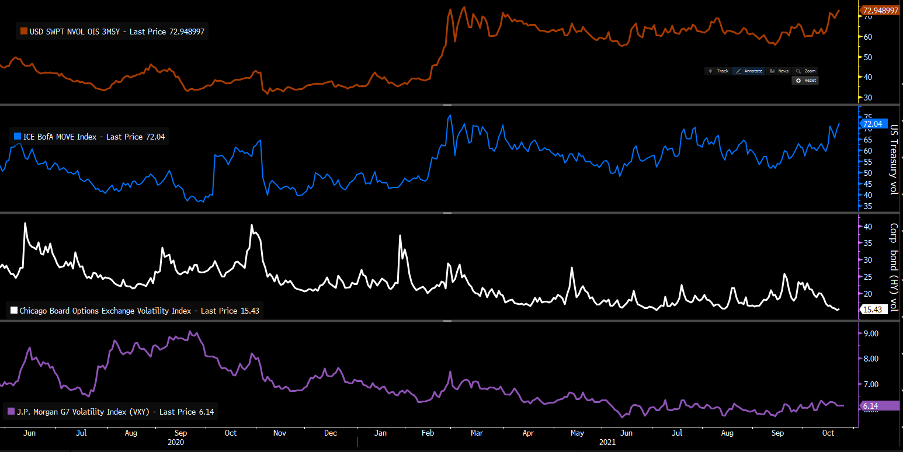

Implied volatility across asset class

(Source: Bloomberg - Past performance is not indicative of future performance)

Another key debate is the rise in implied volatility in rates and bond market, while equity and FX vol has gone south. I see why equity vol (use the VIX index) is low – the VIX futures curve is in steep backwardation, we’ve seen solid earnings; the market knows corporate buybacks are about to ramp up and passive flows are ever-present and suppressing vol. Equity has weathered the rise in rates like a champion, but the best hedge against rising inflation, as we’ve seen in the flow, is equities. Some would argue crypto.

However, given expectations of rate hikes now in so many DM countries and the risk of US political risk kicking up into December it feels like a matter of time that volatility ramps up into the new year.

(Source: Pepperstone - Past performance is not indicative of future performance)

I've put this loose calendar together to offer some of the major known event risks into New Year. Anything inflation-focused is the topic du jour and will see a bigger reaction in markets - so we watch wage data, commodity prices, prices paid components of ISM manufacturing among others. From here we watch inflation expectations, and front-end bond yields and whether the moves have gone too far, too soon and what this means for other markets.

By way of example, by the end-2022 we see six hikes priced in NZ, four hikes priced in the UK, Canada, Norway and two for the Fed and RBA. With economists and central banks certainly acknowledging this, there is still a growing divergence here and that cannot last – one party eventually will need to take a step towards the other. That will have implications for markets.

On the macro front this week, the ECB meeting should be a non-event with the stage set for a huge meeting in December. Aussie CPI (Wed 11:30 AEDT) could see some interest from clients and see AUDUSD back into 0.7550 if the trimmed mean measure is closer to 2%, justifying the market pricing of the first hike from the RBA in August 2022.

In the US we get consumer confidence, and Q3 GDP and these may accelerate the stagflation argument. On the inflationary part of the ledger, we see the employment cost index (ECI), PCE inflation, and finally the University of Michigan sentiment and inflation survey. The ECI is expected to print 0.9%, which would be the equal highest level since 2007.

For now, I stay long risk, but I'm looking at ways to express a rich rates pricing and potential for traders to fade that move as we head into a very lively November period.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.