- English (UK)

We now understand that holding EUR longs above 1.2000 comes with an increasing risk of ECB verbal intervention.

We therefore watch for communications from ECB president, Christine Lagarde. If she expresses a greater worry about the negative influence the EUR is having on inflation at next Thursdays ECB meeting and the market believes that they are prepared to do more, then it might just encourage real money accounts (think life insurance and pension funds) who have amassed a record EURUSD (futures) exposure, to reduce which could push EURUSD towards 1.1750/00.

The fact is the move into 1.2000 has largely been USD driven so there's not a whole lot the ECB can do structurally to alter that. Perhaps a dovish shift from the ECB would be best traded against the crosses, such as GBP or AUD. However, it does suggest that if EURUSD does move above 1.2000 then we expect the ECB to be ever more active in jawboning.

Let’s look at the upside playbook

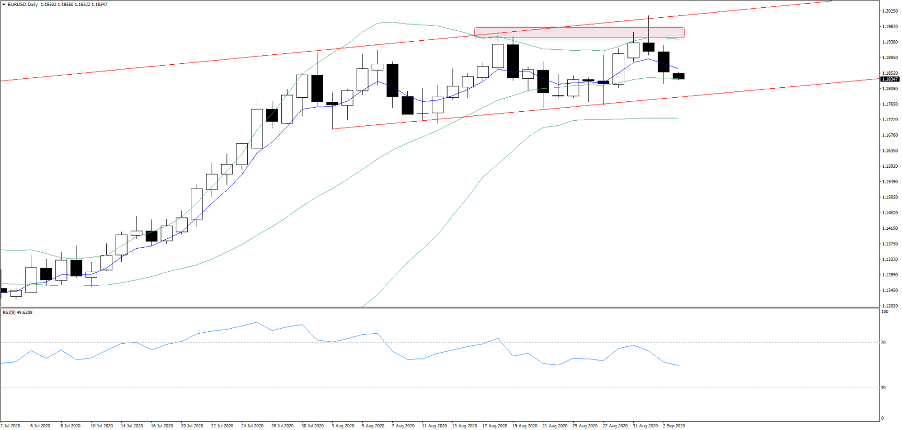

Resistance – 1.1966

As we see supply has come into the market into and above 1.1966 and we have a double top in place. A weekly close above 1.1966 would be the bullish signal for a renewed push above 1.2000 and into 1.2130/50.

Downside playbook

Support

1.1785 – Channel support

1.1763 – Last week’s low

1.1725 – Lower Bollinger Band

1.1695 – 3 August low

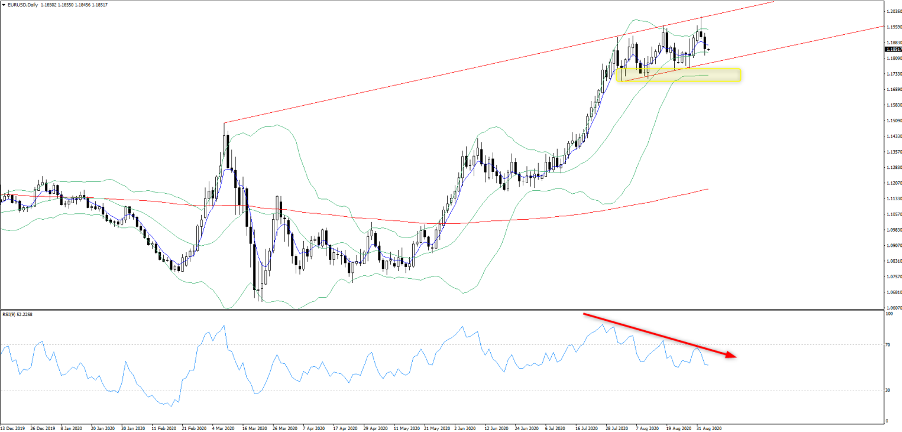

If you look at the current set-up on the daily chart, we can see the reversal off 1.2000 and this is in fitting with the bearish divergence seen between price and the RSI or momentum oscillators. That said, the 9-day RSI sits right at the mid-point with the 20-day MA moving sideways, so the set-up may appeal to range traders at this juncture. In this dynamic one could argue that the downside could be captured into the lower Bollinger Band at 1.1725. However, it would surprise to see a break here this week given the current level of implied volatility and the degree of movement expressed in options vol structures like the weekly straddle.

We also see EURUSD working in a channel, with channel support coming in at 1.1785. For the lower Bolly to come into play the EUR bears need to break this trend. We then look at last weeks low of 1.1763, where a weekly close below here would confirm a bearish outside week reversal and again offer evidence that the ownership structure has changed and the USD bulls are getting a greater say.

A move through the 3 August low (1.1695) and things get interesting, especially if the rate of change picks up. I would expect that to correspond with higher vol in equities and commodities would take a hit too.

The current set-up suggests quite a neutral bias, but the price levels are noted and the battle lines are drawn. I favour an eventual move through 1.2000, but if the market senses a dovish turn from the ECB next week it could encourage a market long of EURs to part liquidate and there are certainly increased risks with being long above 1.1900.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.